A free commerce settlement has been an vital agenda for each the Indian and the Taiwanese authorities. Baushuan Ger, Taiwan’s ambassador to India, stated that each nations ought to signal the FTA on the earliest. Ger confused that the settlement might get rid of all obstacles to commerce and funding and assist in the creation of a resilient provide chain.

Taiwan, with whom India already has a ‘Bilateral Funding Settlement’, has been actively pursuing FTA with like-minded buying and selling companions and India might stand to achieve quite a bit from such an settlement. Taiwan, a small island nation positioned within the western Pacific Nation, is a semiconductor powerhouse and India is prone to profit considerably from its chipmaking capabilities.

India’s semiconductor ambition

Earlier this yr, whereas talking on the Semicon India Convention 2022 in Bengaluru, the Indian Prime Minister urged the trade to determine India as a world manufacturing hub.

With chips rapidly changing into a geopolitical device, India desires to turn out to be technologically resilient in terms of chip design and manufacturing and keep away from a future chip chilly warfare.

“We’re dedicated in the direction of the acceleration and progress of the chip design and manufacturing ecosystem within the nation. An ecosystem that’s constructed on the precept of hi-tech, prime quality and excessive reliability”, Prime Minister Modi stated.

India isn’t a well known identify within the semiconductor area at present, however Taiwan is. With the FTA, India—along with benefiting from Taiwan’s semiconductor expertise—might additionally make a reputation for itself within the close to future.

India doesn’t have the expertise or the bandwidth to provide superior semiconductor chips but. Comparatively, India’s semiconductor chip-making capability proper now would seem very like a bullock cart in entrance of Taiwan’s F1 automobile.

Ger added that Taiwan is keen to share its experience with India in important sectors corresponding to semiconductors, 5G, data safety, and synthetic intelligence.

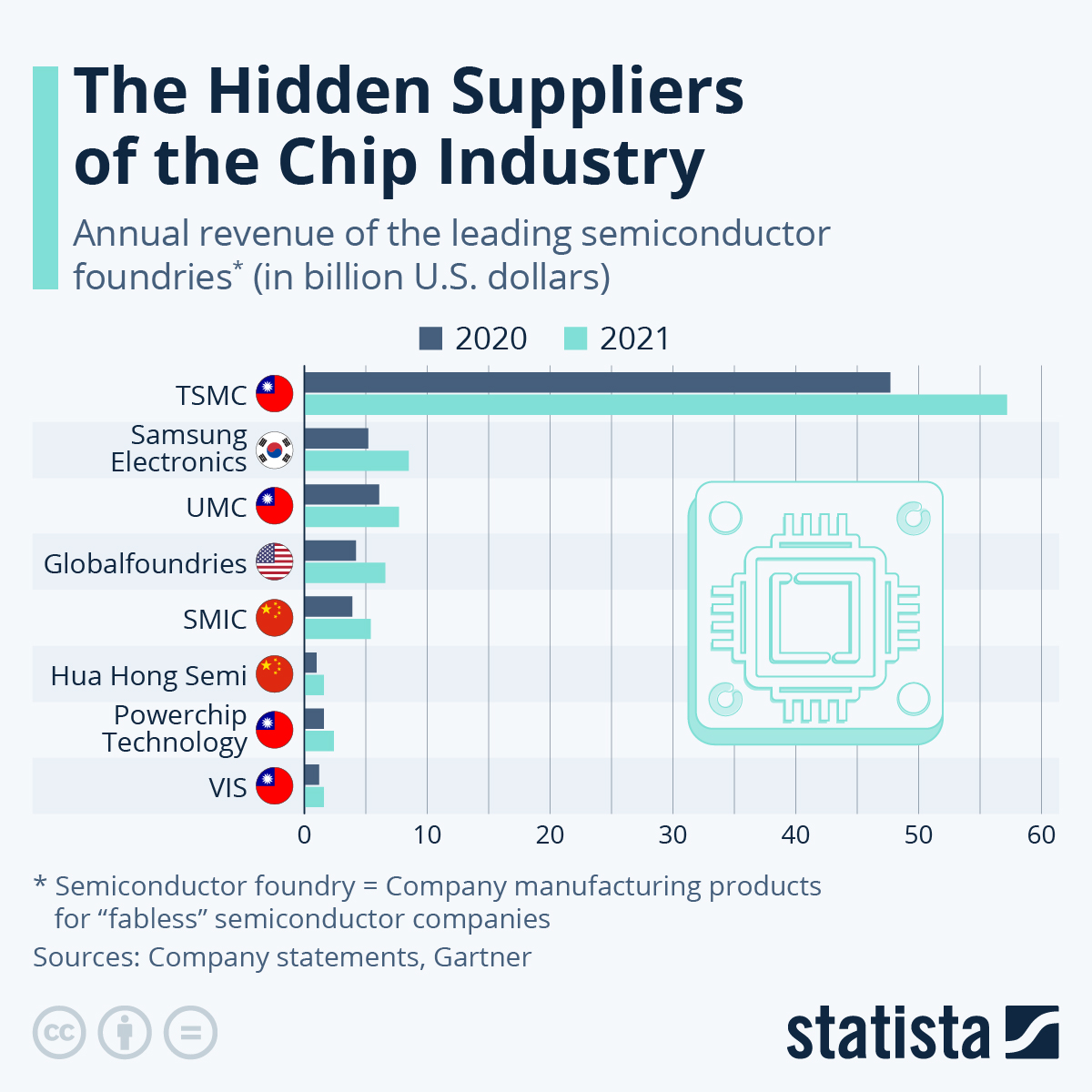

As we speak, over 60% of the worldwide foundry market is dominated by Taiwan. It has a monopolistic maintain relating to the superior expertise nodes, that are utilized in many digital units and even army tech. Taiwan Semiconductor Manufacturing Firm (TSMC) is among the most established enterprises on the planet within the semiconductor area. A number of main car and telephone producers are depending on TSMC for his or her chips.

Additional, based on the Indian Mobile and Electronics Affiliation (ICEA), greater than 75% of the chips utilized in cellular units made in India are imported from Taiwan.

Taiwanese funding

To determine India as a semiconductor manufacturing hub, the federal government is making efforts to entice international chipmakers corresponding to Intel Corp., GlobalFoundries Inc., and TSMC to arrange fabs within the nation. Earlier this yr, Vedanta and Foxconn introduced that they’d set up a fabrication and semiconductor manufacturing facility in Gujarat, India.

Nevertheless, neither Intel nor TSMC have introduced something with regard to their plans to arrange fabs in India but. With the FTA in place, that’s prone to change.

“The FTA will assist entice Taiwan corporations to put money into India to determine manufacturing bases, promote India-made merchandise to the world, and assist India remodel into a world manufacturing centre,” Ger advised PTI.

Presently, TSMC has an workplace in Bengaluru, India. In the event that they determine to determine foundations right here, India will turn out to be the second hub for TSMC following the US.

Taiwan’s third largest chip maker—Powerchip Semiconductor Manufacturing Company (PSMC), has additionally explored alternatives and partnerships to enter India however no concrete steps have been taken as of now.

In addition to TSMC and PSMC, different Taiwanese chip makers corresponding to United Microelectronics Company (UMC), MediaTek, and ASE Know-how may be persuaded to arrange hubs in India.

India may benefit from China–Taiwan tensions

Through the years, Taiwan has been tormented by labour shortages, particularly expert staff. With China being one of many greatest markets, Taiwan consequently arrange manufacturing services on Chinese language soil. Nevertheless, within the mild of current escalating tensions between each nations, Taiwan is seeking to transfer its institution away from China.

Additional, it has additionally expressed considerations about Chinese language corporations attempting to poach expertise from Taiwan together with the technological know-how of chip manufacturing.

Contemplating the worldwide geopolitical scenario, India is well-positioned to profit from Taiwan’s want to shift its manufacturing services away from China.

India can be an enormous marketplace for Taiwan. “Indian benefit is its huge, bustling market, which many different nations embarking on semiconductors don’t. In addition to, India has important native demand justifying the volumes required to drive this type of initiative and an incredible workforce pool required to drive such an initiative, which many different nations don’t have,” Prof. Mayank Shrivastava of the Indian Institute of Science (IISc) acknowledged.

US–China commerce/chip warfare

When former US President Donald Trump launched a number of sanctions in opposition to China, tensions worsened between the 2 nations additional. As two of the world’s largest economies tussle for international affect, the warfare has shifted from commerce to tech. The US just lately launched a provision known as the ‘international direct product rule’ (FDPR) which permits the US authorities to regulate the buying and selling of US-developed tech.

Tech corporations corresponding to Apple and Google have concurrently proven wishes to maneuver their manufacturing items out of China. Now, with tensions additional escalating within the mild of US’ efforts to dam using US-tech for semiconductor manufacturing in China, India might make the most of this chance to draw corporations corresponding to Intel to determine home chip manufacturing services.