The dramatic decline in cryptocurrency has dampened exercise round particular forms of monetary crimes — most importantly, funding scams and unlawful Darkish Net transactions — resulting in a drop in shopper losses for the primary half of 2022.

That is in accordance with an evaluation revealed on Aug. 16 from blockchain information supplier Chainalysis.

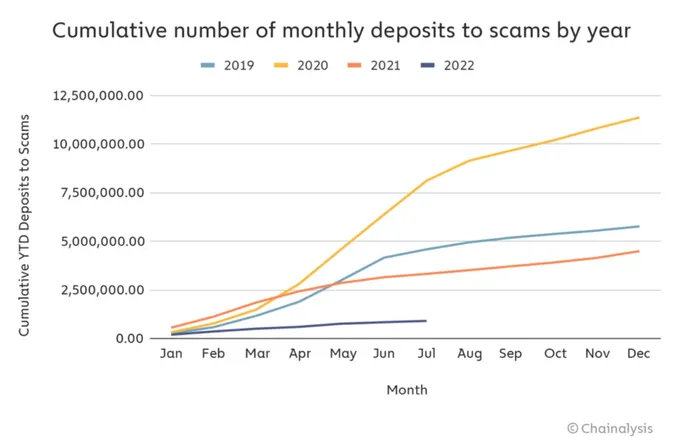

Total, the cumulative income collected by scammers dropped by two-thirds — 65% — for the primary seven months of the 12 months, in accordance with the agency. The decline is simply partly linked to the lower within the worth of main cryptocurrencies. Bitcoin, for instance, plunged in worth by 51% between Jan. 1 and July 31, and that also would not account for the whole drop.

The variety of deposits related to scams additionally dropped by greater than two-thirds, suggesting that fewer shoppers have been falling prey to these efforts, says Kim Grauer, director of analysis at Chainalysis.

“Most scams are funding scams, and if investments throughout the board are down, then much less funds will circulate to the companies which are, the truth is, scams,” she says. “We additionally noticed a whole lot of legislation enforcement wins up to now 12 months which have additional deterred scammers.”

Since their peak final November, main cryptocurrencies have dropped precipitously in worth, reaching lows in June. Bitcoin dropped practically 72%, from its $67,567 shut on Nov. 7, 2021, to $19,018 on June 17. Equally, Ethereum plunged practically 80% to shut at about $994 on June 17. Each digital property have recovered from these lows up to now two months.

Cryptocurrency is the monetary spine of most on-line crimes, Chainalysis acknowledged in its midyear replace, so the drop in cryptocurrency has impacted different main cybercrimes, reminiscent of cash laundering and ransomware. Each have dropped by 20% to 25% for the reason that starting of the 12 months, in accordance with cybersecurity companies.

That stated, crimes that don’t rely on attractive victims with cryptocurrency have been much less affected by the volatility. Enterprise e-mail compromise (BEC), for instance, nonetheless accounted for 35% of the greenback losses in 2021, in contrast with 0.7% for ransomware, in accordance with the FBI’s Web Crime Grievance Middle (IC3).

“No person likes a crypto bear market, however the one silver lining is that illicit cryptocurrency exercise has fallen together with respectable exercise, albeit not as sharply,” the corporate acknowledged. “That is particularly encouraging in scams, the place the lower in market hype appears to imply fewer are fooled by scammers, and in darknet markets, the place legislation enforcement’s [shutdowns of major markets] seems to have dampened all the sector.”

DeFi Providers Nonetheless Sizzling Targets

One fixed? Hacking of digital wallets and decentralized monetary (DeFi) companies continued to develop. Total, cybercriminals stole at the least $1.9 billion in cryptocurrency by way of hacking on-line companies up to now in 2022, a rise of about two-thirds from the identical interval in 2021.

Nearly all of the hacking earnings comes from hacking DeFi protocols, Chainalysis acknowledged within the mid-year report.

“DeFi protocols are uniquely weak to hacking, as their open supply code may be studied advert nauseum by cybercriminals in search of exploits — although this can be useful for safety because it permits for auditing of the code,” the corporate acknowledged. “[I]t’s doable that protocols’ incentives to succeed in the market and develop shortly result in lapses in safety finest practices.”

Particular areas have additionally targeted on particular forms of crime. North Korean nation-state actors have compromised particular DeFi protocols, resulting in large positive aspects for the sanctioned authorities. The attackers stole roughly $1 billion up to now in 2022, accounting for almost all of the $1.9 billion in losses from exchanges and companies, as of July 2022.

“Now we have seen ransomware assaults popping out of North Korea, however proper now DeFi hacking is essentially the most worthwhile factor for the North Korean hacking organizations to hold out,” Grauer says. “North Korean hacking organizations have realized how worthwhile this kind of hacking may be if executed appropriately, so have continued to hold out assaults all through 2022.”

Monetary establishments, shoppers, and cybersecurity professionals shouldn’t count on the decline in fraud associated to cryptocurrency to proceed, Chainalysis careworn. Customers have to be higher educated in regards to the dangers, whereas the cybersecurity of decentralized monetary protocols must be bolstered and audited. Lastly, respectable exchanges ought to have protections in place to forestall the switch of cash to identified scams, and legislation enforcement ought to develop their capabilities to grab cryptocurrency from unhealthy actors, the corporate acknowledged.