When U.S. shoppers have their on-line financial institution accounts hijacked and plundered by hackers, U.S. monetary establishments are legally obligated to reverse any unauthorized transactions so long as the sufferer reviews the fraud in a well timed method. However new knowledge launched this week means that for a number of the nation’s largest banks, reimbursing account takeover victims has turn into extra the exception than the rule.

The findings got here in a report launched by Sen. Elizabeth Warren (D-Mass.), who in April 2022 opened an investigation into fraud tied to Zelle, the “peer-to-peer” digital fee service utilized by many monetary establishments that permits clients to rapidly ship money to family and friends.

Zelle is run by Early Warning Providers LLC (EWS), a personal monetary providers firm which is collectively owned by Financial institution of America, Capital One, JPMorgan Chase, PNC Financial institution, Truist, U.S. Financial institution, and Wells Fargo. Zelle is enabled by default for purchasers at over 1,000 completely different monetary establishments, even when an incredible many purchasers nonetheless don’t understand it’s there.

Sen. Warren mentioned a number of of the EWS proprietor banks — together with Capital One, JPMorgan and Wells Fargo — failed to supply the entire requested knowledge. However Warren did get the requested data from PNC, Truist and U.S. Financial institution.

“General, the three banks that offered full knowledge units reported 35,848 circumstances of scams, involving over $25.9 million of funds in 2021 and the primary half of 2022,” the report summarized. “Within the overwhelming majority of those circumstances, the banks didn’t repay the shoppers that reported being scammed. General these three banks reported repaying clients in solely 3,473 circumstances (representing almost 10% of rip-off claims) and repaid solely $2.9 million.”

Importantly, the report distinguishes between circumstances that contain straight up checking account takeovers and unauthorized transfers (fraud), and people losses that stem from “fraudulently induced funds,” the place the sufferer is tricked into authorizing the switch of funds to scammers (scams).

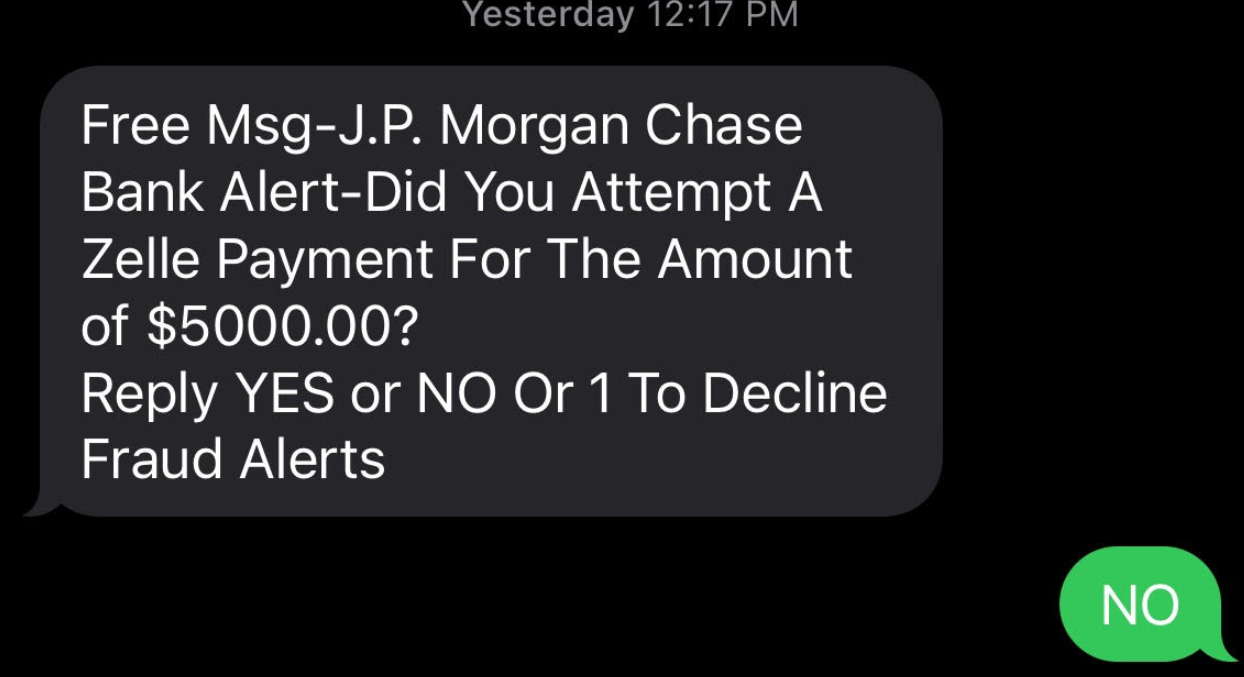

A standard instance of the latter is the Zelle Fraud Rip-off, which makes use of an ever-shifting set of come-ons to trick folks into transferring cash to fraudsters. The Zelle Fraud Rip-off usually employs textual content messages and cellphone calls spoofed to appear like they got here out of your financial institution, and the rip-off often pertains to fooling the shopper into considering they’re sending cash to themselves after they’re actually sending it to the crooks.

Right here’s the rub: When a buyer points a fee order to their financial institution, the financial institution is obligated to honor that order as long as it passes a two-stage check. The primary query asks, Did the request really come from a licensed proprietor or signer on the account? Within the case of Zelle scams, the reply is sure.

Hint Fooshee, a strategic advisor within the anti cash laundering follow at Aite-Novarica, mentioned the second stage requires banks to offer the shopper’s switch order a type of “sniff check” utilizing “commercially cheap” fraud controls that usually will not be designed to detect patterns involving social engineering.

Fooshee mentioned the authorized phrase “commercially cheap” is the first cause why no financial institution has a lot — if something — in the best way of controlling for rip-off detection.

“To ensure that them to deploy one thing that will detect a great chunk of fraud on one thing so exhausting to detect they might generate egregiously excessive charges of false positives which might additionally make shoppers (and, then, regulators) very sad,” Fooshee mentioned. “This is able to tank the enterprise case for the service as an entire rendering it one thing that the financial institution can declare to NOT be commercially cheap.”

Sen. Warren’s report makes clear that banks usually don’t pay shoppers again if they’re fraudulently induced into making Zelle funds.

“In easy phrases, Zelle indicated that it will present redress for customers in circumstances of unauthorized transfers during which a person’s account is accessed by a foul actor and used to switch a fee,” the report continued. “Nevertheless, EWS’ response additionally indicated that neither Zelle nor its guardian financial institution homeowners would reimburse customers fraudulently induced by a foul actor into making a fee on the platform.”

Nonetheless, the information counsel banks did repay at the very least a number of the funds stolen from rip-off victims about 10 % of the time. Fooshee mentioned he’s stunned that quantity is so excessive.

“That banks are paying victims of licensed fee fraud scams something in any respect is noteworthy,” he mentioned. “That’s cash that they’re paying for out of pocket virtually totally for goodwill. You might argue that repaying all victims is a sound technique particularly within the local weather we’re in however to say that it needs to be what all banks do stays an opinion till Congress modifications the legislation.”

UNAUTHORIZED FRAUD

Nevertheless, in relation to reimbursing victims of fraud and account takeovers, the report suggests banks are stiffing their clients every time they’ll get away with it. “General, the 4 banks that offered full knowledge units indicated that they reimbursed solely 47% of the greenback quantity of fraud claims they obtained,” the report notes.

How did the banks behave individually? From the report:

-In 2021 and the primary six months of 2022, PNC Financial institution indicated that its clients reported 10,683 circumstances of unauthorized funds totaling over $10.6 million, of which just one,495 circumstances totaling $1.46 had been refunded to shoppers. PNC Financial institution left 86% of its clients that reported circumstances of fraud with out recourse for fraudulent exercise that occurred on Zelle.

-Over this identical time interval, U.S. Financial institution clients reported a complete of 28,642 circumstances of unauthorized transactions totaling over $16.2 million, whereas solely refunding 8,242 circumstances totaling lower than $4.7 million.

-Within the interval between January 2021 and September 2022, Financial institution of America clients reported 81,797 circumstances of unauthorized transactions, totaling $125 million. Financial institution of America refunded solely $56.1 million in fraud claims – lower than 45% of the general greenback worth of claims made in that point.

–Truist indicated that the financial institution had a a lot better document of reimbursing defrauded clients over this identical time interval. Throughout 2021 and the primary half of 2022, Truist clients filed 24,752 unauthorized transaction claims amounting to $24.4 million. Truist reimbursed 20,349 of these claims, totaling $20.8 million – 82% of Truist claims had been reimbursed over this era. General, nevertheless, the 4 banks that offered full knowledge units indicated that they reimbursed solely 47% of the greenback quantity of fraud claims they obtained.

Fooshee mentioned there has lengthy been an excessive amount of inconsistency in how banks reimburse unauthorized fraud claims — even after the Client Monetary Safety Bureau (CPFB) got here out with steerage on what qualifies as an unauthorized fraud declare.

“Many banks reported that they had been nonetheless not dwelling as much as these requirements,” he mentioned. “In consequence, I think about that the CFPB will come down exhausting on these with fines and we’ll see a correction.”

Fooshee mentioned many banks have lately adjusted their reimbursement insurance policies to convey them extra into line with the CFPB’s steerage from final yr.

“So that is not off course however not with ample vigor and pace to fulfill critics,” he mentioned.

Seth Ruden is a funds fraud professional who serves as director of world advisory for digital id firm BioCatch. Ruden mentioned Zelle has lately made “important modifications to its fraud program oversight due to shopper affect.”

“It’s clear to me that regardless of sensational headlines, progress has been made to enhance outcomes,” Ruden mentioned. “Presently, losses within the community on a volume-adjusted foundation are decrease than these typical of bank cards.”

However he mentioned any failure to reimburse victims of fraud and account takeovers solely provides to strain on Congress to do extra to assist victims of these scammed into authorizing Zelle funds.

“The underside line is that rules haven’t stored up with the pace of fee expertise in the USA, and we’re not alone,” Ruden mentioned. “For the primary time within the UK, licensed fee rip-off losses have outpaced bank card losses and a regulatory response is now on the desk. Banks have the selection proper now to take motion and enhance controls or await regulators to impose a brand new regulatory surroundings.”

Sen. Warren’s report is on the market right here (PDF).

There are, after all, some variations of the Zelle fraud rip-off which may be complicated monetary establishments as to what constitutes “licensed” fee directions. For instance, the variant I wrote about earlier this yr started with a textual content message that spoofed the goal’s financial institution and warned of a pending suspicious switch.

Those that responded in any respect obtained a name from a quantity spoofed to make it appear like the sufferer’s financial institution calling, and had been requested to validate their identities by studying again a one-time password despatched through SMS. In actuality, the thieves had merely requested the financial institution’s web site to reset the sufferer’s password, and that one-time code despatched through textual content by the financial institution’s website was the one factor the crooks wanted to reset the goal’s password and drain the account utilizing Zelle.

Not one of the above dialogue entails the dangers affecting companies that financial institution on-line. Companies in the USA don’t get pleasure from the identical fraud legal responsibility safety afforded to shoppers, and if a banking trojan or intelligent phishing website leads to a enterprise account getting drained, most banks won’t reimburse that loss.

This is the reason I’ve all the time and can proceed to induce small enterprise homeowners to conduct their on-line banking affairs solely from a devoted, entry restricted and security-hardened machine — and ideally a non-Home windows machine.

For shoppers, the identical outdated recommendation stays the most effective: Watch your financial institution statements like a hawk, and instantly report and contest any costs that seem fraudulent or unauthorized.