Equifax information breach settlement pay as you go card choice is being supplied to people who find themselves affected by the the large hack. After this incident on the client credit score company, Equifax, in 2017, hundreds of thousands of individuals have seemingly simply acquired an e-mail or letter suggesting they’re eligible to declare a category motion payout. However how will you make certain the e-mail is legit?

Virtually 150 million individuals had their Social Safety numbers, birthdates, addresses, and probably different private info stolen after Equifax introduced an enormous, protracted information breach in 2017. In 2019, Equifax agreed to a settlement that features as much as $425 million to compensate individuals harmed by the breach in alternate for the decision of all remaining class motion lawsuits in opposition to it. Now, the payback time has come.

Equifax information breach settlement pay as you go card: Is it legit?

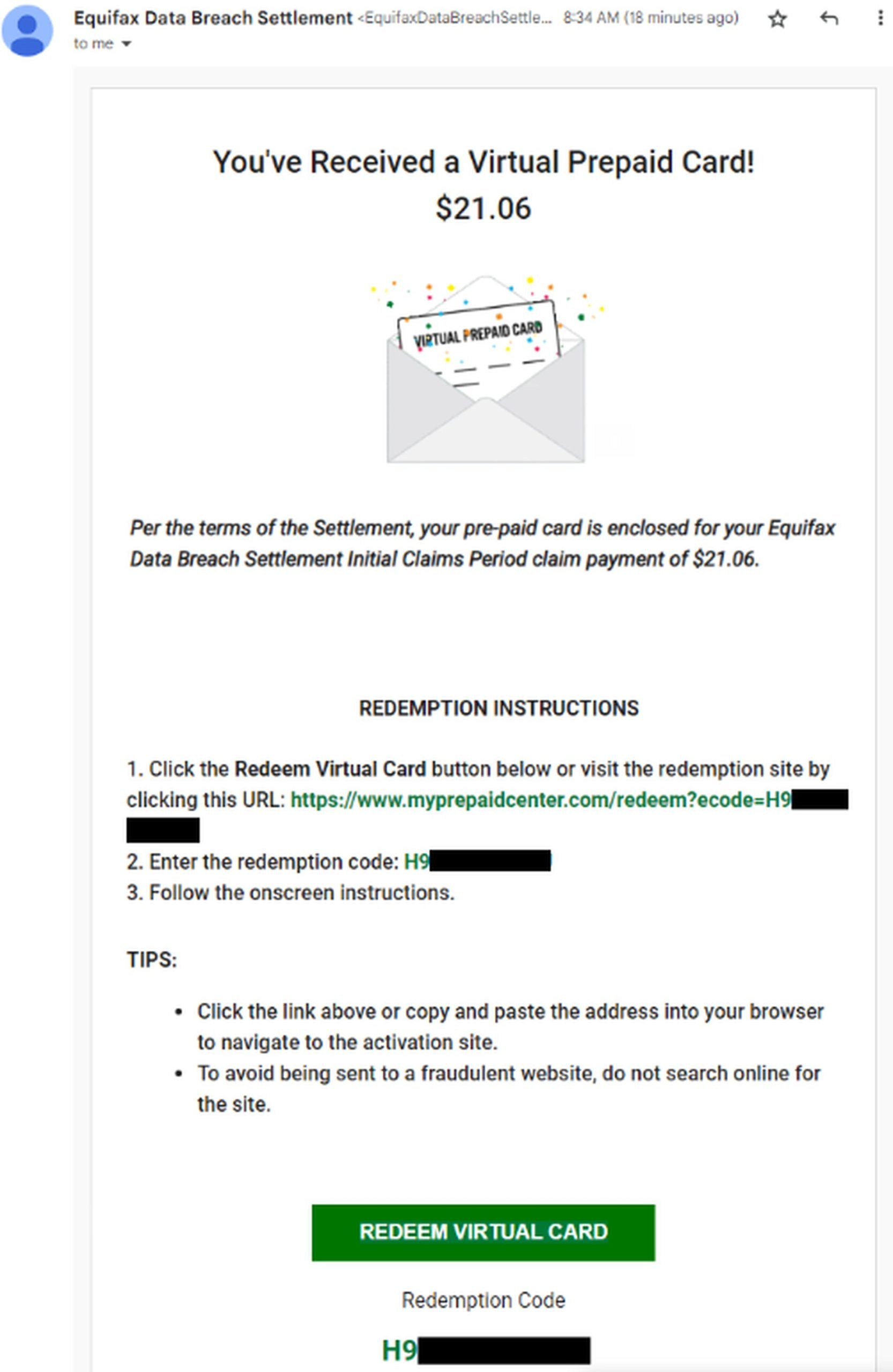

Suppose you’ve acquired an e-mail claiming to be an Equifax information breach settlement pay as you go card announcement however are hesitant to open the linked hyperlinks. In that case, there’s a approach to confirm the e-mail’s legitimacy.

Be certain to repeat the redemption code within the Equifax information breach settlement pay as you go card announcement after which paste it into the search bar on myprepaidcenter.com/redeem. Acceptance of a pay as you go MasterCard settlement is required to finish the appliance course of.

You need to use your final identify and the final six digits of your Social Safety Quantity to see whether or not or not you had been affected by the incident on the settlement web page. Nonetheless, needless to say as public consciousness concerning the payouts to deceive individuals rises, so will the probability that phishers and different scammers would try to reap the benefits of this.

You may select to be paid through verify or Equifax information breach settlement pay as you go card. Additionally, you possibly can select free credit score monitoring or as much as $125.

Do you have to decide free credit score monitoring or money?

Credit score monitoring companies are supplied for free of charge as a part of the settlement. You’ll obtain $1,000,000 in identification theft insurance coverage, free credit score monitoring for as much as six extra years from Equifax, and a minimum of 4 years of credit score monitoring in any respect three main bureaus (through Experian). Should you had been below the age of 18 in Might of 2017, you might be entitled to free credit score monitoring for the subsequent 18 years.

Credit score monitoring and safety companies sometimes final for six months, however you possibly can ask for a money payout of as much as $125 if you have already got them. The actual sum you obtain, nonetheless, will seemingly be considerably much less.

It’s tempting to go along with the $125 money choice if you have already got credit score monitoring companies that may maintain you lined for a minimum of one other six months. Nonetheless, free credit score monitoring for 10 years is the superior choice in most situations. The common month-to-month charge for a credit score monitoring service is $30.

A credit score monitoring service’s ten-year worth begins at $1,200. That is excess of $125. Not many individuals sustain with a credit score monitoring service for therefore lengthy. You would possibly really feel extra comfortable realizing that your credit score is being monitored for the subsequent decade if you’re involved concerning the fraud and identification theft. Your alternative of Equifax information breach settlement pay as you go card or free credit score monitoring, in the long run, is solely as much as you.

Over 4.5 million purposes for the (potential) $125 money award have been submitted as of December 1, 2019. Since simply $31 million was put aside for compensation, the common payout to every claimant can be nearer to $7.

Different settlements that made the information this yr: Epic Video games settlement, T-Cell information breach settlement, Equifax Information Breach Settlement, ATT settlement, Tiktok information privateness settlement, Snapchat privateness settlement, and Google location monitoring lawsuit settlement

Equifax information breach abstract

It’s been a very long time since 2017. Let’s bear in mind the Equifax information breach briefly.

Equifax, a credit score reporting service, introduced on September 7 {that a} information leak had occurred in one among its laptop networks, compromising the non-public info of 150 million purchasers.

It held delicate info resembling names, addresses, dates of delivery, Social Safety numbers, and bank card particulars, making it weak to identification theft and different types of fraud.

Equifax settlement timeline:

- July 2019: Equifax had agreed to pay a minimum of $575 million and perhaps as much as $700 million, in accordance with the FTC.

- January 2020: The court docket offers last approval to the settlement.

- Quantity of precise settlement: $425 million (Equifax Breach Settlement)

- January 2022: Settlement accomplished (FTC)

- February 2022: The settlement administrator delivers activation codes to certified clients who select free credit score monitoring companies.

- Fall 2022: Advantages for eligible out-of-pocket bills related to the breach or identification theft ensuing from the breach, in addition to time spent (as much as 20 hours) regaining management over the info breach, start to be distributed to clients by the settlement administrator.

Information breaches and hacks are at this time’s largest issues. Try the newest information breaches and hacks earlier than we proceed: CHI Well being information breach, Fb information breach, Uber safety information breach, American Airways information breach, Medibank cyber assault, and Binance hack.

What’s Equifax?

One of many three largest client credit score reporting corporations, along with Experian and TransUnion, is Equifax Inc., an American multinational firm with its headquarters in Atlanta, Georgia (collectively generally known as the “Huge Three”).

Equifax gathers and combines information on greater than 88 million organizations and over 800 million particular person customers worldwide. Equifax gives credit score monitoring and fraud prevention companies on to people and supplies companies with demographic and credit score information and companies.

Equifax operates or has monetary pursuits in America, Europe, and Asia Pacific. Equifax, which has greater than 10,000 staff globally and generates US$3.1 billion in yearly income, is listed on the NYSE below the identify EFX.