Engine management unit, EV/HV, HVAC, infotainment, and lighting account for 95% of the automotive electronics demand within the nation. Authorities initiatives, such because the Automotive Mission Plan, which goals to supply 940 million autos by FY26, are anticipated to generate vital demand for automotive electronics over the subsequent 5 years. In accordance with Frost & Sullivan, the Indian automotive electronics market has the potential to generate income of $9.2 billion by 2025

The automotive business in India is reworking due to its sustained progress and profitability. Indian automotive business at the moment accounts for 7.1% of GDP and 49% of producing output, producing 32 million direct or oblique employments. Based mostly on the Automotive Mission Plan 2019-2026, a collective imaginative and prescient of the federal government of India and the Indian automotive business, the sector is anticipated to make use of 36 million folks by 2026, based on the Automotive Talent Growth Council.

The business has made a powerful restoration in CY2021, with the passenger automobile phase registering a file 26% Y-O-Y progress, as per the Society of Indian Vehicle Producers. The Indian automotive market, significantly the passenger automobile phase, is anticipated to develop at a CAGR of 10% to 12% (as per CRISIL) over the subsequent 5 years. This can be pushed by rising urbanisation, greater disposable earnings, increasing home buyer base, beneficial demographics, supportive infrastructure, and elevated overseas funding.

The panorama of the Indian automotive business is altering quickly with rising enterprise fashions and traits, corresponding to linked, autonomous, shared, and electrical (CASE). Applied sciences that assist the shift towards linked, autonomous, and electrical autos, together with customer-centric parameters, corresponding to person expertise and infotainment, are anticipated to spice up the demand for automotive electronics within the coming years.

The panorama of the Indian automotive business is altering quickly with rising enterprise fashions and traits, corresponding to linked, autonomous, shared, and electrical (CASE). Applied sciences that assist the shift towards linked, autonomous, and electrical autos, together with customer-centric parameters, corresponding to person expertise and infotainment, are anticipated to spice up the demand for automotive electronics within the coming years.

In accordance with Frost & Sullivan, the Indian automotive electronics market has the potential to generate income of $9.2 billion by 2025. Physique management module (BCM), anti-lock braking system (ABS), in-care leisure system (ICES), tire strain monitoring system (TPMS), telematics, and battery administration system (BMS) are a number of the outstanding applied sciences that may drive this market. About 65 to 70% of India’s demand for automotive electronics is at the moment met by imports.

Numerous measures and coverage incentives have been introduced in recent times to spice up the home electronics system design and manufacturing (ESDM) and strengthen the home automotive electronics manufacturing ecosystem. Buyer expectations, laws, and evolving mobility infrastructure are the drivers.

Evolving buyer expectations

Indian automotive business continues to evolve with rising buyer expectations from merchandise, worth sensitivity, shorter product life cycles, frequent modifications in product possession, deal with security and leisure options, and personalised experiences. Subsequent-generation digital options will play a pivotal position on this transformation, which can drive the automotive electronics enterprise.

Regulatory interventions

India’s automobile security requirements have improved noticeably in recent times with next-gen applied sciences, such because the superior driver help system (ADAS), anticipated to be launched quickly. Authorities security requirements, corresponding to AIS 145, the adoption of telematics techniques, and shopper demand for safer autos, will act as a catalyst for elevated adoption of automotive electronics in India sooner or later, with estimates indicating that security, ADAS, and infotainment will account for 60% of this demand.

Altering face of mobility infrastructure

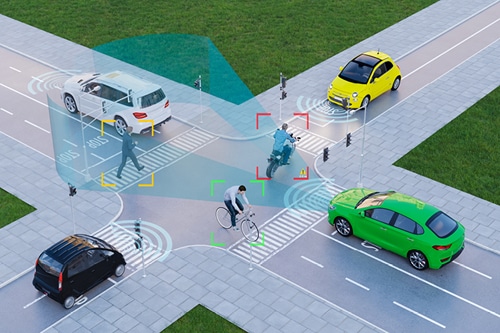

Applied sciences like self-driving autos revolutionise the mobility sector. The event of different technique of transportation and sensible infrastructure (sensible cities, parking optimisation, AI-driven visitors lights, and enabling EV-charging infrastructure) is anticipated to rework India’s mobility infrastructure and generate the enterprise potential for automotive electronics business.

Subsequent-gen applied sciences

A number of next-gen applied sciences can be commercialised over the subsequent 4-5 years. The passenger autos phase is anticipated to contribute two-thirds income of the Indian automotive electronics market. This could be pushed by the rising utilization of the telematics management unit (TCU), infotainment, digital management unit (ECU), onboard diagnostics (OBD), and anti-lock braking system (ABS). Head-up show (HUD), blind-spot detection, superior driver help techniques (ADAS), auto-dimming mirror, and automated transmission options will stay mainstream for the premium phase vehicles.

Developments in electronics for numerous automobile elements would require the set up of digital management and communication techniques. Superior digital techniques needs to be directed to function lively security options like twin airbags, digital stability management, superior braking techniques, and tire strain monitoring techniques. Stringent laws, corresponding to Company Common Gas Effectivity II and Bharat Stage-VI, are additionally vital drivers of the rising digital content material in a automotive. The federal government’s deal with selling electrical mobility by numerous coverage measures will propel the demand for automotive electronics within the coming years.

![]() The Web of Issues (IoT) could be essential for automobile connectivity. The linked autos able to speaking with the encircling setting will result in the emergence of new-age enterprise alternatives by linked information. These enabling applied sciences for futuristic autos can be commercially out there within the subsequent 4-5 years.

The Web of Issues (IoT) could be essential for automobile connectivity. The linked autos able to speaking with the encircling setting will result in the emergence of new-age enterprise alternatives by linked information. These enabling applied sciences for futuristic autos can be commercially out there within the subsequent 4-5 years.

The 2-wheeler phase will even witness elevated adoption of electronics sooner or later. The three-wheeler phase is a laggard within the adoption of electronics. Embedded telematics and infotainment choices are occasional within the three-wheelers class and are anticipated to stay the identical over the quick to medium time period.

Home capability constructing

Home capability constructing could be a key to tapping this potential. Indian suppliers have constructed a powerful functionality in {hardware} manufacturing, forging, and machining of the elements however are comparatively new in electronics design and manufacturing. Because of this, majority of the demand for automotive electronics is met by imports, primarily from China, Taiwan, and Korea.

The highest 5 merchandise, particularly, engine management unit (ECU), EV/HV, HVAC, infotainment, and lighting, account for 95% of the automotive electronics demand within the nation, based on Frost & Sullivan’s evaluation. Authorities initiatives, such because the Automotive Mission Plan, which goals to supply 940 million autos by FY26, are anticipated to generate vital demand for automotive electronics over the subsequent 5 years.

The Nationwide Coverage on Electronics (NPE 2019) goals to place India as a worldwide hub for electronics system design and manufacturing (ESDM) by encouraging and driving nation capabilities to develop core elements, together with chipsets, and create an enabling setting for the business to compete globally. The NPE 2019 additionally envisions the creation of a vibrant and dynamic semiconductor design ecosystem within the nation by incentivising the start-ups and making design infrastructure accessible to them.

In direction of this, the federal government has promoted the complete ecosystem of the Indian electronics business by incentive schemes. Incentive assist is being offered to corporations/consortia which might be engaged in silicon semiconductor fabs, show fabs and compound semiconductors/silicon photonics/sensors (together with MEMS), fabs semiconductor packaging (ATMP/OSAT) and semiconductor design (design linked incentive or DLI).

In direction of this, the federal government has promoted the complete ecosystem of the Indian electronics business by incentive schemes. Incentive assist is being offered to corporations/consortia which might be engaged in silicon semiconductor fabs, show fabs and compound semiconductors/silicon photonics/sensors (together with MEMS), fabs semiconductor packaging (ATMP/OSAT) and semiconductor design (design linked incentive or DLI).

PLI for IT {hardware} and huge scale electronics

Manufacturing linked incentive (PLI) schemes will increase funding in the complete worth chain of the Indian electronics business, together with designing, making certain native availability of elements (ICs, chipsets, techniques on chip, techniques or IP cores, and so on), and make Indian electronics business extra self-reliant and export-oriented. Creating the native manufacturing ecosystem will strengthen the native provide chain, thereby bettering time to market, lowering lead instances, saving treasured overseas alternate, lowering element and logistics prices, and making electronics merchandise extra reasonably priced within the coming years.

Electronics producers can now deal with bettering capabilities in such areas as PCB manufacturing methods, SMT based mostly automated manufacturing traces, ESD precautions in dealing with digital elements, in-circuit testing procedures, and PLC based mostly automated methods, to call a number of. Moreover, Indian producers must construct superior functionality in {hardware} design, testing, software program integration, in-vehicle networking, and Simulink instruments for creating and simulating interface techniques.

Rudranil Roysharma is Director, Vitality & Atmosphere Apply at Frost & Sullivan