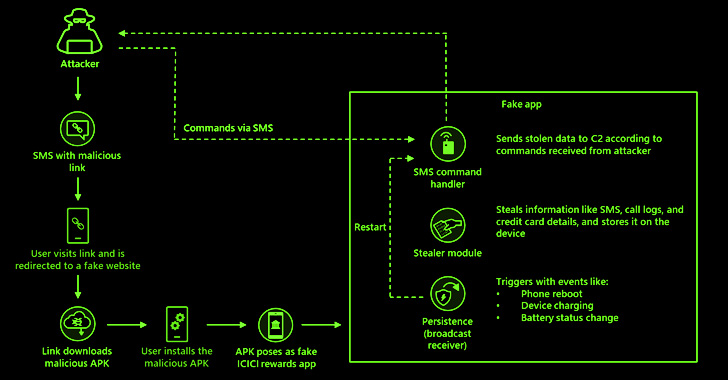

An SMS-based phishing marketing campaign is focusing on clients of Indian banks with information-stealing malware that masquerades as a rewards utility.

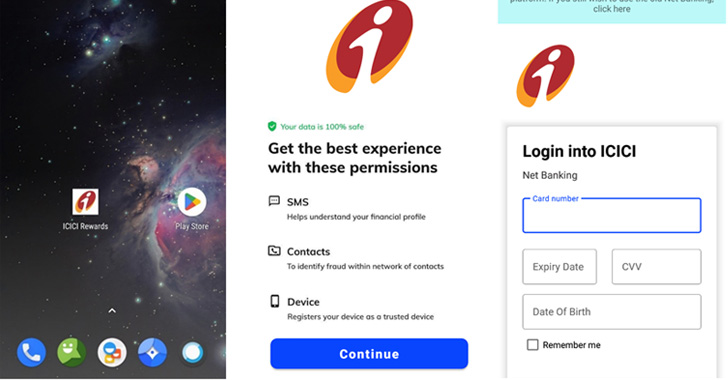

The Microsoft 365 Defender Analysis Workforce stated that the messages comprise hyperlinks that redirect customers to a sketchy web site that triggers the obtain of the faux banking rewards app for ICICI Financial institution.

“The malware’s RAT capabilities permit the attacker to intercept necessary machine notifications reminiscent of incoming messages, an obvious effort to catch two-factor authentication (2FA) messages usually utilized by banking and monetary establishments,” researchers Shivang Desai, Abhishek Pustakala, and Harshita Tripathi stated.

Moreover, the malware is provided with the power to steal SMSes, doubtlessly enabling the attacker to swipe 2FA codes despatched as textual content messages and achieve unauthorized entry to sufferer accounts.

Like different social engineering assaults, acquainted model logos and names are used within the smishing message in addition to the rogue app in a bid to provide an phantasm of legitimacy and trick the customers into putting in the apps.

The assaults are additionally a continuation of an ongoing marketing campaign that has distributed comparable rewards-themed apps for different Indian banks such because the State Financial institution of India (SBI) and Axis Financial institution previously.

As soon as put in, the fraudulent app not solely asks for in depth permissions, but in addition requests customers to enter their credit score/debit card info as a part of a supposed sign-in course of, whereas the trojan waits for additional directions from the attacker.

These instructions permit the malware to reap system metadata, name logs, intercept cellphone calls, in addition to steal credentials for e-mail accounts reminiscent of Gmail, Outlook, and Yahoo.

“This malware’s persevering with evolution highlights the necessity to shield cell gadgets,” the researchers stated. “Its wider SMS stealing capabilities would possibly permit attackers to the stolen information to additional steal from a consumer’s different banking apps.”