One phrase I have been listening to an increasing number of of in current instances is “macroeconomic headwinds,” and I believe we’ll be listening to extra of it within the coming months forward throughout Microsoft’s financials.

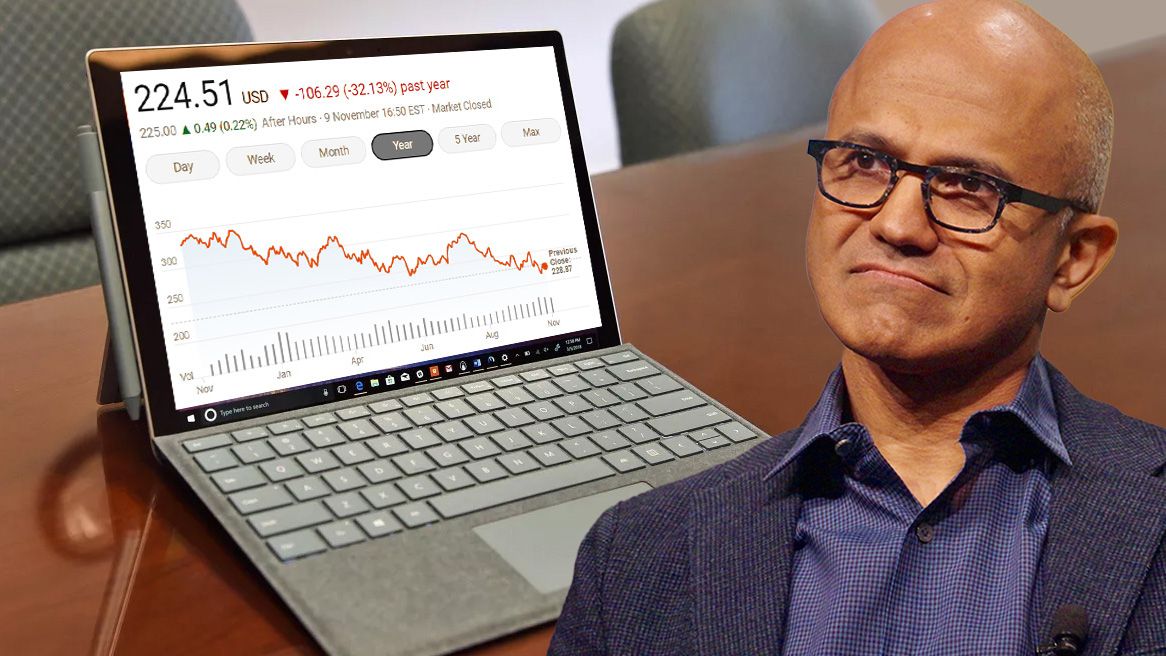

We’re transferring into powerful instances for the worldwide economic system. After years upon years of Microsoft inventory development, we’re lastly seeing a long-expected course correction, with varied firms enduring a reasonably staggering route. It isn’t thousands and thousands of {dollars} we’re speaking about and even billions, however trillions — and a number of the world’s largest tech corporations are getting bitten like by no means earlier than.

Amazon is actually the primary firm within the historical past of the world to lose $1 trillion {dollars} in worth, just a few years after varied tech megacorps like Google, Apple, and Microsoft broke into the celebrated $1 trillion greenback market cap membership. And it appears Microsoft could also be on track to hitch them.

As of writing, Microsoft is down $900 billion {dollars} for the yr, becoming a member of different tech firms like Tencent, Meta (Fb), and Google who’ve seen trillions of {dollars} in market capitalization evaporate over the previous yr. The quantities are really unimaginable, outstripping total nations’ value of GDP, with little signal of abating within the close to time period.

Why are tech shares down?

There are a number of elements behind why tech shares are underperforming these days. Should you take heed to Microsoft’s monetary experiences, it looks as if a head-scratcher at first look. Microsoft is persistently beating expectations in some areas whereas posting strong earnings and revenues. The tech inventory market correction usually displays future outlooks, and people sentiments have not too long ago been on a downward pattern.

Issues like China’s Covid-Zero coverage impacting provide chains, Russia’s warfare of aggression in Ukraine impacting power markets, and an inflation bubble brought on by quantitative easing from the pandemic are all elements feeding into this air of pessimism. Central banks worldwide have raised rates of interest to fight hovering inflation, and those self same rates of interest impression tech firms’ capability to put money into future platforms, companies, and different disruptive know-how that we noticed rise to prominence within the 2010s.

Crucially as effectively, Russia’s warfare has seen foreign money markets fluctuate, with buyers fleeing the Euro and British sterling (thanks Liz) in favor of the U.S. greenback. On condition that Microsoft does an enormous quantity of its enterprise (roughly half, actually) abroad, the fee to their enterprise will increase as they transfer earnings from nations like Europe again residence. For this reason you’ve got additionally seen firms like Sony increase the worth of the PlayStation 5 in Europe, however not America.

The previous decade actually was relentless with regard to how customers and companies work together with know-how. Microsoft joined Amazon on the very slicing fringe of cloud service provision, as an increasing number of of us opted for completely related units and subscription companies by way of what Microsoft used to name the “Clever Edge.” Microsoft Workplace went from a boxed product to a subscription service. Xbox is transferring deeper into subscription companies with Xbox Recreation Move. Microsoft is even gearing as much as provide Home windows itself as a subscription service, with cloud-based computing for customers.

Nonetheless, investing in information facilities to energy this know-how is more and more difficult for quite a lot of causes. Rates of interest and foreign money issues however, we have additionally seen lots of disruption to chip provide chains. Vitality markets are placing small and medium-sized firms out of enterprise, or on the very least, decreasing their willingness to spend. Shoppers are additionally feeling a contraction of their spending energy, which additionally has a knock-on impact throughout every little thing. Basically: bills are going up, and earnings goes down.

The flood of recent cash into the economic system in the course of the pandemic coupled with a world upheaval in person habits allowed Microsoft and different cloud-oriented tech corps to seek out, after which meet new demand. PC and laptop computer gross sales soared as everybody took to arrange their residence workplaces for distant working. Demand for companies like Netflix, Xbox gaming, and Amazon procuring led to hiring sprees to satisfy demand. A lot of this development was financed by way of borrowing at these historically-low rates of interest — a pattern now reversing course as central banks search to drive down inflation.

Through the pandemic, hypothesis was completely rife about what the panorama would possibly appear like with regard to client habits and behaviors. Mark Zuckerberg and Fb (now Meta) rebranded the complete firm round this concept of distant working utilizing VR headsets. This gamble led to Meta hiring actually hundreds of engineers to satisfy Zuckerberg’s imaginative and prescient of a related, always-remote working world. Even Microsoft bought on board with Meta’s metaverse desires. Though, the piper now needs his due — Fb introduced yesterday that it plans to put off over ten thousand of those self same engineers it employed to satisfy this imaginative and prescient of a distant world — a actuality which stays wholly digital at greatest.

Meta is among the many largest losers within the present tech retreat and is uniquely threatened by hubris over the metaverse, Apple’s altering advert monitoring guidelines, and rising competitors from websites like TikTok. However what about Microsoft? Analysts appear largely break up on whether or not or not tech shares will rebound to the bull market of the earlier decade.

The place’s the underside?

Microsoft, Apple, Google, and Amazon mixed characterize a whopping 20% of the complete S&P 500 high firms’ complete worth, so their shares characterize a significant well being test for the present state of the economic system. Meta has fairly uniquely shot itself within the foot lately, however firms like Microsoft and Apple have not precisely made any main errors on the dimensions of the metaverse or Google Stadia lately.

Fears over the warfare in Europe, provide chain disruption, and “a return to regular” after the pandemic have all impacted how buyers see tech shares — however rates of interest appear to be extensively fingered as the principle perpetrator for the decline of tech shares. As firms like Microsoft et al. grew their employees roster to satisfy demand in an more and more cloud-based world, rising rates of interest, and the super-heated worth of the American greenback compound with these different elements to drive up working prices. Microsoft and different tech firms have issued steering to warn about profitability by means of 2023, which some count on will mirror (and even exceed) the 2008 “Nice Recession” for instability and declines.

Microsoft cannot management rates of interest or world foreign money markets, but it surely’s effectively positioned to stay a pacesetter within the tech area. After all, know-how is all the time on the march. Person habits change, and new technological breakthroughs disrupt and create markets. Smartphones modified the complete world, and tech firms that capitalized on the rise of the “pocket pc” noticed a number of the most spectacular development in financial historical past. Microsoft has repeatedly proven itself to be a disruptor and innovator, and deeper funding in its gaming part ought to assist it offset loses which can be probably coming to its Home windows PC licensing operation. Gaming is commonly seen as, not less than, recession-resistant, in any case.

And naturally, no person can predict the longer term. However many analysts suspect that what we’re seeing this yr is just the start of what might be a painful interval within the tech trade.