Cryptomining has been within the headlines in current months for all of the mistaken causes if you’re a cryptocurrency investor or speculator. It isn’t all doom and gloom for crypto, although, as we now have lately reported on newer, extra environment friendly mining tools changing into obtainable from the likes of Intel and Bitmain. Furthermore, on Thursday, Bloomberg reported that the price of mining Bitcoins had reached a 10-month low.

Some might have scoffed on the new ASIC cryptomining techniques changing into obtainable this summer season, contemplating the dire valuation charts for all the most important blockchain-based currencies. Nevertheless, it now appears to be like like new environment friendly mining techniques coming on-line are rapidly having a useful affect on the underside traces of mining operations. Even with the continued crypto crash, the distinction between prices and crypto valuations makes mining operations sound extremely worthwhile in the interim.

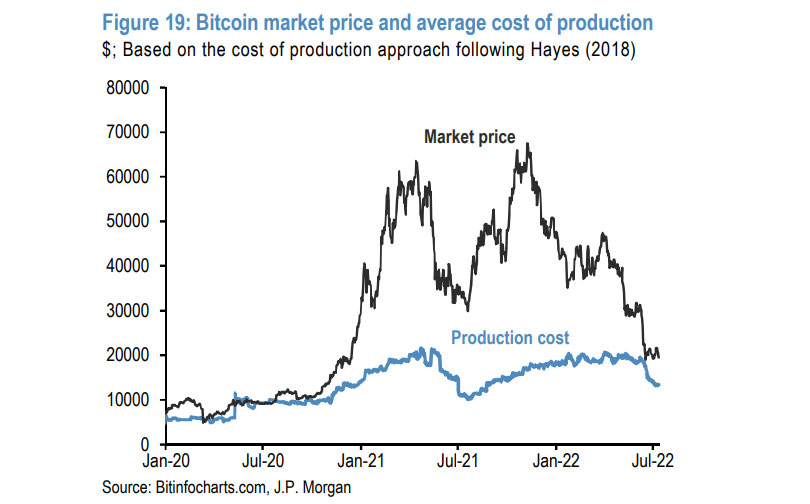

In response to information from JP Morgan, at the beginning of June, cryptomining operations have been spending $24,000 to mine one Bitcoin (BTC). At present, they count on to mine a Bitcoin after spending solely $13,000. To place that into perspective, you may promote 1 BTC at the moment for nearly $21,000, which is best than a 60% revenue.

The Bloomberg report asserts the discount in mining prices is fully all the way down to the deployment of extra energy-efficient mining rigs. One should additionally keep in mind that that is taking place whereas power costs are rocketing worldwide. That makes the mining value reductions and effectivity of the newest mining tools all of the extra spectacular.

Cheaper Mining to Lead to Decrease Bear Market Valuations?

Apparently, a crypto valuation concept shared within the supply report means that reducing the manufacturing value might negatively affect BTC valuations. In different phrases, some see the manufacturing value as a resistance line buoying BTC, and maybe different main cryptocurrencies. If this line may be shifted down, so can also crypto valuations after we are in a bear market.

We talked about above that 1 BTC is price about $21,000 at the moment. Some would possibly really feel the valuation may be very low, but when we be taught from historical past and the 2 earlier bull/bear markets Bitcoin has been via, we must always count on it to drop to about $13,000 earlier than the ache ends (80% down from its peak), and earlier than there generally is a restoration. Nevertheless, the place we stand in 2022, with a battle in Europe and on the precipice of a recession, we shouldn’t count on issues to pan out precisely the identical, or reverse as rapidly as in 2018 and late 2020.

General, it’s attention-grabbing to see such a dramatic reduce within the prices of Bitcoin mining (and sure different currencies too). Whether or not diminished mining prices will contribute to additional reductions in valuations, or assist miners keep afloat throughout this droop, stays to be seen. Equally unsure are the depths of the worldwide inflation, recession and monetary points we are going to see via 2022 and past.