Within the early hours of right now, September 15, 2022, the Ethereum neighborhood stood breathless. At 2:43 AM EST, there have been over 41,000 individuals viewing an “Ethereum Mainnet Merge Viewing Get together” through YouTube. The explanation: a software program improve to the Ethereum Digital Machine (EVM), generally known as The Merge, the second most essential occasion in Ethereum’s historical past barring its creation. After the primary validator node was efficiently introduced on-line (with extra following go well with), Ethereum’s Proof-of-Work (PoW) ceased, changed with Proof-of-Stake (PoS). Avid gamers and GPUs rejoice!

And we finalized!Blissful merge all. It is a massive second for the Ethereum ecosystem. Everybody who helped make the merge occur ought to really feel very proud right now.September 15, 2022

The Ethereum Merge has been a very long time coming ever since its proposal (in December 2020) as a potential improve to Ethereum. The Merge’s foremost characteristic is to allow Ethereum to transition from the energy-intensive PoW technique to the far much less demanding PoS. In PoW, validators/miners employed the finest graphics playing cards and maybe a couple of ASICs to crunch the cryptocurrency’s Dagger-Hashimoto algorithm, securing the blockchain within the course of and guaranteeing transactions are processed accurately.

PoS does away with the computationally intensive safety technique. As an alternative, validators should present they’ve a stake in Ethereum’s future by holding the equal of 32 ETH (~$50,615 at time of writing) of their node. Holding these 32 ETH items theoretically signifies that these validators have Ethereum’s well-being on their minds, since working in opposition to it or “poisoning” transactions would doubtless eat into Ethereum’s market notion and worth, in flip scale back the worth of their staked Ethereum tokens.

One concern that is been raised in opposition to the brand new PoS technique is that centralized exchanges can take part within the staking course of: customers will have the ability to stake their ETH straight with providers reminiscent of Coinbase. This has raised questions relating to the true decentralization of Ethereum. Establishments and legislation enforcement having higher energy over centralized exchanges than they do on particular person/organized miners has been one of many Merge’s mentioned elements. Lido, a community-run validator collective, controls over 30% of the stake on Ethereum’s PoS chain. Coinbase, Kraken and Binance — three of the biggest crypto exchanges — personal one other 30% of the community’s stake. That reads as a couple of key gamers being trusted with the keys to the dominion.

That mentioned, Ethereum’s $60 billion ecosystem of cryptocurrency exchanges, lending corporations, non-fungible token (NFT) marketplaces, and different apps at the moment are supposedly safer and scalable.

Maybe extra essential for our readers and PC fanatics (granted, a few of which doubtless did loads of mining), The Merge and the PoS transition lastly put an finish to GPU mining on the Ethereum community, which has been on-line since July 2015. Hypothesis previous to The Merge was that this could result in a flood of used graphics playing cards from AMD’s RX 6000-series and Nvidia’s RTX 30-series hitting secondary markets. The result’s that graphics playing cards which can be already promoting at a reduction, such because the $680 RX 6900 XT, might fall even additional.

Till yesterday, the Ethereum community counted round 900 TH/s of primarily GPU-driven computing energy. That is the equal of roughly 9.5 million RTX 3080 playing cards, however extra doubtless a big mixture of slower and older GPUs had been additionally collaborating — which means there was in all probability nearer to twenty million GPUs concerned with Ethereum mining, give or take. This does not essentially imply that a mixture of 20 million playing cards are going to immediately hit the market, in fact. If miners do select to dump their graphics playing cards, although, Nvidia and AMD might see some problem in promoting new graphics playing cards at retail.

At the least some graphics playing cards have been put to work on alternate mining cryptocurrencies reminiscent of Ethereum Traditional (whose hash charge has already doubled since The Merge, as much as 158 Terahashes per second) and Ravencoin (additionally nearly doubling from 8.9 TH/s as much as 15,9 TH/s). However the extra miners flip to those cash, the upper the mining problem imposed by the community, which can drive income down. Cryptocurrencies utilizing PoW usually observe a components that adjusts the problem of the algorithm to regulate the circulation of latest cash into circulation. This implies extra persons are competing for a restricted useful resource, and if value does not surge in lockstep with hash charges, the profitability of mining will plummet.

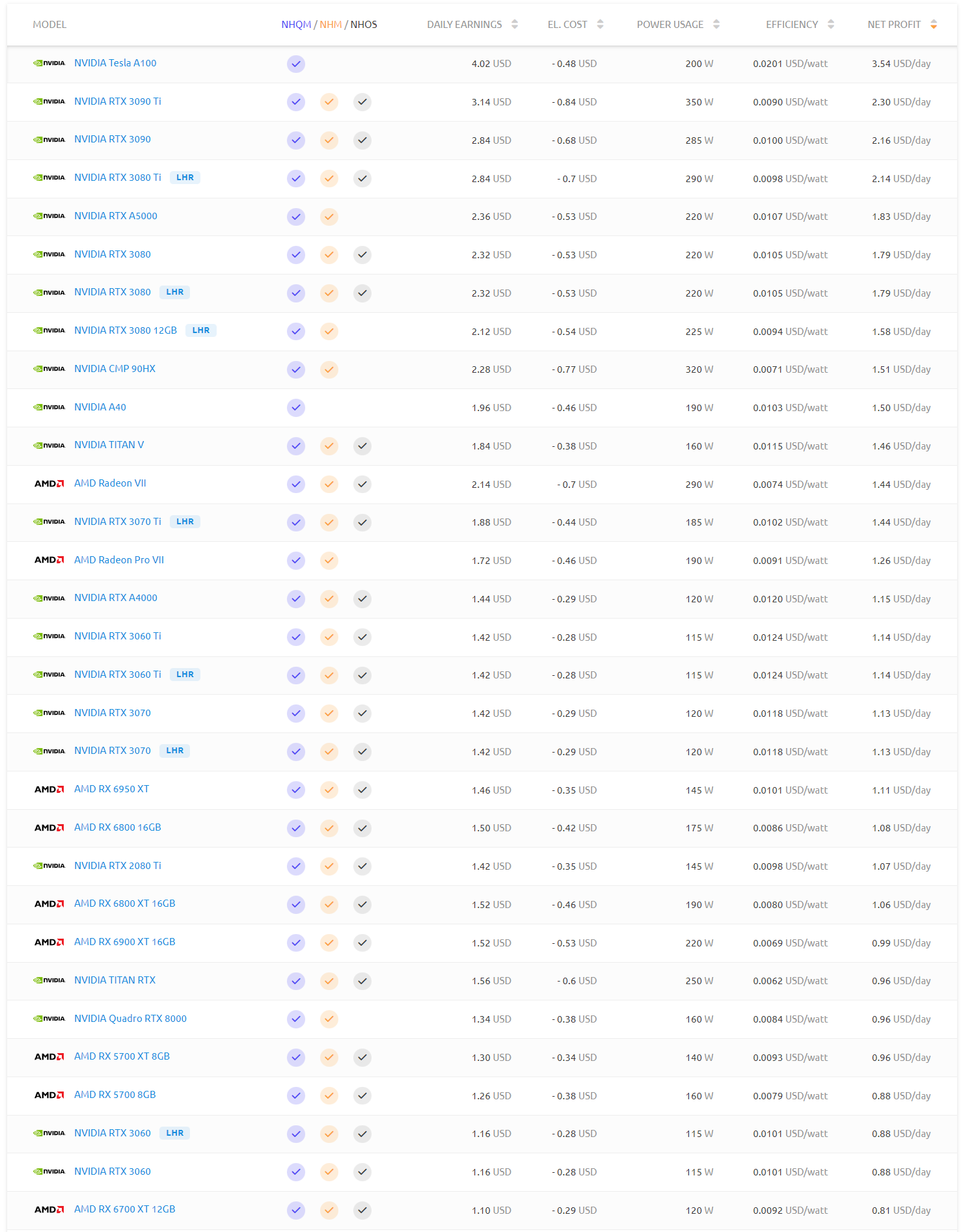

Above, you’ll be able to see the info from NiceHash’s Mining {Hardware} web page (opens in new tab), which continues to be based mostly on the pre-Merge values. We ran some fast checks, utilizing NiceHashMiner (and NiceHash’s QuickMiner) to see the place issues stand proper now. Previous to The Merge, a GPU just like the RTX 3090 might gross round $2.80 per day and the RTX 3080 sat round $2.30 per day, nearly totally because of Ethereum mining. Now? Oh boy, how issues have modified.

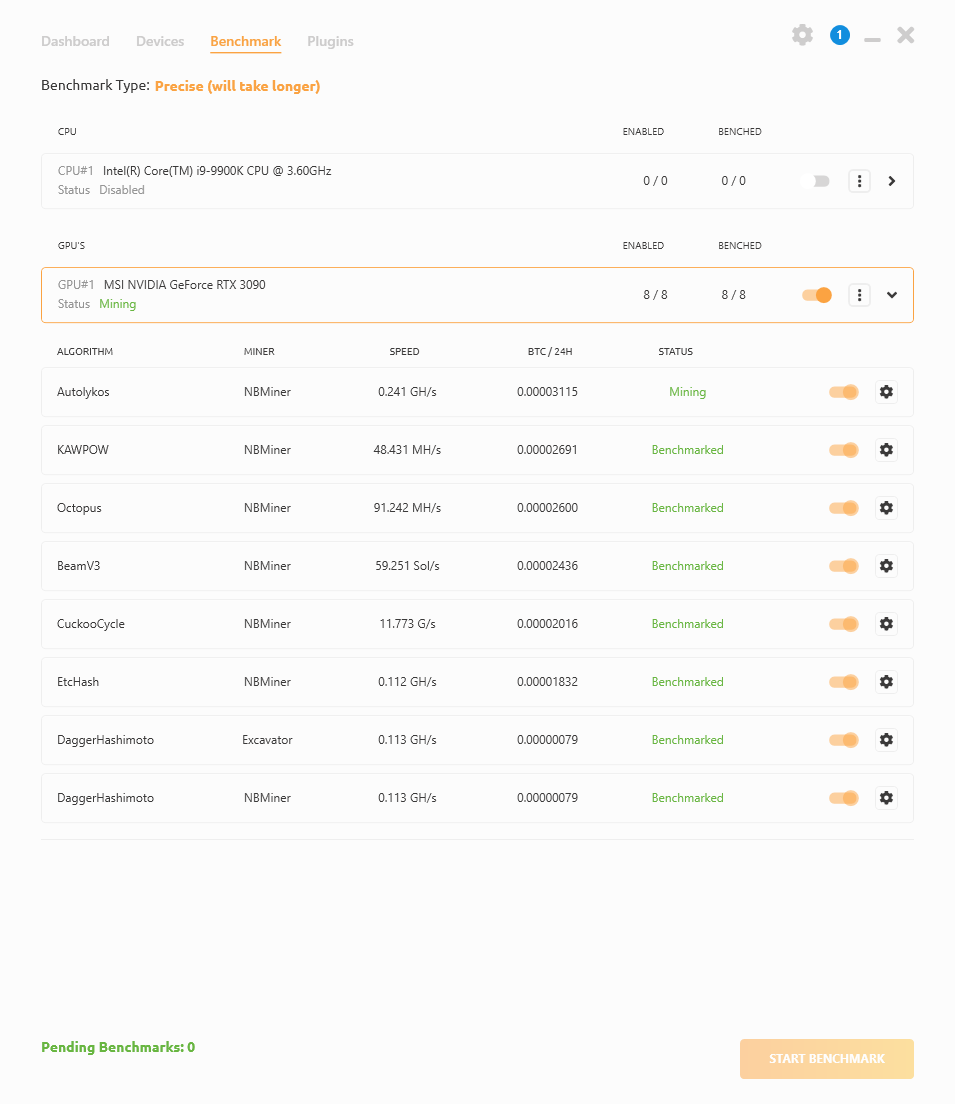

An RTX 3090 operating NiceHash Miner determined Autolykos with probably the most worthwhile selection for mining. At 245 MH/s, it was bringing in BTC equal to round $0.65 per day, whereas the PC consumed 400W (about 330W from the GPU). Ethereum Traditional in the meantime ran at 120 MH/s and consumed the identical 330W, probably bringing in $0.33 per day. At a baseline estimate of $0.10 per kWh, that is $0.80 in energy utilized by the GPU per day, and $0.96 for the whole PC, which means each coin proper now could be properly into the unprofitable vary with NiceHash.

This is the total set of NiceHash Miner benchmarks for the RTX 3090, operating the most recent model 3.1.0.0 of the software program. The GPU was tuned for reminiscence intensive workloads like Ethereum, nonetheless, so these outcomes ought to solely be taken as a tough baseline of what may very well be achieved.

What about direct mining? WhatToMine’s RTX 3090 information (opens in new tab) suggests you would gross as much as $1.35 per day with mining Ergo (ERG) mining, which makes use of the Autolykos algorithm. GPU energy is likely to be tunable to as little as 260W, which implies you would probably internet $0.70 per day. That is nonetheless far lower than half of what the RTX 3090 was doing previous to The Merge, and it stays to be seen if any coin can emerge from the collective with sustainable mining profitability on GPUs in a post-Ethereum world.

The abandonment of GPU mining additionally signifies that Ethereum is enhancing its power effectivity by leaps and bounds. Since graphics playing cards not have to run advanced computations to energy and safe the community, Ethereum’s power consumption footprint (and carbon footprint) has been lowered by 99.9%, concurrently chopping worldwide energy consumption by 0.2% (which continues to be a lot lower than the worldwide power consumption of electronics left on standby, by the best way).

Apparently, no price-action occurred for Ethereum post-Merge, constructive or damaging. That is partly as a result of most exchanges put a freeze on Ethereum buying and selling whereas ready for the community transition to happen. It is also potential that hypothesis had already made its manner into the pricing over the previous few weeks, particularly because the final profitable testnet for the Merge, Goerli, occurred little greater than a month in the past.

Whereas the principle Ethereum community has achieved away with GPU mining, present communities of miners should try to hold their cash-cow operating. A number of proposals to repeat the Ethereum blockchain whereas maintaining mining functionality (also called a tough fork of the community, which we have seen occur with Ethereum Traditional) have gained some floor inside the mining neighborhood. Making a brand new coin based mostly on an present coin is not troublesome; the actual drawback shall be convincing the cryptocurrency customers of the utility of such a coin, to offer it some perceived worth.