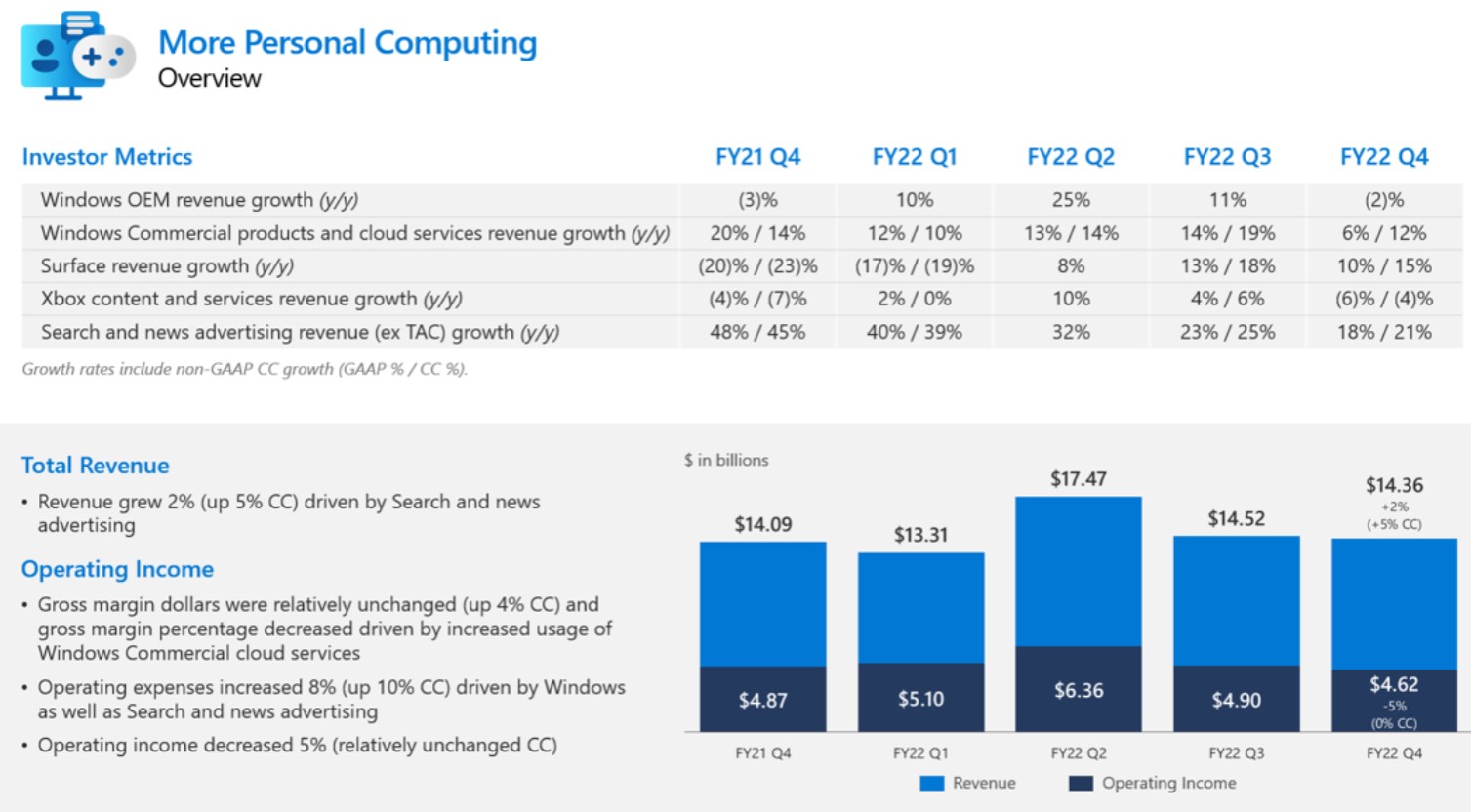

- Microsoft introduced in $14.36B in Extra Private computing, just under ahead steerage, for FY22 This fall

- Floor income was up 10%, pushed by business gross sales

- Home windows OEM rev declined 2% attributable to “manufacturing shutdowns” in Could and a deteriorating PC market

- Search and information promoting grew 18%, just under the anticipated 20% projected

Replace 7/26/22: 6:10 PM ET: Throughout its earnings name, Microsoft anticipated subsequent quarter’s income for Extra Private Computing to fall between $13 and $13.4 billion. Home windows OEM is predicted to say no within the “excessive single digits” attributable to continued weak spot within the PC market. Floor income is predicted to be down within the “low single digits.” Search and promoting, nonetheless, is predicted to be up mid to excessive teenagers.

Microsoft has posted its FY22 This fall earnings (opens in new tab) immediately, reporting $51.9 billion in whole income (up 12% year-over-year), just under the road estimate of $52.4 billion, marking one of many first instances the corporate hasn’t overwhelmed Wall Avenue expectations.

In Extra Private Computing, which incorporates Floor, Home windows, Bing, and extra, income was $14.36B, beneath the estimated $14.65- to $14.95 billion projected throughout final quarter’s earnings name. Nonetheless, the quantity is up 2% year-over-year as Microsoft introduced in $14.09 billion in 2021.

Home windows OEM was down 2%, pushed by PC manufacturing shutdowns in China, which hampered the discharge of recent PCs introduced earlier this 12 months at CES. These constraints have now been fastened as a lot of these laptops are actually transport with Intel twelfth chips, Qualcomm 8cx Gen 3, and AMD’s newest. Nevertheless, Microsoft estimated Home windows OEM progress within the low to mid-single digits to be “pushed by the continued shift to a commercial-led PC market the place income per license is increased.”

Through the earnings name, Microsoft famous that PC gross sales are nonetheless above pre-pandemic ranges regardless of supply-chain constraints.

For Floor, issues weren’t as dangerous. Microsoft had anticipated “low double digits” for income progress, and it hit 10%, year-over-year, hitting the underside of that estimate. Business purchases as an alternative of customers principally drove gross sales of Floor, in response to Microsoft.

Search, together with information promoting, was up 18%, beneath the 20% projected final quarter. Microsoft notes that search income was negatively impacted by “reductions in buyer promoting spend,” doubtless attributable to issues over inflation and a doable recession.

Gaming, together with Xbox, did see declines, however they had been in keeping with steerage from final quarter.