As the worth of Bitcoin plunged within the final eight months, some safety corporations have noticed an affect on ransomware exercise.

Because the starting of the 12 months, for instance, ransomware assaults have dropped by a few quarter, in line with cybersecurity agency Arctic Wolf. In one other measure of the disruption, many of the fly-by-night cryptocurrency exchanges serving to launder ransoms have stopped promoting their providers, suggesting that as cash-outs surged — basically, making a financial institution run — they might not fulfill demand, in line with a brand new weblog publish from cyber-threat intelligence agency Cybersixgill.

And in line with new information launched this week from the Id Theft Useful resource Heart, ransomware assaults resulting in information breaches fell 20% within the second quarter of 2022 in contrast with the primary quarter of this 12 months, and have declined quarter over quarter.

Most main ransomware teams money out cryptocurrency rapidly, however smaller gamers usually tend to maintain onto their property, resulting in a panicked response, says Dov Lerner, safety analysis lead at Cybersixgill.

“I do not understand how a lot reserves Binance or Coinbase might need, however these Darkish Internet exchanges, they actually haven’t got hundreds of thousands of {dollars} in reserves,” he says. “If everyone seems to be dumping cryptocurrency for {dollars}, they can not sustain.”

The volatility in cryptocurrency markets has led to huge disruption among the many nascent firms looking for their place in what had been a burgeoning market. This week, cryptocurrency lending agency Celsius Community filed for Chapter 11 chapter after locking out clients from making withdrawals final month. Two different corporations — crypto hedge fund Three Arrows Capital and Voyager Digital — have each declared chapter previously two weeks. The whereabouts of the 2 founders of Three Arrows Capital are at present unknown.

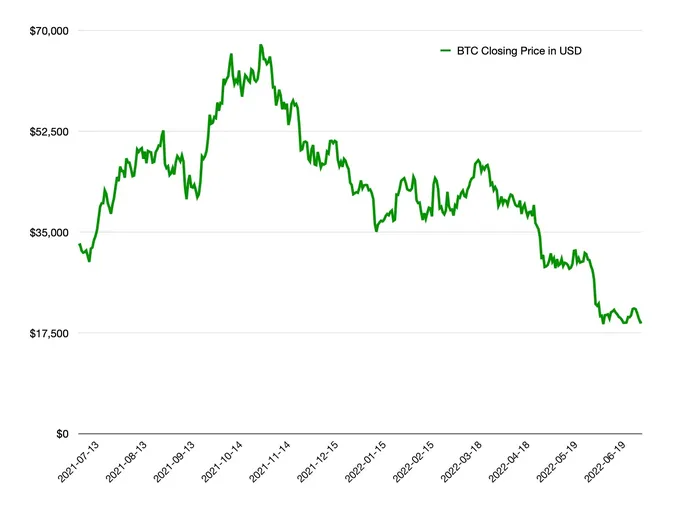

Behind the monetary culling is a 71% drop within the worth of Bitcoin — and related drops in different cryptocurrencies — since November 2021.

Darkish Internet Shaken by Crypto’s Decline

The underground market has fared no higher. In an evaluation of 34 Darkish Internet cryptocurrency exchanges, which generally cost excessive charges of two% to fifteen% of transactions for anonymity, Cybersixgill discovered that each considered one of them now not advertises any functionality to alternate cryptocoins for money.

But cybercriminals are usually agnostic to fluctuations in cryptocurrency. They usually promote providers and instruments in US {dollars}, and so they analysis enterprise victims’ revenues earlier than making a ransom demand in {dollars} or euros.

“If the worth of Bitcoin declines, ransomware attackers will merely ask for extra Bitcoin,” says Jackie Koven, head of menace intelligence at cryptocurrency-monitoring agency Chainalysis. “They typically money out ransom funds rapidly and don’t maintain them in crypto as investments.”

The shake-up in Darkish Internet cryptocurrency exchanges might account for the drop in ransomware because the starting of the 12 months. Nonetheless, cybercriminals may be shifting ways.

Enterprise e mail compromise (BEC), as an illustration, has all the time outpaced ransomware when it comes to profitability for the cybercriminals and damages to firms. In 2017, for instance, ransomware accounted for under 0.2% of losses tracked by the Web Crime Criticism Heart (IC3), whereas BEC accounted for 27% of losses. In 2021, BEC accounted for 35% of greenback losses, whereas ransomware had climbed barely to 0.7%, in line with IC3 information.

As governments focus extra on dissuading the legal use of cryptocurrencies, schemes that don’t depend on cryptocurrency — BEC steals precise funds from companies — will take off, says Crane Hassold, director of menace intelligence for cybersecurity agency Irregular Safety. The corporate has noticed a rising variety of BEC-related emails over the previous 5 years — a development he expects to proceed.

“Inserting extra friction into cryptocurrency transactions and making them tougher to make use of for illicit functions … are issues that cybercriminals cannot compensate for and would possible drive down the general ROI for cryptocurrency-driving cybercrimes, like ransomware,” he says, including: “We have … noticed a rising variety of extra refined actors from international locations like Russia and Israel enter the BEC area lately, which signifies that an increasing inhabitants of actors are realizing how profitable BEC assaults might be.”

Different explanations for a drop in ransomware assaults embody the disruption of the Conti — related to an 18% drop in ransomware exercise — and Russia’s invasion of Ukraine, since each international locations are house to a number of the major actors within the ransomware scene.

“Ebb and Circulate”

Nonetheless, different information means that ransomware teams are recovering rapidly. Menace intelligence agency Digital Shadows discovered that the 88 data-leakage web sites that it tracks had listed 705 victims within the second quarter of 2022, up 21% from the earlier quarter.

The restoration means that ransomware teams are pretty proof against the value fluctuations of their major manner of monetizing infections. The teams have few different choices for getting paid, and till cryptocurrency poses extra threat, they are going to proceed, says Mark Manglicmot, senior vice chairman of safety providers at Arctic Wolf.

“There is no such thing as a good different to cryptocurrency at this level, so I do not see cybercriminals asking for the rest,” he says. “I do not assume that cryptocurrency will completely collapse and go away, so what we see occurring — the ebb and circulation — will proceed.”

Nonetheless, the volatility could persuade cybercriminals to make the dealing with of cryptocurrency extra versatile of their instruments kits. The cryptocurrency utilized in completely different campaigns might simply be a swappable piece that cybercriminals will change commonly, like servers, IP addresses, and malware signatures, says Manglicmot.

“Altering the way in which they manner you use, altering the infrastructure, whereas sustaining the elemental infrastructure behind the operations is one thing that they already do, so I might see them seeing them utilizing one cryptocurrency for a while after which switching to a different,” he says. “It could be nearly like diversifying their portfolio.”