Greg Noone on the Techmonitor website coated this downside early October 2022, beginning with a horror story.

Greg Noone on the Techmonitor website coated this downside early October 2022, beginning with a horror story.

An organization had taken cyber protection for the previous yr with no claims, however throughout a routine scan a software program vulnerability was found. They didn’t repair it in time. A brand new coverage was proposed that may not cowl ransomware. They signed it. Guess what occurred per week after? Proper. Here’s a quick extract and additional under a hyperlink to the positioning.

“I’d be disingenuous if I informed you that ransomware wasn’t a key think about a number of the headwinds that we’ve seen out there with reference to pricing,” explains Bob Parisi, head of cyber options in North America for German reinsurance firm Munich Re.

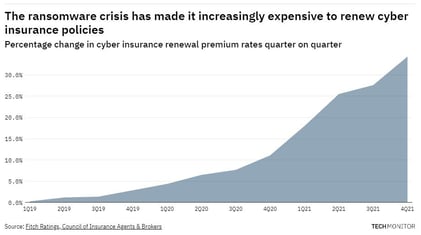

The primary half of this yr noticed one cybersecurity vendor block 63 billion threats, a year-on-year rise of fifty%, whereas cyber insurance coverage prices shot up by 102% within the first quarter. Phrases and circumstances for protection have additionally been tightened. Lloyds of London, for instance, went so far as to get rid of protection for breaches that arose immediately from state-sponsored assaults, a sizeable portion of the general damages accrued from ransomware. Its reasoning, in accordance with the agency’s underwriting director Tony Chaudhry, was that insurance policies shouldn’t “expose the market to systemic dangers that syndicates may battle to handle”.

Cyber insurance coverage doesn’t have an extended historical past. The market itself, explains Mario Vitale, chief government of cyber insurance coverage supplier Resilience., has solely been round for about 15 years. “I’ve to say we’re nonetheless throughout the infancy stage,” he says, a time period that’s additionally related when describing the section’s measurement.

“I believe the insurers are nonetheless determining, ‘How assured are we in our capability to estimate and predict this danger?” says Josephine Wolff, a professor in cybersecurity coverage at Tufts College and an professional within the cyber insurance coverage market. Over time, provides the professor, this has led to a “much less steady market… and in addition simply loads of uncertainty wherein folks aren’t assured about what their cyber insurance coverage will cowl.”

Ongoing volatility is making reinsurers nervous

Ongoing volatility within the cyber insurance coverage market has additionally made reinsurers nervous about rising their publicity to the house. These behemoths, explains Vitale, assist to maintain most of the frontline suppliers afloat. In recent times, nonetheless, they “have in the reduction of on their protection phrases and circumstances, similar to these [cyber] insurers have achieved to their purchasers”, he says. Resilience’s reply to this downside, explains Vitale, has been to double down on carefully liaising with purchasers to minimise their vulnerability to breaches so far as is humanly potential.

The method of drawing up cyber insurance coverage insurance policies is rigorous. It begins with an evaluation of how well-equipped the consumer is to cope with a cybersecurity risk from a governance standpoint, explains Parisi. After that, he continues, suppliers sometimes drill down into the mundanities of cyber defence: whether or not multi-factor authentication is in place on company units, how knowledge is uploaded to the cloud, and the extent of safety consciousness coaching amongst employees. That is the hyperlink to the full article. Warmly beneficial.

As Cyber Insurance coverage Dries Up, Treasury Division Eyes a Backstop

Bloomberg legislation coated the identical subject from one other attention-grabbing angle: “A US Treasury Division request for public enter on a possible federal cyber insurance coverage program highlights a protection hole for US firms as insurers scale back choices.

The regulator is looking for public remark till Nov. 14 on whether or not the federal government must shore up the insurance coverage business to pay for extreme cyberattacks, particularly these involving important infrastructure similar to energy grids, practice traces, hospitals, and utility firms.

Cyberattacks are occurring so regularly that underwriting requirements generally can’t match the quick improvement and class of the hacks. Insurers are elevating charges to ranges that make it onerous for companies to search out inexpensive protection. A federal insurance coverage backstop may shut the hole as insurers minimize protection to restrict their publicity.

The Treasury Division’s Federal Insurance coverage Workplace is looking for touch upon a listing of questions, together with what sorts of cyberattacks are “catastrophic,” whether or not companies are getting sufficient protection, and how you can encourage policyholders to strengthen cybersecurity practices.

Cyber insurers have seen losses leap 300% from 2018 to 2021, in accordance with Fitch Rankings. Insurers, together with Lloyd’s of London, Chubb Ltd., and Beazley PLC are racing to minimize protection for catastrophic cyberattacks that may paralyze a number of industries without delay.

Federal monetary assist for sure cyber dangers would additionally give insurers aid and safety to make cyber insurance coverage extra broadly accessible, stated Andy Moss, a accomplice at Reed Smith LLP. “A cyber insurer can write insurance policies with consolation realizing it may well switch some danger to the federal government, so it may well supply greater coverage limits for companies,” Moss stated. Hyperlink to full Bloomberg article: https://information.bloomberglaw.com/privacy-and-data-security/as-cyber-insurance-dries-up-treasury-department-eyes-a-backstop?

It’s clear as daylight that you just want defense-in-depth and a data-driven strategy to defending your networks. Ransomware seems to be an actual headache and right here is an on-demand grasp class to get you up to the mark.