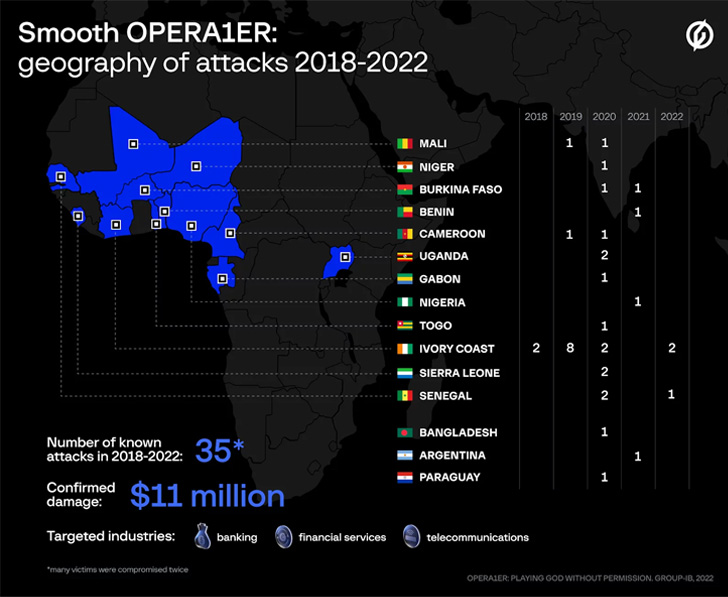

A French-speaking risk actor dubbed OPERA1ER has been linked to a collection of greater than 30 profitable cyber assaults geared toward banks, monetary companies, and telecom firms throughout Africa, Asia, and Latin America between 2018 and 2022.

In line with Singapore-headquartered cybersecurity firm Group-IB, the assaults have led to thefts totaling $11 million, with precise damages estimated to be as excessive as $30 million.

Among the more moderen assaults in 2021 and 2021 have singled out 5 totally different banks in Burkina Faso, Benin, Ivory Coast, and Senegal. Most of the victims recognized are stated to have been compromised twice, and their infrastructure subsequently weaponized to strike different organizations.

OPERA1ER, additionally identified by the names DESKTOP-GROUP, Frequent Raven, and NXSMS, is thought to be lively since 2016, working with the aim of conducting financially motivated heists and exfiltration of paperwork for additional use in spear-phishing assaults.

“OPERA1ER typically operates throughout weekends and public holidays,” Group-IB stated in a report shared with The Hacker Information, including the adversary’s “total arsenal is predicated on open-source applications and trojans, or free printed RATs that may be discovered on the darkish internet.”

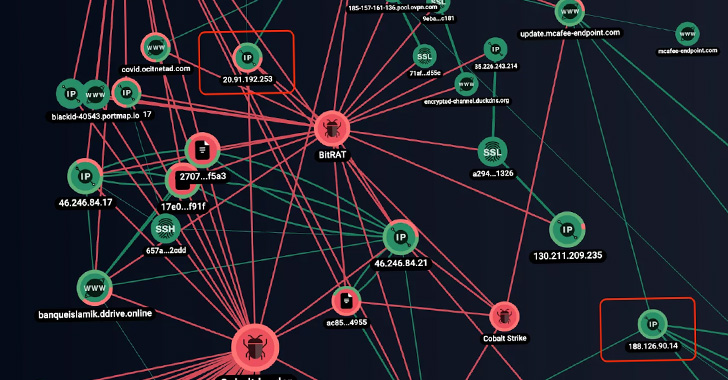

This contains off-the-shelf malware resembling Nanocore, Netwire, Agent Teslam Venom RAT, BitRAT, Metasploit, and Cobalt Strike Beacon, amongst others.

The assault chain commences with “high-quality spear-phishing emails” with bill and delivery-themed lures written primarily in French and to a lesser extent in English.

These messages characteristic ZIP archive attachments or hyperlinks to Google Drive, Discord servers, contaminated legit web sites, and different actor-controlled domains, which result in the deployment of distant entry trojans.

Succeeding within the RAT execution, post-exploitation frameworks like Metasploit Meterpreter and Cobalt Strike Beacon are downloaded and launched to ascertain persistent entry, harvest credentials, and exfiltrate recordsdata of curiosity, however not earlier than an prolonged reconnaissance interval to grasp the back-end operations.

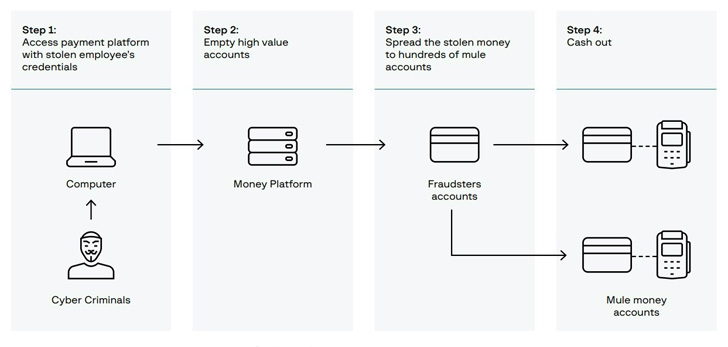

That is substantiated by the truth that the risk actor has been noticed spending wherever between three to 12 months from preliminary intrusion to creating fraudulent transactions to withdraw cash from ATMs.

The ultimate part of the assault includes breaking into the sufferer’s digital banking backend, enabling the adversary to maneuver funds from excessive worth accounts to tons of of rogue accounts, and in the end money them out by way of ATMs with the assistance of a community of cash mules employed prematurely.

“Right here clearly the assault and theft of funds had been potential as a result of the dangerous actors managed to build up totally different ranges of entry rights to the system by stealing the login credentials of varied operator customers,” Group-IB defined.

In a single occasion, over 400 mule subscriber accounts had been employed to illicitly siphon the cash, indicating that the “assault was very subtle, organized, coordinated, and deliberate over a protracted time period”

The findings – carried out in collaboration with telecom big Orange – that OPERA1ER managed to tug off the banking fraud operation by solely counting on publicly obtainable malware highlights the hassle that has gone into finding out the inner networks of the organizations.

“There aren’t any zero-day threats in OPERA1ER’s arsenal, and the assaults typically use exploits for vulnerabilities found three years in the past,” the corporate famous. “By slowly and cautious inching their approach via the focused system, they had been capable of efficiently perform not less than 30 assaults all world wide in lower than three years.”