Know-how has enabled the setting in of a brand new age of consumerism. Public coverage consultants Divya Singh Rathore and Pratyush Prabhakar time period this new age of consumerism the age of hyper-lapse consumerism. In keeping with them, together with the ever-increasing consumption of products and providers, shoppers at the moment are additionally prioritising the convenience with which they can place orders for varied items and providers and the velocity at which they’re delivered. Hyper-lapse consumerism is centred across the thought of being the quickest to achieve the patron, and it has largely been fuelled by the ever-present web and the expansion of e-commerce.

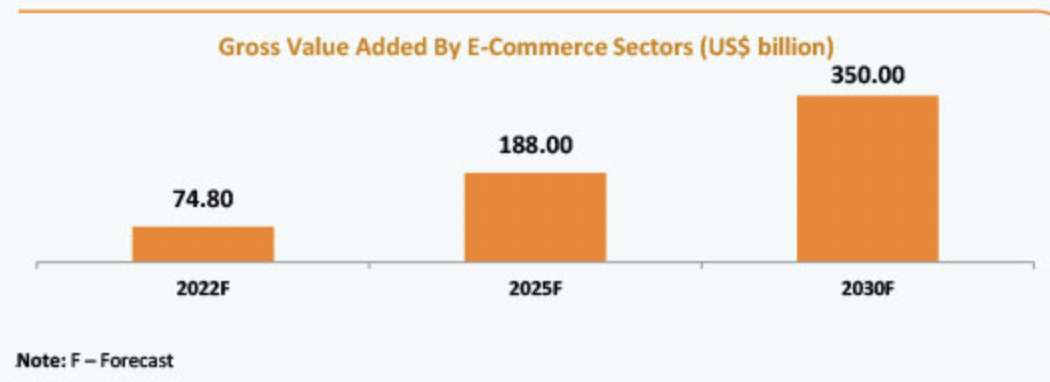

In keeping with India Model Fairness Basis (IBEF), the Indian e-commerce market is ready to achieve USD 74.8 billion in 2022, registering a 21.5% enhance. E-commerce has not solely reworked the best way companies function in India but additionally impacted consumerism. Might you think about ordering your favorite ice cream late at evening ten years again? Or may you think about sitting someplace in Kerala and ordering Ghewar? E-commerce has turned these fantasies into actuality.

Supply: IBEF

At the moment, in India alone, there are a number of e-commerce platforms being pushed by the notion of hyper-lapse consumerism. Just lately, now we have seen ads by a famend grocery e-commerce platform claiming to ship orders inside 10 minutes. With the continual evolution of expertise, client behaviour can also be present process adjustments. Within the preliminary days, on-line procuring was simply one other medium for procuring with fewer choices. Shoppers resorted to purchasing these merchandise on-line that they did get within the native market. Nonetheless, in the previous couple of years, this discipline has revolutionised to draw increasingly clients and canopy segments like each day necessities. Within the monetary yr 2021, the Indian on-line grocery market dimension was USD 3.95 billion. It’s estimated to develop to USD 26.93 billion by 2027 at a CAGR of 33%.

In actual fact, a definite class of shoppers who store solely on-line exists now. Such has been the extent of evolution of consumerism pushed by e-commerce firms. The race to achieve shoppers as quick as attainable is in full swing. Not to mention grocery and different perishables supply platforms like Blinkit, Licious and Zepto, e-commerce giants like Amazon and Flipkart are additionally being pushed by hyper-lapse consumerism. They’ve included options like Prime and Plus in efforts to prioritise shoppers’ supply expectations. In some cities, they even provide shoppers choices for identical day deliveries.

Undoubtedly, the e-commerce market in India has recorded a formidable progress in the previous couple of years pushed by a large number of things together with rising investments in e-commerce corporations, enhance in digital literacy, coverage help within the type of beneficial local weather for funding—100% FDI below automated route is allowed within the market mannequin of e-commerce—together with enhance in web and smartphone penetration. Indian shoppers are more and more adopting 5G smartphones even earlier than the rollout of the next-gen cellular broadband expertise within the nation.

Straightforward credit score placing client credibility to query

Nonetheless, one other essential issue driving the brand new age consumerism is the supply of straightforward credit score on e-commerce platforms. Earlier, shoppers resorted to credit score choices for getting belongings like property or expensive sturdy items like automobiles. Nonetheless, of late, shoppers are utilizing ‘credit score’ to purchase nearly something like cell phones, mixers and grinders and different trivial housekeeping objects. This has been made attainable resulting from a number of credit score choices accessible on e-commerce platforms. In actual fact, Flipkart in partnership with IDFC FIRST financial institution supplies clients the choice to ‘purchase now and pay later’. Curiously, that is additionally accessible for not-so-high-valued merchandise like apparels, yoga mats, and different commonplace home goods.

At a look, it might seem very democratising—in any case, in a rustic like India the place 45% households account for decrease center earnings households, folks could have the will to purchase a branded shirt that prices say INR 2000 however can not pay straight away. Nonetheless, many new-to-credit shoppers don’t have any correct credit score historical past. Thus, offering straightforward loans may set off a tradition of credit score indiscipline. Individuals cease being aware of what they need to or mustn’t purchase on credit score. Typically such irrational behaviour leads shoppers to borrow way more than their repayable capability. This could in the end put them in perpetual debt traps.

Does that imply hyper-lapse consumerism is all dangerous? By no means. Each shoppers in addition to companies should be aware of this evolutionary section of consumerism and the dire penalties it might have. Whereas e-commerce platforms should be acutely aware of the social, behavioural and moral implications of prompt deliveries, shoppers too should be accountable whereas availing credit score. It’s advisable that they deploy the 50/30/20 rule in dividing earnings amongst wants, desires and aspirations respectively. Utilizing monetary leverage is not going to solely assist purchase invaluable belongings but additionally forestall one from resorting to reckless credit score.