Intel on Thursday posted its first loss in many years as gross sales of its processors for shopper PCs, and information facilities dropped sharply within the second quarter due to what Intel calls “a speedy decline in financial exercise” attributable to inflation, geopolitical tensions, and the continued Russia-Ukraine conflict.

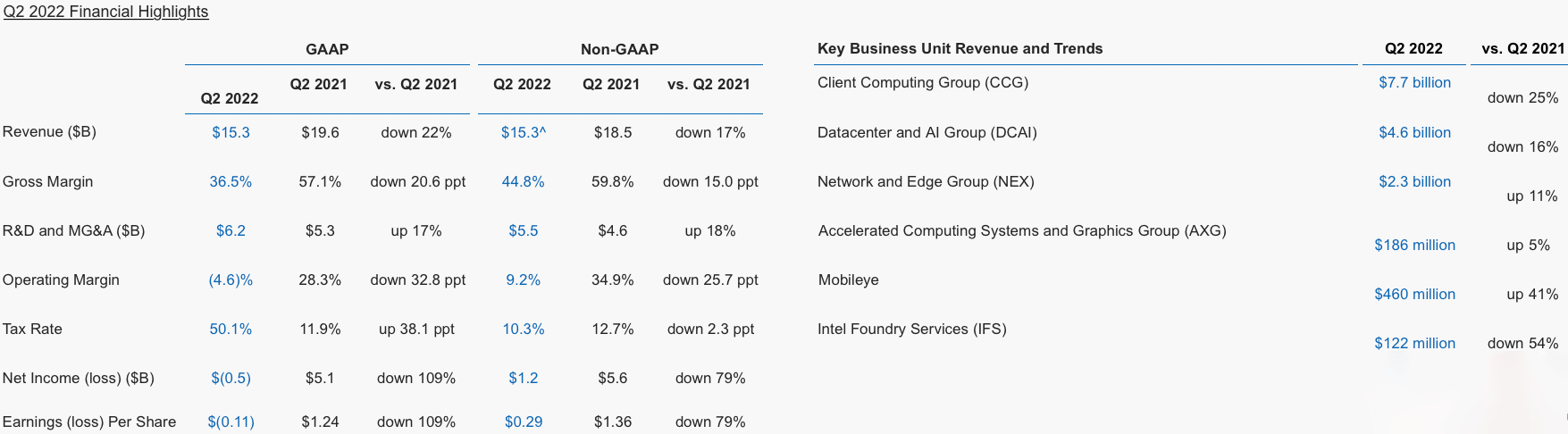

Intel’s income in Q2 2022 totaled $15.3 billion, a 17% decline year-over-year (YoY) and a 22% drop sequentially. As well as, the corporate’s gross margin fell 36.5% from 57.1% in the identical quarter a 12 months in the past. The corporate additionally posted a lack of $0.5 billion, the corporate’s first loss in many years. Whereas Intel’s quarterly loss appears to be like surprising, it ought to be famous that the corporate needed to make stock reserves for upcoming product launches, which generated losses in accordance with GAAP.

“This quarter’s outcomes have been beneath the requirements we’ve set for the corporate and our shareholders,” mentioned Pat Gelsinger, Intel CEO. “We should and can do higher. The sudden and speedy decline in financial exercise was the most important driver, however the shortfall additionally displays our personal execution points.”

Shipments of Core and Xeon Decline for First Time in Years

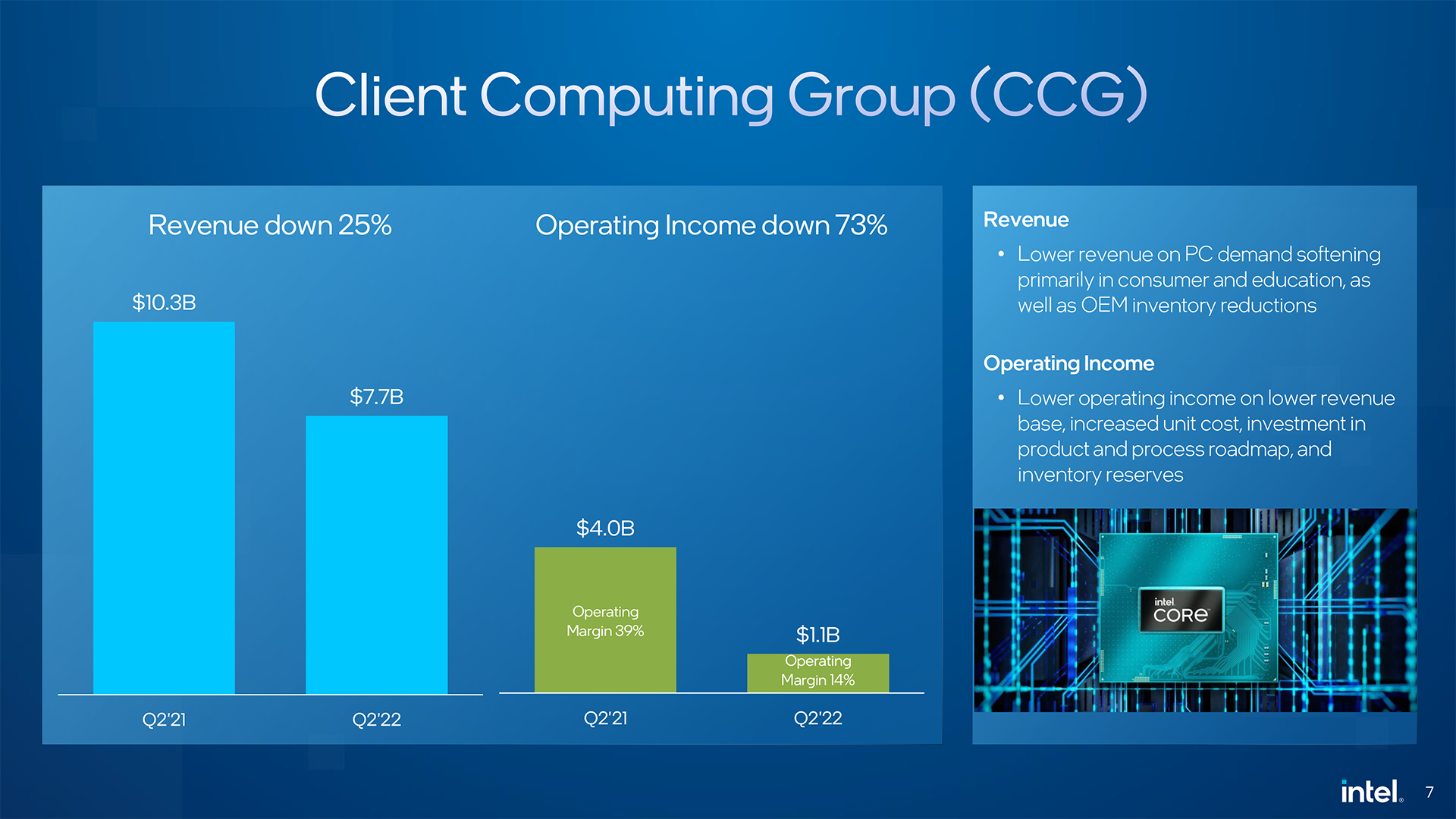

Intel’s major money cow — the Consumer Computing Group (CCG) — earned $7.7 billion in income in Q2 2022, down 25% from the identical quarter a 12 months in the past. There are a number of explanation why Intel’s shopper CPU and chipsets gross sales dropped so considerably. Firstly, demand for PCs was down in Q2 each sequentially and YoY. Secondly, as a result of PC OEM makers are unsure about demand within the coming quarters, they purchase fewer CPUs than they eat, desire to make use of their current shares, and drain current stock. It implies that as quickly as their stashes drain, they’ll improve their purchases from Intel.

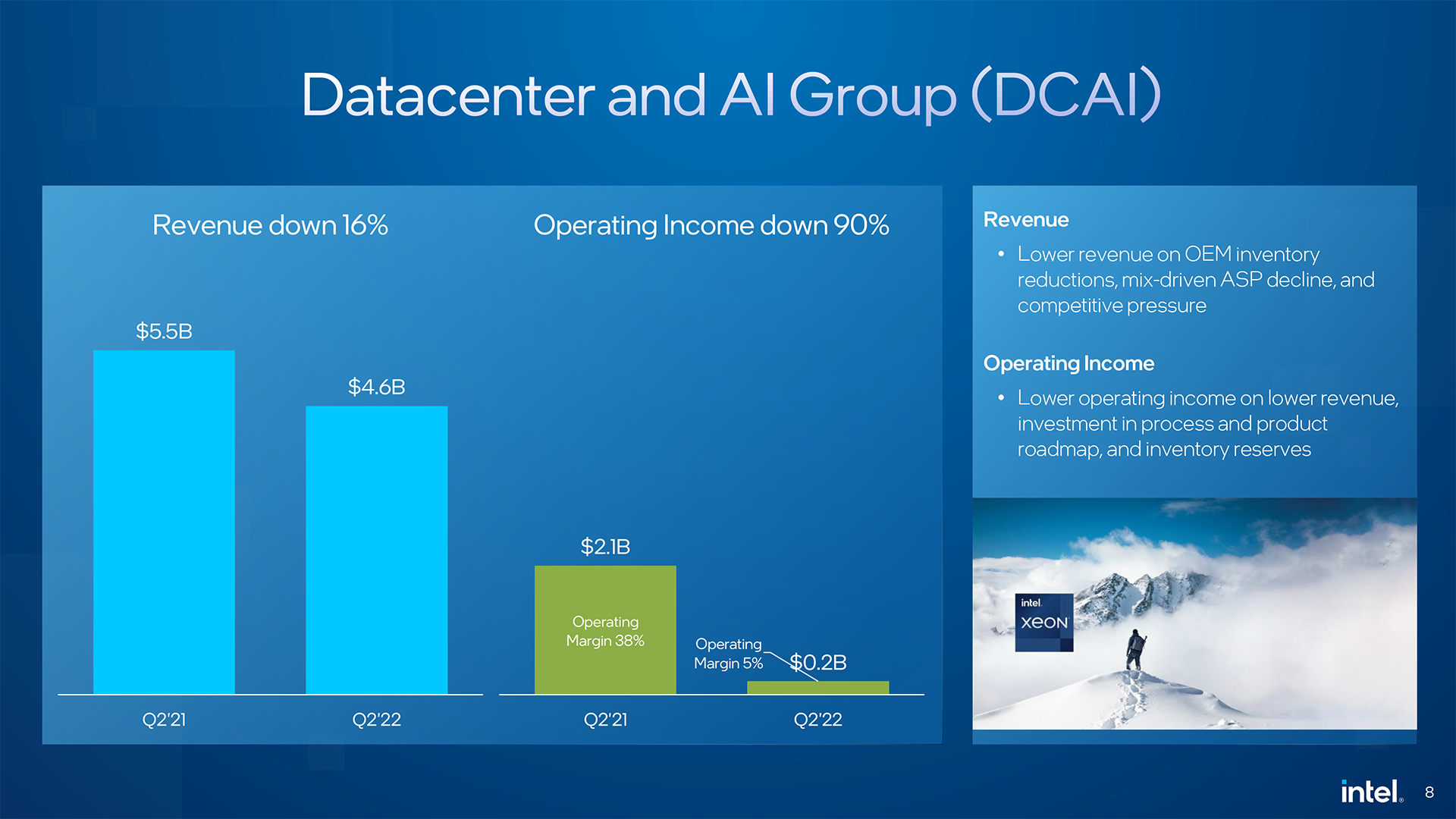

Intel’s Datacenter and AI Group (DCAI) gross sales of datacenter {hardware} declined to $4.6 billion in Q2 2022, down from $5.5 billion in Q2 2021, a drop of 16% YoY. Intel talked about three causes for the decline: aggressive stress from AMD, mix-driven common promoting worth (ASP) lower (which may be attributable to the need to regulate costs or tailor choices to answer competitors), and OEM stock reductions.

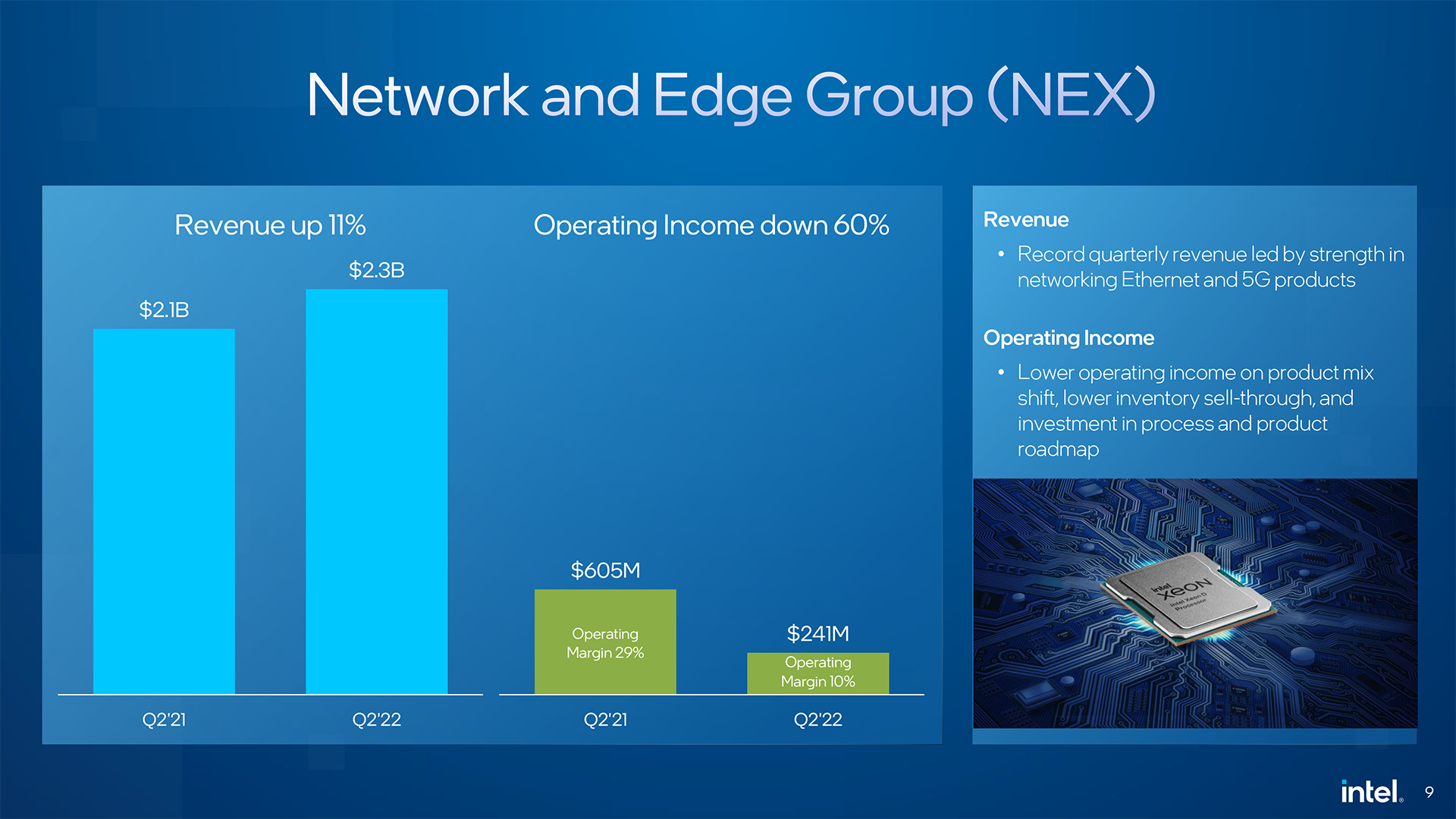

The income of Intel’s Community and Edge Group (NEX) was maybe a ray of sunshine within the firm’s in any other case gloomy earnings report because the enterprise unit managed to extend its income to $2.3 billion, up 11% year-over-year. Intel says that NEX’s good outcomes have been pushed by strong gross sales of its 5G (which in all probability means compute options for infrastructure tools) and Ethernet merchandise. In the meantime, Intel’s NEX additionally started shipments of its codenamed Mount Evans 200Gb SoC IPU and began to ramp up shipments of the newest Xeon D-1700/2700 elements based mostly on the Ice Lake-D microarchitecture.

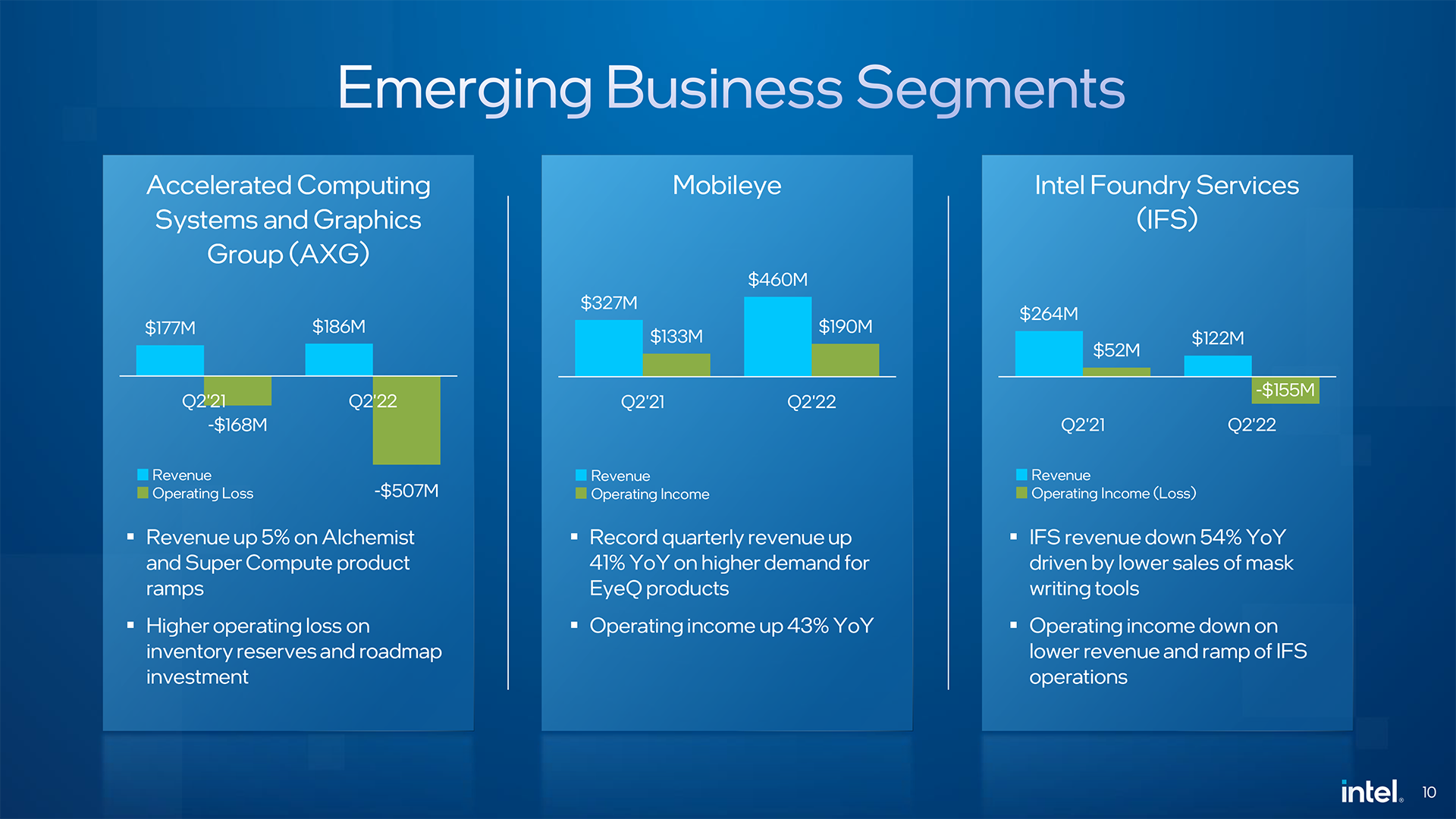

One in all Intel’s most formidable tasks lately is indisputably its shopper and information heart GPU endeavor led by Raja Koduri. However coming into the GPU market is dear, which is why the corporate’s Accelerated Computing Programs and Graphics Group (AXG) misplaced a whopping $507 million in Q2 2022 on gross sales of $186 million (up from $177 million in Q2 2021) as Intel is ramping up shipments of Arc Alchemist, transport its Blockscale mining ASIC, and is starting to ship its supercomputing merchandise. The loss is generated primarily by further investments in R&D and prototyping and stock reserves for the high-volume Arc launch in Q3.