A current report from EE Instances appears to corroborate phrase on-line about Apple provider TSMC’s struggles with assembly demand over manufacturing of the newest 3nm A17 Bionic chips. The chips, sure for the iPhone 15 and iPhone 15 Professional, face an uphill battle to fulfill desired specs and demand forward of an anticipated September launch because of the rising value of manufacturing and a gradual improve in yields.

TSMC’s points are additionally more likely to have a knock-on impact on the manufacturing of Apple’s new M3 chip, which it’s going to additionally produce — that would lead to related efficiency points or a value hike on M3 units to offset the elevated manufacturing prices.

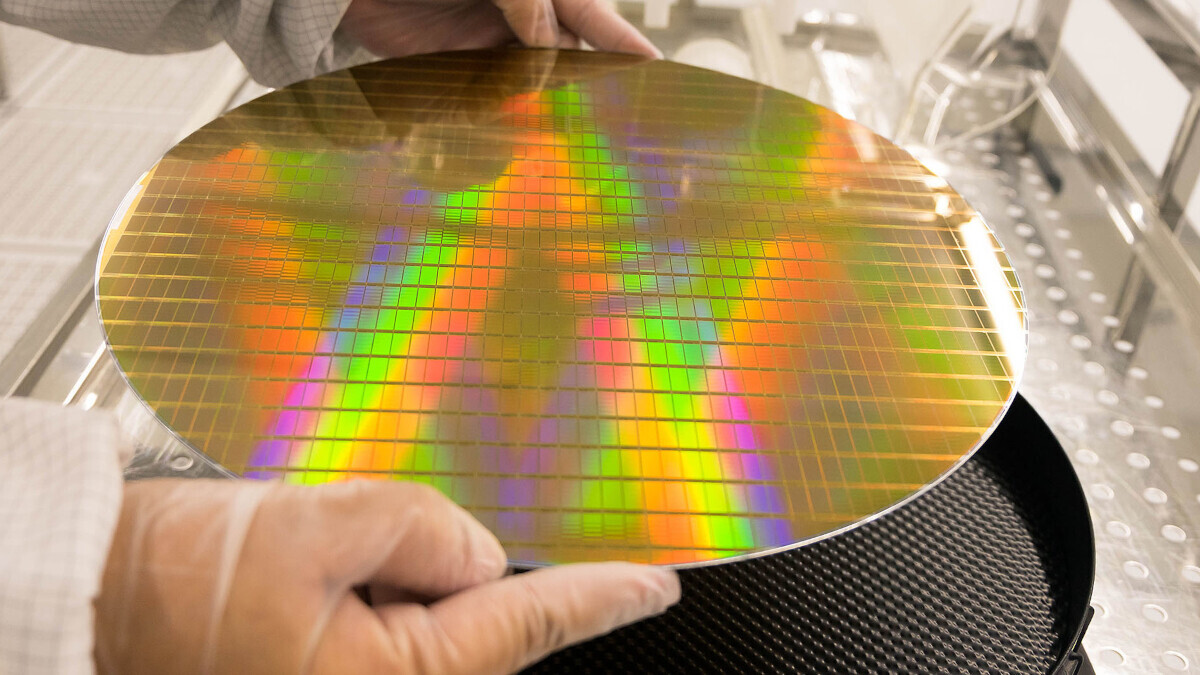

TSMC’s tech troubles

Taiwan Semiconductor Manufacturing Co. (TSMC) is certainly one of two producers at the moment able to producing the 3nm spec chips, the opposite being Samsung. With such a small pool of accessible producers, TSMC is reportedly feeling the pressure on account of the next degree of demand than anticipated and ‘software and yield’ points slowing the ramping up of manufacturing.

A senior analyst of Arte Analysis reportedly believes TSMC’s 3nm yields for A17 and M3 processors are “at round 55%.” Which means that just below half of all manufactured 3nm chips are beneath normal or faulty. Whereas this sounds unhealthy, it’s truly pretty regular — with yields growing because the manufacturing course of turns into extra environment friendly over time.

Nonetheless, that course of has been hampered with TSMC having to delay each the introduction and ramp-up of its 3nm node as a result of excessive value of required instruments to be able to refine manufacturing. TSMC CEO C.C. Wei believes that 3nm will develop into totally utilized in 2023, although he additionally admitted that “clients’ demand for N3 [TSMC’s terminology for 3nm] exceeds our means to provide.”

The rise in manufacturing prices and time to fabricate might severely affect the provision of Apple’s newest chips — and doubtlessly be the explanation we “in all probability” received’t see the M3 make its look this yr at Apple’s WWDC in June.

In distinction, TSMC reportedly started to pattern Apple’s 5nm A14 Bionic processors in October 2019 and introduced a mean yield of ~80% by December of that yr — giving the producer loads of time forward of the discharge of the iPad Air and iPhone 12 units that might ship in 2020.

The gradual utilization of TSMC’s 3nm manufacturing might be due, partially, to the foundry’s FinFET transistors nearing their limitations — making the 3nm (and future 2nm) a extra time and money-consuming enterprise.

Outlook