The newest IDC report has indicated the market share of high enterprise swap suppliers in the course of the first quarter of 2023.

The newest IDC report has indicated the market share of high enterprise swap suppliers in the course of the first quarter of 2023.

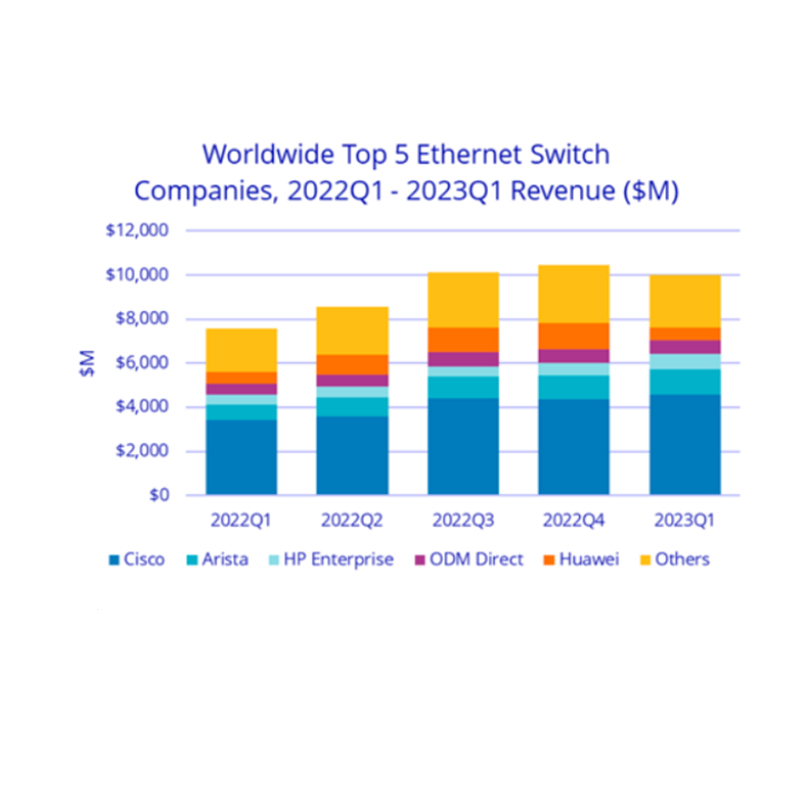

The Ethernet swap market grew revenues 31.5 p.c within the first quarter of 2023 (1Q23) to $10 billion.

The income of enterprise and repair supplier (SP) router market rose 14.1 p.c to $4.1 billion within the first quarter.

The Ethernet swap market confirmed power throughout each the datacenter and non-datacenter segments of the market.

Revenues within the non-datacenter/enterprise campus and department section grew 38.7 p.c, whereas port shipments rose 14.1 p.c. Revenues within the datacenter portion of the Ethernet swap market rose 23.2 p.c in 1Q23, whereas port shipments elevated 19.7 p.c.

Revenues for 200/400 GbE switches rose 141.3 p.c yearly in 1Q23 and have been up 14.3 p.c sequentially from 4Q22 to 1Q23. 100GbE revenues elevated 18.2 p.c 12 months over 12 months in 1Q23. 25/50 GbE revenues elevated 21.1 p.c in 1Q23.

Decrease-speed switches, generally utilized in enterprise campus and department setups, demonstrated notable development as effectively. The income for 1GbE switches elevated by 43.7 p.c within the first quarter of 2023. Equally, 10GbE switches skilled an increase of 9.7 p.c throughout the identical interval. Notably, multi-gigabit Ethernet switches (2.5/5GbE) recorded a powerful surge of 128.0 p.c in income in 1Q23..

Ethernet swap market development

Asia Pacific +31.8 p.c

China –5 p.c

United States +40.3 p.c

Canada +39.1 p.c

Latin America +65.3 p.c

Western Europe +36.1 p.c

Central and Jap Europe +16.4 p.c

Center East & Africa +40.4 p.c

Router Market Highlights

The service supplier section, which incorporates each communications SPs and cloud SPs, accounted for 77.7 p.c of the market’s whole revenues. The service supplier section of the market elevated 13.1 p.c in 1Q23.

Revenues within the enterprise section account for the remaining share of the market and rose 17.6 p.c in comparison with the primary quarter of 2022.

Cisco’s Ethernet swap revenues elevated 33.7 p.c in 1Q23, giving the corporate a market share of 46 p.c. Cisco’s mixed service supplier and enterprise router income grew 18.2 p.c within the quarter, giving the corporate a market share of 37.9 p.c in 1Q23.

Arista Networks noticed Ethernet swap revenues improve 61.6 p.c in 1Q23, giving the corporate 11.4 p.c market share.

Huawei’s Ethernet swap income elevated 5.5 p.c in 1Q23, giving the corporate a market share of 6.0 p.c. The corporate’s mixed SP and enterprise router income rose 2.7 p.c, giving the corporate a market share of 23.6 p.c within the quarter.

HPE’s Ethernet swap income elevated 54.9 p.c in 1Q23, leading to a market share of seven.0 p.c.

In 1Q23, H3C skilled a 15 p.c decline in Ethernet swap income, resulting in a market share of three.6 p.c. The mixed service supplier and enterprise routing market additionally noticed a lower of 10.3 p.c in H3C’s revenues throughout the identical interval, leading to a market share of 1.6 p.c.

Don’t miss out on enhancing your community options with Router-switch’s premium merchandise. As a system integrator, yow will discover one of the best Ethernet switches and routing options to satisfy your purchasers’ calls for. Act now and go to our web site to take advantage of unique presents and elevate your enterprise success as we speak!

Examine Extra Router-Swap Merchandise:

Learn Extra:

Be a part of Router Swap Weblog as a Visitor Author and Columnist!

Igniting the Way forward for ICT: An Invitation to Router-switch.com’s InnovateTech Speaker Program

What to Take into account When Selecting a 48-Port PoE Swap?