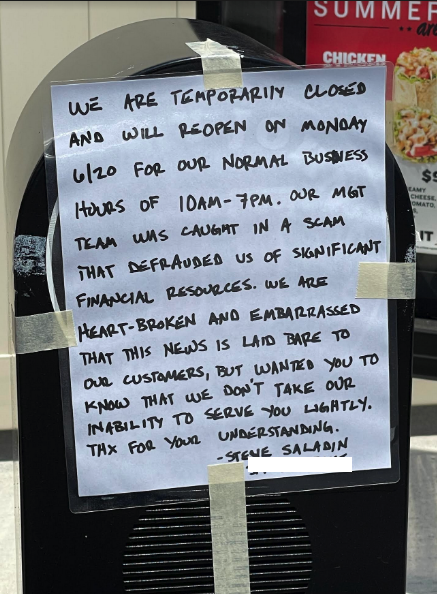

Try this handmade signal posted to the entrance door of a shuttered Jimmy John’s sandwich chain store in Missouri final week. See for those who can inform from the shop proprietor’s message what occurred.

If you happen to guessed that somebody within the Jimmy John’s retailer may need fallen sufferer to a Enterprise E mail Compromise (BEC) or “CEO fraud” scheme — whereby the scammers impersonate firm executives to steal cash — you’d be in good firm.

Actually, that was my preliminary assumption when a reader in Missouri shared this photograph after being turned away from his favourite native sub store. However a dialog with the shop’s proprietor Steve Saladin introduced house the reality that a number of the greatest options to combating fraud are much more low-tech than BEC scams.

Go to any random fast-casual eating institution and there’s an excellent probability you’ll see an indication someplace from the administration telling clients their subsequent meal is free in the event that they don’t obtain a receipt with their meals. Whereas it is probably not apparent, such insurance policies are supposed to deter worker theft.

The thought is to pressure staff to finalize all gross sales and create a transaction that will get logged by the corporate’s methods. The provide additionally incentivizes clients to assist hold staff sincere by reporting once they don’t get a receipt with their meals, as a result of staff can typically conceal transactions by canceling them earlier than they’re accomplished. In that state of affairs, the worker offers the shopper their meals and any change, after which pockets the remainder.

You’ll be able to most likely guess by now that this explicit Jimmy John’s franchise — in Sundown Hills, Mo. — was amongst those who selected to not incentivize its clients to insist upon receiving receipts. Because of that oversight, Saladin was compelled to shut the shop final week and fireplace the husband-and-wife managers for allegedly embezzling practically $100,000 in money funds from clients.

Saladin stated he started to suspect one thing was amiss after he agreed to take over the Monday and Tuesday shifts for the couple so they might have two consecutive days off collectively. He stated he observed that money receipts on the finish of the nights on Mondays and Tuesdays had been “considerably bigger” than when he wasn’t manning the until, and that this was constant over a number of weeks.

Then he had pals proceed by means of his restaurant’s drive-thru, to see in the event that they acquired receipts for money funds.

“One in all [the managers] would take an order on the drive-thru, and once they decided the shopper was going to pay with money the opposite would make the shopper’s change for it, however then delete the order earlier than the system might full it and print a receipt,” Saladin stated.

Saladin stated his attorneys and native legislation enforcement at the moment are concerned, and he estimates the previous staff stole near $100,000 in money receipts. That was on prime of the $115,000 in salaries he paid in whole annually to each staff. Saladin additionally has to determine a method to pay his franchisor a payment for every of the stolen transactions.

Now Saladin sees the knowledge of including the receipt signal, and says all of his shops will quickly carry an indication providing $10 in money to any clients who report not receiving a receipt with their meals.

Many enterprise house owners are reluctant to contain the authorities once they uncover {that a} present or former worker has stolen from them. Too typically, organizations victimized by worker theft draw back from reporting it as a result of they’re frightened that any ensuing media protection of the crime will do extra hurt than good.

However there are quiet methods to make sure embezzlers get their due. A couple of years again, I attended a presentation by an investigator with the prison division of the U.S. Inner Income Service (IRS) who steered that any embezzling victims searching for a discreet legislation enforcement response ought to merely contact the IRS.

The agent stated the IRS is obligated to research all notifications it receives from employers about unreported revenue, however that embezzling victims typically neglect to even notify the company. That’s a disgrace, he stated, as a result of underneath U.S. federal legislation, anybody who willfully makes an attempt to evade or defeat taxes might be charged with a felony, with penalties together with as much as $100,000 in fines, as much as 5 years in jail, and the prices of prosecution.