Corporations might want to re-evaluate their cyber-insurance premiums after main insurance coverage firms have adopted exclusions for catastrophic cyberattacks carried out by “state-backed” actors.

This limits the danger that firms can offset with cyber insurance coverage, safety and threat consultants inform Darkish Studying — making taking out a coverage probably not price it.

Within the newest limits on cyber insurance policies, insurance coverage market Lloyd’s of London issued a discover on Aug. 16 to its member insurers, or syndicates, requiring that they exclude protection for state-backed cyberattacks. The motive for the extra restrictions is to guard insurance coverage firms and their underwriters from catastrophic loss, and assist handle systemic threat that might overwhelm insurers, Lloyd’s market bulletin acknowledged.

Is Cyber Insurance coverage Nonetheless Price It?

Whereas the insurers’ place is comprehensible, companies — which have already seen their premiums skyrocket over the previous three years — ought to query whether or not insurance coverage nonetheless mitigates threat successfully, says Pankaj Goyal, senior vp of knowledge science and cyber insurance coverage at Secure Safety, a cyber-risk evaluation agency.

“Insurance coverage works on belief, [so answer the question,] ‘will an insurance coverage coverage maintain me complete when a foul occasion occurs?’ ” he says. “At present, the reply may be ‘I do not know.’ When prospects lose belief, everybody loses, together with the insurance coverage firms.”

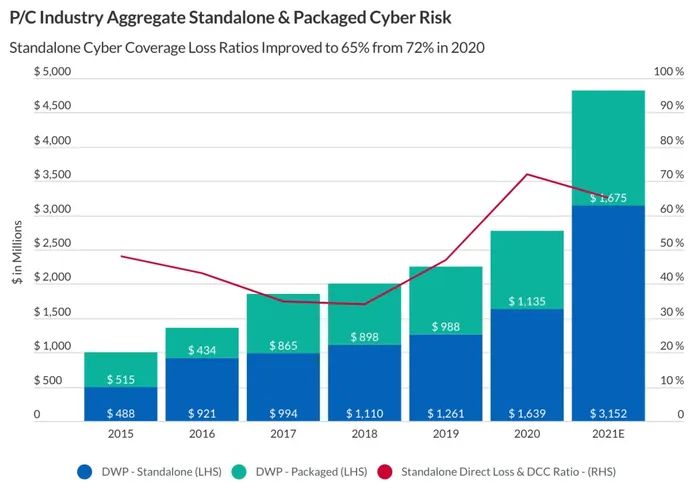

The cyber-insurance trade has seen earnings decline sharply prior to now decade, as losses jumped from 35% of the income from premiums 5 years in the past, to 72% in 2020. To adapt, insurance coverage firms have dramatically raised the price of insurance policies — by 74% simply in 2021, after rising 22% in 2020, in keeping with FitchRatings.

But, insurance coverage corporations have additionally centered on limiting their legal responsibility. In 2021, world insurance coverage agency AXA determined to cease paying ransoms to cybercriminals. And over the previous two years, insurance coverage firms have added act-of-war exclusions to their insurance policies.

In its market bulletin (PDF), Lloyd’s argued that the danger posed by cyberattacks continues to evolve and its members must adapt to the threats posed by giant or broadly distributed assaults. Whereas wartime dangers are sometimes excluded, Lloyd’s requires that syndicates go additional and be certain that sure insurance policies have “an appropriate clause excluding legal responsibility for losses arising from any state-backed cyberattack.”

“If not managed correctly it has the potential to show the market to systemic dangers that syndicates may wrestle to handle,” the insurance coverage facilitator acknowledged. “Particularly, the power of hostile actors to simply disseminate an assault, the power for dangerous code to unfold, and the vital dependency that societies have on their IT infrastructure, together with to function bodily belongings, signifies that losses have the potential to enormously exceed what the insurance coverage market is ready to take in.”

The choices come after pharmaceutical agency Merck gained its lawsuit in opposition to its insurers after they refused to pay its $1.4 billion in enterprise losses sustained within the NotPetya crypto-ransomware assault in 2017. The choose within the case dominated that the insurance coverage insurance policies’ act-of-war exclusion didn’t apply, as a result of the clause was meant to solely exclude losses throughout armed conflicts.

Regardless, the coverage modifications are poorly thought out, some argue.

“Indicators level to continued breaches and hacks, leading to an extended claims course of, and extra litigations,” says Goyal. “Until the trade can collectively repair the way in which cyber insurance coverage insurance policies are understood, written and priced, guaranteeing that they’re primarily based on precise knowledge and particular person organizational threat — one dimension doesn’t match all — there isn’t a finish to the challenges and distrust in cyber insurance coverage.”

Too Broad an Exclusion

The important thing downside is that the time period “state-backed cyberattack” could possibly be a really broad exclusion, and if abused by the insurance coverage trade, one that can scuttle the usefulness of cyber insurance coverage, consultants say.

Attributing an assault to a nation-state is notoriously tough, says James Turgal, vp of cyber-risk and technique for Optiv, a cybersecurity consultancy.

“Even when a pc concerned within the assaults was traced again to an IP handle situated in an Iranian or North Korean army base, that does not essentially imply that it was an assault executed with the data of or on the course of the federal government’s authorities,” he says. “It may have been compromised by hackers in different nations [as a false-flag attempt].”

Presently, virtually two-thirds of firms — 64% — suspect that they’ve been both straight focused or impacted by a nation-state assault, says Kevin Bocek, vp of safety technique and risk intelligence at Venafi. Lots of the main sources of cyberattacks in opposition to North American, European, and Asian firms come from cybercriminal teams linked ultimately with China, Iran, North Korea, or Russia. Whether or not that hyperlink will equate to being “state-backed” is an open query.

“These firms are clearly going to be anxious about whether or not insurers will deem most assaults to be nation-state sponsored,” he says. “In consequence, we count on most companies which might be critical about safety to double down on their efforts to guard themselves from hackers within the first place.”

Insurers must develop clear pointers relating to what proof and knowledge can be used to find out the attribution of an assault, and what habits patterns or knowledge factors they’ll think about in figuring out whether or not an assault is state-backed, he says.

Time to Beef Up Cyberdefenses

Certainly, the exclusion will doubtless lead to fewer firms counting on cyber insurance coverage as a approach to mitigate catastrophic threat. As a substitute, firms must guarantee that their cybersecurity controls and measures can mitigate the price of any catastrophic assault, says David Lindner, chief data safety officer at Distinction Safety, an software safety agency.

Creating knowledge redundancies, comparable to backups, increasing visibility of community occasions, utilizing a trusted forensics agency, and coaching all staff in cybersecurity can all assist harden a enterprise in opposition to cyberattacks and cut back damages.

“Organizations can not simply depend on their cyber insurance coverage coverage and should proactively defend themselves from these catastrophic cyberattacks,” Lindner says.

Corporations additionally shouldn’t count on insurance coverage corporations to reverse course. Their method is only a continuation of the trade’s reactive method to cyber insurance coverage, says Secure Safety’s Goyal. Insurance coverage corporations have elevated premiums, put sub-limits on ransomware, and now, have adopted arguably broad exclusions, which can simply lead to delayed payouts and a rise in lawsuits when insurers refuse to pay out on a big coverage.