Each different day, the lunch desk dialog steers into murky waters like cryptocurrencies and central financial institution digital currencies. Some are for it, some are towards, only a few admit that it’s all very complicated, whereas the truth is, it’s! Get pleasure from your dessert, whereas we offer you a easy, no-tension rundown of the digital foreign money scene.

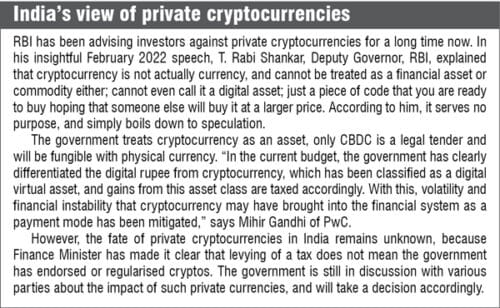

For the previous couple of years, the Reserve Financial institution of India (RBI) has held a agency stance towards cryptocurrencies, that are risky in nature, have the potential to trigger monetary instability, and allow under-the-radar transactions. There are severe discussions occurring about banning them.

However, on this 12 months’s funds, Finance Minister Nirmala Sitharaman introduced that India can be launching its personal central financial institution digital foreign money (CBDC) within the monetary 12 months 2022-23. She additionally went on to announce a 30% tax on positive factors constituted of every other personal digital belongings like non-fungible tokens and cryptocurrencies.

Does that imply the federal government has regularised cryptocurrencies? To grasp these developments, we have to begin from the ABC, and perceive cryptocurrencies, CBDCs, and all the things in between.

Digital currencies, undoubtedly fascinating

“Cash has modified in kind all through historical past. Primarily, cash is a belief machine between customers who agree on some intrinsic worth for that ‘kind’ after which use it as a retailer of worth or to facilitate trade. Something that succeeds in gaining acceptance has the potential to turn into cash or foreign money—from sea shells, pepper and gold to paper and digital. Digital, as a result of the world is now a village, and with real-time international commerce and exchanges between organisations, companies, governments and now peer-to-peer rising exponentially, digital cash is required to facilitate these instantaneously. Digital cash additionally serves an vital function of compression of worth (permitting for fast motion and generally invisibility) that previously artwork and gems have supplied,” says Rajesh Lalwani, CEO, State of affairs Consulting Pvt Ltd, getting ready the bottom for a dialogue on this important monetary instrument!

Digital foreign money is an umbrella time period, which refers to foreign money that exists in digital kind. It’s saved, managed, and transacted via laptop programs, different digital gadgets, and wallets. Digital currencies shouldn’t have bodily attributes, like notes or cash—although they might be equal to or convertible to fiat foreign money. There isn’t a minting, storage, transportation, or different logistical processes related to digital foreign money. Digital foreign money transactions are cheap and nearly instantaneous. They allow seamless switch of worth—even throughout borders.

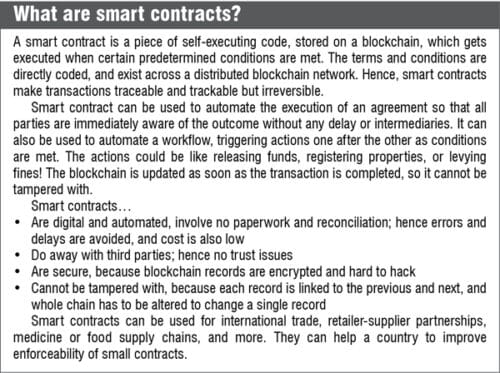

If the system is predicated on distributed ledger know-how (DLT), every transaction is linked to the earlier one and the subsequent one in a distributed ledger. So, to vary one transaction, you’ll have to change the complete chain. This ensures that every one transactions are traceable however not reversible, making them very tough to tamper with. All transactions are encrypted between digital wallets, leading to actual parity calculation on the ledger. This instils a way of belief within the system, reduces the potential for errors, and the necessity for in depth reconciliation processes.

Given all the benefits, we’ve to keep in mind that even essentially the most strong and safe digital programs have fallen prey to hackers throughout time. There have been uncommon circumstances of hackers stealing from wallets, or tampering with the protocol and making the foreign money unusable!

Total, the idea of digital foreign money is unquestionably a fascinating one, which might remodel the world of finance. Nevertheless, not all digital currencies are the identical—and a few may be very problematic too.

The various varieties of digital foreign money

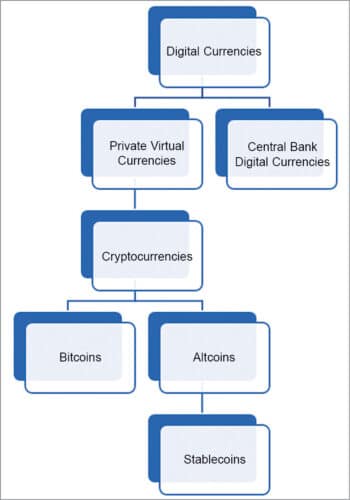

Digital currencies may be both open or closed, regulated or unregulated, centralised or decentralised—which provides rise to totally different classes: personal digital currencies, cryptocurrencies, and central financial institution digital currencies. We should first be capable of differentiate between these, to discern which is healthier or worse.

Non-public digital foreign money is usually unregulated. It’s issued and managed by a non-public issuer, such because the developer or founding organisation of a platform, and never by a central financial institution. It’s normally native to a community, and has little worth exterior of it. It may be algorithmically managed. Transactions are normally direct, celebration to celebration, with out intermediaries. It might be centralised or decentralised, could or will not be encrypted, and should or will not be convertible to fiat foreign money.

Cryptocurrency is a type of personal digital foreign money, which makes use of cryptography to handle and management the creation of foreign money, in addition to to safe and confirm transactions. This makes it tough to counterfeit or double-spend cryptocurrencies. Cryptocurrencies are decentralised digital currencies, which rely on blockchain networks to validate transactions and instil belief within the system. The most well-liked cryptocurrency is the Bitcoin, which was developed in 2008 by an unknown particular person or group by the identify of Satoshi Nakamoto. Bitcoins are principally small items of code, given to reward mining—a compute-intensive course of that verifies Bitcoin transactions on the blockchain.

Altcoins check with all cryptocurrencies aside from Bitcoin, resembling Ether, Dogecoin, and so on. These use cryptography too, however could use totally different logic to validate transactions or embody superior options to unravel the inherent issues of Bitcoin resembling volatility.

Stablecoins are a kind of altcoin, which peg the worth of the cryptocurrency to some bodily entity like fiat foreign money, gems, or valuable metals. It will act as a reserve to redeem holders if the cryptocurrency collapses. Value fluctuations are additionally restricted to a slim vary. Examples of stablecoins embody Tether’s USDT and MakerDAO’s DAI.

Central financial institution digital currencies (CBDCs) are regulated and centralised digital currencies, issued and managed by the central financial institution of a rustic. Whereas the fiat foreign money is a paper contract, the CBDC is a digital authorized tender. It dietary supplements and coexists with conventional fiat foreign money, and is normally fungible with it.

Digital currencies, actual issues

In accordance with CoinMarketCap, as of February 2022, there have been 17,436 cryptocurrencies and 458 crypto exchanges. The market capitalisation of all cryptocurrencies stood at $1.98 trillion. But, regulators preserve advising buyers to watch out for the chance in investing in cryptocurrencies, as a result of they’re extraordinarily risky in nature, and will result in monetary instability. Allow us to perceive the dangers which are inherent in

cryptocurrencies.

Cryptocurrency is only a piece of code, a decentralised digital asset, which is managed via a blockchain to make sure transparency and belief. It derives its worth or buying energy from its neighborhood of customers—and can be utilized within the community (or digital world) that it belongs to, to pay for providers or digital belongings like non-fungible tokens (NFTs).

Cryptocurrency isn’t backed by any central company, and doesn’t contain any intermediaries like banks or different monetary establishments. It’s principally pushed solely by free market forces, and is proof against authorities interference. For that reason, many name it ‘freedom cash,’ describing it as a disruptive know-how and a possible social motion.

The worth of cryptocurrency is extraordinarily risky, and tends to vary by the day, even by the hour. “Cryptocurrencies are all otherwise envisioned primarily based upon their designed function and utility. Fluctuations of their costs are a perform of demand and provide (actual and manipulated) and the change in future worth as consumers and sellers understand it,” says Lalwani. Knowledge from CoinMarketCap exhibits that the Bitcoin was valued at round $5000 in March 2020, rose to $65,000 by April 2021, and dropped to lower than half that worth by June 2021. This fluctuation was attributed to the novel coronavirus pandemic.

Equally, Bitcoin valuations noticed a steep fall after Russia’s assault on Ukraine. Nevertheless, the costs bounded again quickly thereafter, as buyers’ threat urge for food returned! In a speech delivered in February 2022, T. Rabi Shankar, Deputy Governor, RBI, defined that concentrated possession within the arms of some “crypto whales” makes the system susceptible to manipulation.

For one thing for use as common foreign money, its worth needs to be fairly secure. The extremely risky nature of cryptocurrencies implies that you may not be capable of use them to pay in your meals, garments, shelter, or different necessities! It is because of this that Subash Chandra Garg, former Finance Secretary of India, commented in an interview final 12 months that he most well-liked to name them simply cryptos and never cryptocurrencies as they functioned solely marginally as currencies, and can in all probability need to be recognised as one other distinctive product or asset class in itself.

One other big downside with cryptocurrencies is the entire privateness that it provides. In these decentralised blockchain primarily based programs, the transactions are authorised by the members and validated by the community with none intermediaries. A transaction stays nameless when it comes to individuals and function. Plenty of misguided buyers use this anonymity to evade authorities management and taxes. The benefit of doing under-the-radar transactions additionally makes the crypto ecosystem a gorgeous playground for terrorists and cash launderers.

Additional, when buyers put increasingly cash into cryptocurrencies, it may weaken a creating nation’s foreign money, since most of right now’s cryptocurrencies are valued solely in {dollars} and euros. Additionally, if individuals begin doing cross-border transactions via personal cryptocurrencies, a nation’s international trade reserve would additionally go down. As extra money goes into personal currencies, the cash circulating within the economic system would go down. With a number of personal currencies getting used concurrently, the federal government would lose coverage management of the economic system. Their capacity to manage inflation can be weakened. All of this might result in monetary instability.

CBDCs overcoming the chance of crypto

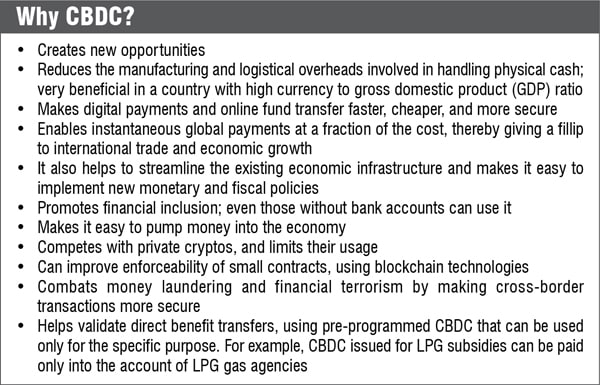

Whereas personal, decentralised, and unregulated digital currencies are dangerous and troublesome, there may be additionally the great facet—regulated and centralised digital currencies may inject plenty of effectivity into a rustic’s cost mechanism. For that reason, governments internationally are within the strategy of launching their very own central financial institution digital currencies. CBDCs provide the advantages of cryptocurrencies, sans the chance, as a result of the respective nation’s central financial institution would play its position as a regulatory and stabilising power.

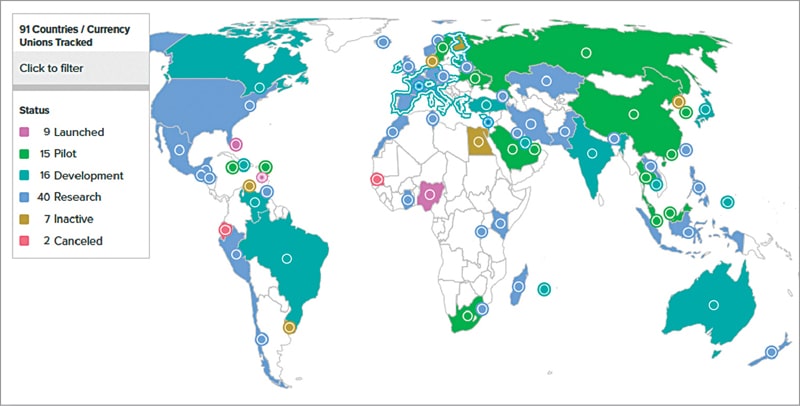

9 nations, together with The Bahamas and Nigeria, have launched their CBDCs, whereas fifteen, together with Russia and China, are within the pilot stage. Sixteen nations, together with India, are at present creating their CBDC framework. Whereas asserting the upcoming digital rupee, Finance Minister mentioned that its introduction will give an enormous enhance to the digital economic system and can result in a extra environment friendly and cheaper foreign money administration system.

“Central financial institution digital currencies are to not be confused with cryptocurrencies in that, whereas they might use encryption and should reside on the blockchain, they’re backed by the respective central banks of sovereign states. They’re the legal responsibility of the central financial institution and backed by the central financial institution belongings similar to the bodily foreign money put into circulation by a central financial institution. Their unit worth doesn’t fluctuate. So, one rupee is valued at one rupee whether or not in money or as a digital holding. When it comes to trade worth to a different central financial institution foreign money, say a greenback, that rupee’s worth could change primarily based on the varied dynamics of international trade valuation,” explains Lalwani.

Mihir Gandhi, Associate and Chief – Funds Transformation, PwC explains how CBDC may gain advantage a nation: “Options like belief, programmability, traceability, and so on will impart extra advantages over bodily kind. Digital rupee will complement the present cost modes and might make a big affect in a couple of notable areas like offline funds, programmable or focused funds (subsidies), cross border funds and remittances. Benefit is it’s traceable, and lower-cost than bodily foreign money to deal with and handle, and interoperable with different digital currencies for worldwide transactions.”

Does India want a CBDC?

As quickly because the announcement concerning the digital rupee was made, debates exploded about whether or not India actually wants a CBDC, contemplating that we have already got a fairly superior digital cost system—for each wholesale and retail funds. In accordance with a CLSA report, digital funds in India rose from $61 billion in 2016 to $300 billion in 2021. It’s anticipated to go up additional to round $1 trillion by 2026. It’s fairly evident that persons are comfy with digital cost programs like United Funds Interface (UPI) and Rapid Fee Service (IMPS). So, the query arises as to why we’d like digital currencies.

In a November 2021 media interview, Garg defined that although greater than 95% of funds by worth are digital funds, there may be about ₹30,000 billion of foreign money floating within the nation, and it’s believed that greater than 90% of funds by quantity are nonetheless bodily funds. It’s this phase of small-value foreign money transactions that wants CBDC essentially the most.

“CBDC’s benefit is envisioned when it comes to creating frictionless, accessible, and inexpensive cost mechanisms. Whereas we’ve digital cost programs right now, together with fast settlements via IMPS, UPI, and so on, they don’t seem to be common and generally carry excessive charges or transaction prices (significantly cross-border). CBDCs will permit cross-border funds at fractional prices and ship unprecedented affect,” says Lalwani.

Though the digital rupee is prone to creation in a quite simple kind, it would incorporate extra options as time goes by.

Understanding retail and wholesale CBDCs

India is prone to introduce each retail and wholesale CBDCs.

Wholesale CBDC is to be used by banks and different monetary establishments. Wholesale cost programs in India are already digital and fairly well-evolved, so CBDC may not be visibly disruptive however will certainly introduce efficiencies utilizing the blockchain. Wholesale CBDC will allow settlement on internet foundation. Settlements shall be validated utilizing good contracts. It is going to be used for interbank, cross-border, capital, and safety market settlements. It’s rumoured that work on wholesale CBDCs is extra superior in India than retail CBDC.

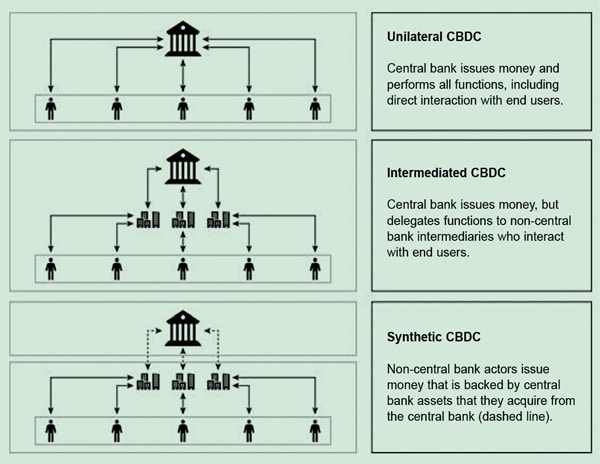

Retail CBDC is, understandably, extra complicated as a result of it includes a bigger inhabitants. It is going to be utilized by most people for conducting day-to-day transactions, normally small-value ones. There are totally different conceptual working fashions (refer Fig. 3), which resolve how the CBDCs would movement via the economic system, and what position banking and monetary establishments, cost providers, and software suppliers play within the ecosystem.

Blockchain and different applied sciences

India’s CBDC is probably going to make use of DLT, most certainly a non-public blockchain dealt with by the federal government. This is able to allow RBI to have good management over the blockchain. Sankar defined in his speech {that a} blockchain may be maintained with out native foreign money, if transactions are authenticated centrally. It’s attainable to keep up accounts and reward work with authorized tender foreign money too, making the DLT helpful for a number of functions with none personal foreign money.

The iSPIRT Basis earlier launched the Bharat Distributed Ledger (BADAL) for establishing belief for Indian B2B commerce. The BADAL protocol makes use of a private-public ledger (PPL) substrate, which is perhaps helpful for the RBI to launch CBDC.

Garg advised in one other media interview that it could be a lot simpler, handy, and cost-effective to dematerialise the bodily foreign money on the strains of how fairness, bonds, and different securities have been dematerialised, and use it to usher in digital foreign money in India.

In accordance with Eswar Prasad, Professor at Cornell College, retail CBDC may take two varieties—worth primarily based or token primarily based. In a Bloomberg Quint interview, he mentioned, “One might be a pay as you go card, besides it could be an account with a pay as you go steadiness that you’d have in your telephone. A second kind is the place a CBDC basically features as a token in a cost system. This is able to take the type of a digital pockets the place one may maintain CBDCs, which might basically be like accounts, however non-interest-bearing accounts.”

“Blockchain is without doubt one of the many distributed ledger applied sciences accessible for launching a CBDC, nevertheless not the one know-how accessible. We might want to consider accessible applied sciences on a number of standards like accessibility, privateness, scalability, efficiency, resiliency, finality and so on. Choice must be taken primarily based on the mannequin chosen, if there needs to be a centralised know-how or decentralised know-how,” concludes Gandhi.

Pitfalls to be averted

Whereas designing its CBDC framework, India should take into accounts some potential issues, and attempt to design the options into the system proper at first:

Potential financial institution run

A bulk shift from industrial to central banks may result in a form of monetary disaster. To keep away from this, central banks should restrict the sum of money that may be held in CBDC accounts, and ensure digital wallets are maintained by industrial banks.

Pressure on the central financial institution

Full management within the arms of central banks may result in a pressure on their community infrastructure and make the central financial institution susceptible to safety threats.

Non-public innovation

Diminished position of business banks may kill personal innovation within the banking sector. To keep away from this, nations like Sweden and China try out a two-tier CBDC, the place the central financial institution supplies the cost infrastructure within the backend. Within the front-end, industrial banks innovate and supply efficient cost mechanisms to customers.

Coverage making challenges

CBDC, with the direct nature of its transactions, could have a dynamic affect on the economic system, and macroeconomic policymaking shall be more difficult than ever earlier than!

Power consumption

Blockchain primarily based cryptographic networks require immense computing energy, and lots of of them, together with the Bitcoin community, have come below heavy criticism for his or her socially wasteful power utilization. Nevertheless, excessive power consumption isn’t intrinsic to all blockchain community architectures. The quantity of power consumed by a blockchain community relies on its consensus mechanism, that’s, what data is added to the community ledger. India should optimise this, such that it doesn’t have a deep environmental affect.

India is in for a really attention-grabbing experience, which includes not solely designing and creating the infrastructure, and rolling out the digital foreign money in a phased method, but in addition clearing misconceptions and creating consciousness about digital currencies—what’s accepted and what’s not. We’d see wholesale CBDC in motion first, adopted by retail CBDC in a easy kind, with extra options being added as we go alongside.

Janani G. Vikram is a contract author primarily based in Chennai, who loves to write down on rising applied sciences and Indian tradition. She believes in relishing each second of life, as completely happy recollections are the most effective financial savings for the longer term