Apple Pay Later is the corporate’s newest monetary service that gives a mortgage you possibly can pay again in 4 installments with no curiosity or charges. Right here’s how one can set it up.

As I allude to within the headline, consider this like Klarna — a pay later service, however with the additional advantage of being built-in straight into Apple Pockets.on the likes of your iPhone 14 or iPad.

Proper now, Apple has not confirmed whether or not there’s a minimal credit score rating to use for a mortgage, however the firm will conduct a credit score verify that doesn’t affect your rating, utilizing “Experian and different credit score bureaus.” If you’re interested in setting your self up on Apple Pay Later, right here’s a fast information.

The best way to arrange Apple Pay Later

So, I want to begin this by tearing a small bandaid off and say you possibly can’t straight apply for Apple Pay Later. Proper now, the corporate is inviting randomly chosen customers to entry a prerelease model.

Should you had been fortunate sufficient to have been picked, right here’s how one can set it up. As soon as you possibly can apply, we are going to replace this information with a fast tutorial on how to take action.

1. Test off the conditions

You’ll need to satisfy just a few necessities. These are:

- You might be 18 years outdated or over

- You’re a lawful U.S. citizen with a sound U.S. handle

- You have already got Apple Pay setup with a debit card

- You will have two-factor authentication setup in your Apple ID account

- You will have a Driver’s License or State-issued picture ID (chances are you’ll have to confirm your id)

2. Head into your Apple Pockets

Should you’re utilizing this in your iPhone, open the Apple Pockets app. For anybody on an iPad, head over to Settings, and faucet Pockets & Apple Pay.

3. Begin the setup course of

Faucet the plus image, choose Apple Pay Later and hit proceed.

4. Arrange your Apple Pay Later mortgage

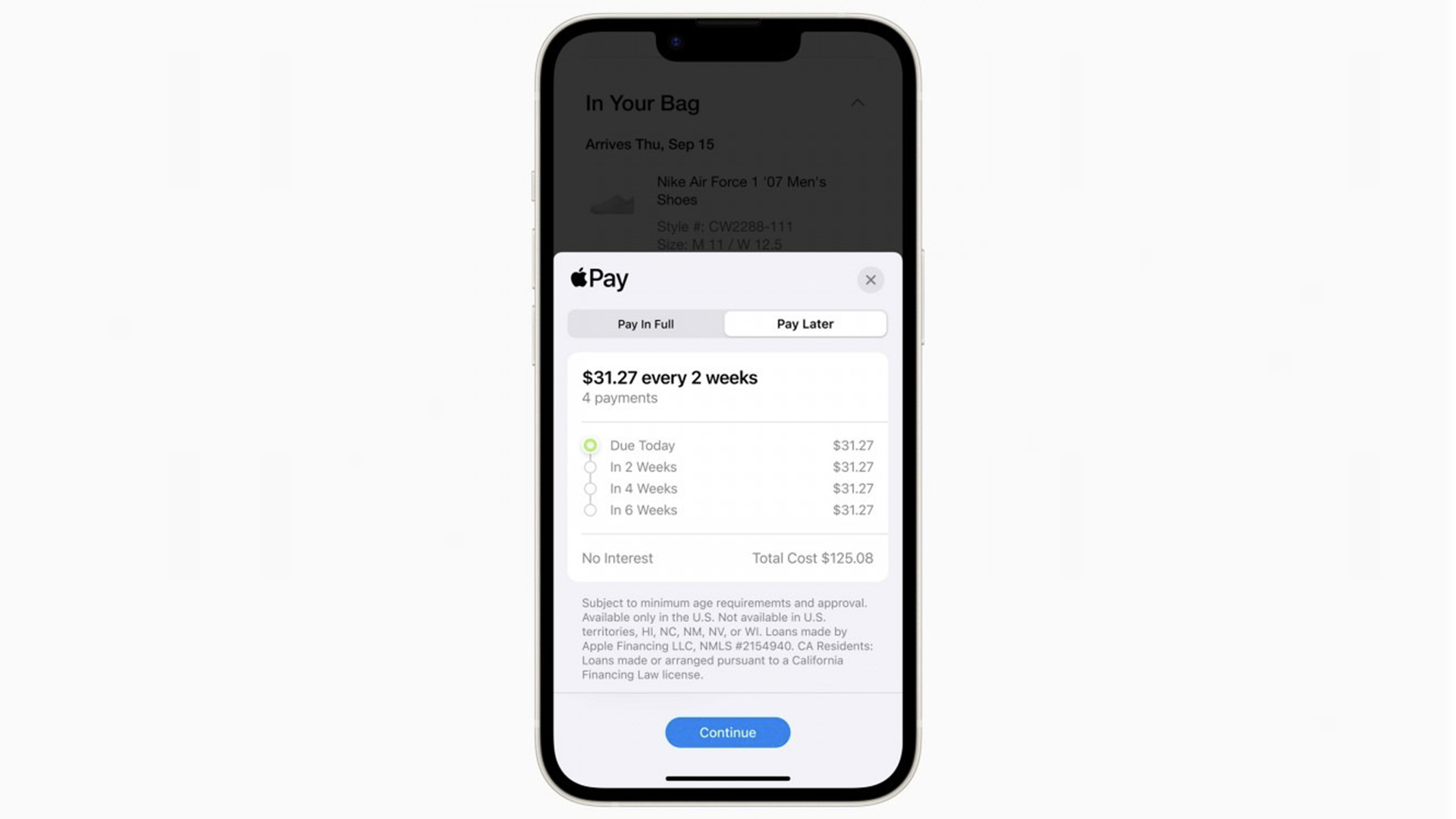

Head by the steps to use on your Apple Pay Later mortgage. This contains submitting your requested quantity, and the complete worth of the acquisition together with delivery and taxes. The worth you possibly can request will be something between $50 and $1,000.

5. Verification and affirmation

(Picture: © Apple)

Faucet Subsequent, which can lead you to verifying your private data. As soon as executed, faucet Agree and apply.

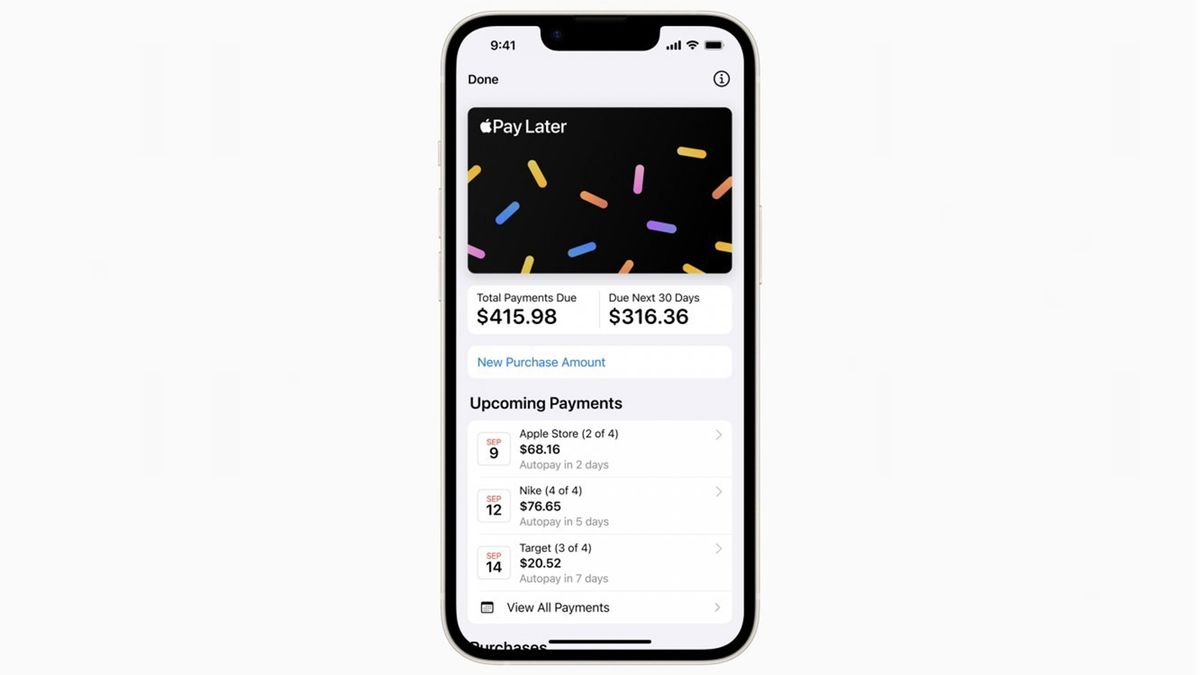

6. Affirm the mortgage

At this level, you will notice the mortgage settlement particulars and cost plan. Should you’re pleased with all of it, faucet Add to Pockets. At this level, you’ll have 30 days to make use of this mortgage. Should you don’t handle to make use of it on this timeframe, you will want to re-apply.