Final week, Tata Consultancy Providers (TCS) introduced its consolidated monetary outcomes for the quarter ending June 30, 2022 (FY-23, Q1).

On the earnings name, the corporate reported a unbroken progress momentum, the place it has been steadily seeing progress throughout each markets and prospects.

TCS additionally revealed that the demand for know-how could be very sturdy, primarily pushed by cloud transition, investments in client expertise and working mannequin transformation initiatives centered on progress and transmission and buyer optimisation points.

The corporate says that it has a gradual demand, mirrored in its pipeline and deal closures. It has full contract signings of $8.2 billion this quarter, with a few offers within the vary of about 400+ million.

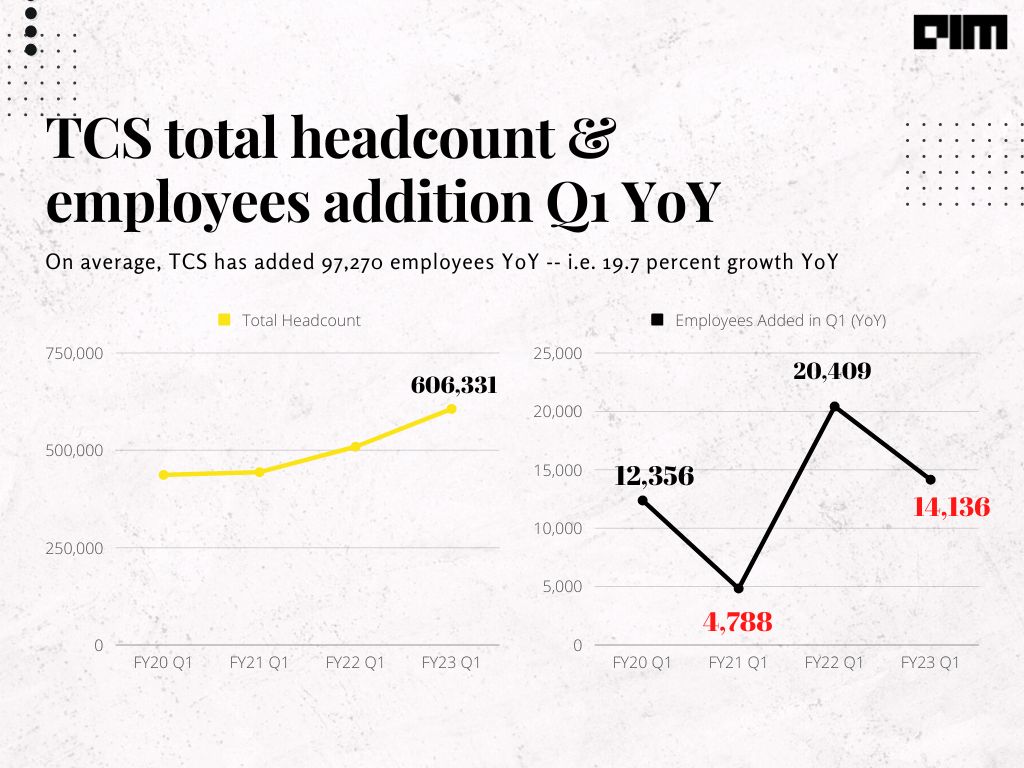

When it comes to worker headcount, TCS stands at 606,331, i.e., up 97,270 workers YoY foundation, or a progress of 19.7 per cent for this quarter. It goals to proceed including extra individuals to construct up the capability for its long-term progress whereas additionally balancing its demand for expertise. The identical is mirrored of their attrition numbers as effectively.

Income-wise, it has generated a progress of $6.8 billion, rising 16.2 per cent in rupee phrases, 15.5 per cent in fixed foreign money phrases and 10.2 per cent year-on-year (YoY) in greenback phrases.

From a vertical market perspective, TCS recorded steady progress momentum in its BFSI with 13.9 per cent YoY progress and clocking in at $2.18 billion of quarterly income. Then again, retail and CPG, which just about bore the brunt of the pandemic, have been recovering very effectively, in response to TCS—who additional acknowledged that restoration continues with a 25 per cent YoY progress, clocking $1.08 billion in income. Manufacturing, which has been barely risky, continues to develop at 16.4 per cent on fixed foreign money phrases at $670 million for the quarter.

India enterprise stalls

Assessing phase efficiency, North America, one of many largest markets for TCS, grew at 19.1 per cent YoY.

“Persevering with the very robust progress that we’ve got been experiencing during the last many quarters, we at the moment are at $3.6 billion on a quarterly foundation in North America”, shares Rajesh Gopinathan, CEO and Managing Director at TCS.

Additional, he added that the UK and Europe grew barely above 12 per cent YoY, every contributing reasonably above a billion.

Nevertheless, TCS’ India enterprise appears on a decline because the final monetary quarter. Gopinathan reveals that India continues to be very risky and additional explains that the general public sector and small and medium companies appear unstable within the Indian context in comparison with the company sector that’s doing comparatively effectively.

“We’re additionally selective about what initiatives we’re taking given the general volatility available in the market,” feedback Gopinathan.

Know-how patents filed

On the earnings name, TCS reported that it could proceed investing in IP growth. The corporate has filed an entire patent software of about 6,750 patents, i.e., 760 patents YoY. When it comes to precise patents granted, TCS has 2,400 patents, as much as 429 patents YoY foundation.

“This continues to be a key focus for us, not simply from our manufacturing perspective, but in addition reflecting the type of mental energy that the corporate has, throughout its options and numerous different merchandise and analysis areas”, says Rajesh Gopinathan.

TCS’s IP portfolio features a complete set of platforms and merchandise that addresses enterprises’ enterprise and know-how wants throughout industries. This consists of the TCS BaNCS™ suite for monetary establishments; Algo Retail™ suite consisting of TCS Optumera™ and TCS Omnistore™; ignio™ cognitive automation suite; TCS ADD platform for the life sciences trade; TCS HOBS™ and the TwinX™ platforms for communications and media firms; Jile™ enterprise Agile planning and supply instrument; TCS MasterCraft™ suite of clever automation merchandise and others.

That is backed by many accelerators, frameworks and toolsets in areas like knowledge analytics and insights, cloud migration, cloud administration, IoT, enterprise software transformation and others.

With these patents, how is TCS planning to place itself as a know-how firm going ahead?—requested Tom Easton, Finance Editor at The Economist, on the earnings name.

“It’s like asking which is our favorite little one”, quips Gopinathan. He then elaborated additional that they’re equally essential to TCS’ researchers who labored on them. Nevertheless, he additionally added that the way in which to consider TCS’ patent portfolio and its strategy to patents just isn’t designed to unearth one merchandise that’s more likely to pivot utterly.

Citing pharma, Gopinathan mentioned that they’ve a way more broad-based analysis agenda throughout all kinds of spectrums, and their strategy is kind of totally different from what one would observe in different industries. Utilizing a verticalisation strategy, TCS plans to consolidate and incorporate these patents into a lot of its product options. He provides, “A few of them might be game-changing on their very own, however our strategy to it is rather totally different from a typical agency or a know-how strategy.”

TCS on Metaverse

TCS mentioned they’re at present engaged on numerous metaverse initiatives as proof of functionality and particular person options. The corporate mentioned that it’s at present engaged on the retail facet, together with a number of banking and monetary providers points.

TCS chief Gopinathan mentioned that the initiatives are exploratory.

“However positively it’s one thing that may occur—how briskly and the way, [and] what the uptake will likely be tough for us to foretell,” he provides.

He mentioned their strategy, nevertheless, is to stay engaged.

Lately, TCS partnered with Tata group firms like Tanishq, Tata Motors and Croma to deploy metaverse options. Apart from these partnerships, TCS revealed that it’s at present working with a telecom vendor that’s serving to them develop an eCommerce platform. As well as, additionally it is engaged on constructing a metaverse resolution within the wealth administration area centered on the youthful demographic.

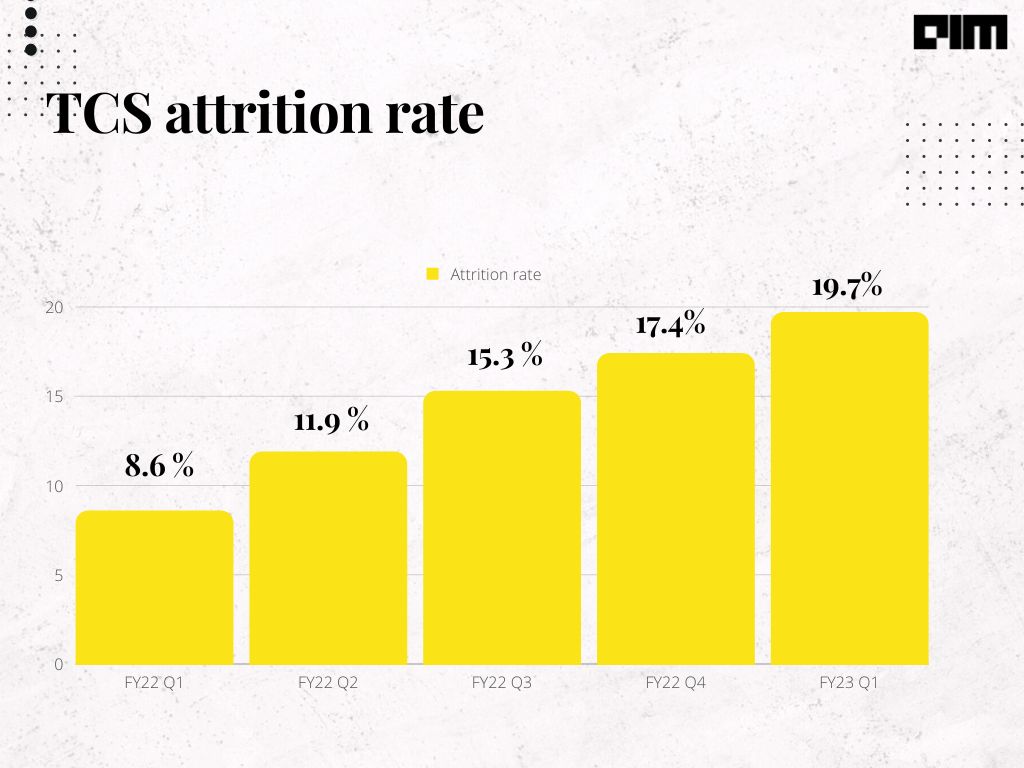

Rising attrition

Final quarter, the attrition variety of TCS was round 17.4 per cent. Nevertheless, this quarter the attrition price stands at 19.7 per cent and is rising.

“We expect it is going to rise additional in Q2, after which it ought to begin tapering”, says Samir Seksaria, Chief Monetary Officer at TCS.

So, how is TCS addressing the attrition price?

Rajesh Gopinathan mentioned that there was nothing totally different from what they noticed at the start of the quarter whereas addressing TCS’ attrition price. He additional mentioned that one of many charges is wage will increase whereas the opposite is the persevering with demand atmosphere and the attrition atmosphere resulting in the elevated working prices, particularly on the worker facet.

“I feel it is going to take one other few extra months earlier than it is going to begin to come down. So, until then, the margin pressures will proceed, however we hope to sequentially enhance from the place we’ve got taken that and can hit utterly”, says Gopinathan. Additional, he revealed that they’re conserving an in depth watch on the charges and can react in accordance to how the demand-supply scenario finally performs out.

Nevertheless, one other perspective that may be thought of is that the utilisation will enhance as soon as the attrition price comes down.

“That may be a cheap assumption. That’s our technical working mannequin additionally when in a high-demand state of affairs, we first prioritise demand, and attrition can be linked into that”, says Gopinathan in response to Ravi Menon, Analyst at Macquarie.

TCS additionally introduced a wage hike of 5–8 per cent and better for high efficiency with impact from April 1, 2022. This choice had a 1.5 per cent influence on working margins whereas continued supply-side challenges entailed extra bills reminiscent of backfilling bills and better subcontractor utilization. This, together with normalising journey bills, negated numerous operational efficiencies leading to an working margin of 23.1 per cent, a sequential contraction of 1.9 per cent.

In comparison with its friends, TCS has the bottom attrition price. Nevertheless, when it comes to the trajectory of controlling attrition, the corporate appears to be lagging behind the curve in comparison with others. So, what’s TCS doing in a different way to flatten the attrition price within the coming quarters?—requested Debashish Mazumdar, Analyst at B&Ok Securities.

In response, Gopinathan mentioned its worker reward programme is way more holistic than its friends.

“I imagine our worker retention numbers additionally mirror this holistic worker engagement and whole rewards programme. So, we’re fairly assured about the place we’re”, he says in reference to the pandemic occasions when the corporate had introduced that it could not be shedding anyone. He added that TCS was the primary firm to announce wage hikes in October 2020.

Additional, he defined that their programme just isn’t totally primarily based on the short-term impacts, and that TCS is kind of assured with its present government mannequin. He believes that the numbers mirror that confidence as effectively—“We anticipate attrition to begin truly fizzling out within the subsequent few months.”

Moreover, TCS additionally reported that their workflow expenditure crossed the 600K mark this quarter, ending this quarter with 6,06,331 workers.

“We proceed to rent expertise from internationally with a internet addition of 14,136. It’s a very various workforce with 153 nationalities represented and ladies making up 35.5 per cent of the bottom”, says Samir Seksaria.

Seksaria additional emphasised that TCS stays dedicated to investing in natural expertise growth to construct the next-generation GNT workforce. He revealed the corporate clocked 12 million studying hours ensuing within the acquisition of 1.7 million competencies.

General, an excellent quarter

TCS believes FY-23 Q1 has been 1 / 4 of robust efficiency, persevering with its journey from the previous couple of quarters. Nevertheless, within the coming quarter, the corporate mentioned that it could proceed to chase demand and hold an in depth eye on how the recession performs out within the close to future.

“With all our trade verticals displaying good progress, our order e-book and pipeline are additionally very robust, giving us good visibility for the following few months. Our margin dipped this quarter because of wage enhance and different supply-side associated prices, however we’re assured in our potential to carry it again to our most well-liked vary over time”, says Rajesh Gopinathan.

On the individuals entrance, TCS states that it could proceed to rent throughout all its markets and add over 14,000 workers on a internet foundation. On the attrition, the corporate revealed that it has been elevated at 19.7 per cent in IT providers on an LTM foundation.

“This may most likely peak subsequent quarter after which begin truly fizzling out”, concludes Rajesh Gopinathan.