A category motion lawsuit has been filed towards big-three client credit score bureau Experian over reviews that the corporate did little to stop identification thieves from hijacking client accounts. The authorized submitting cites liberally from an investigation KrebsOnSecurity printed in July, which discovered that identification thieves had been capable of assume management over present Experian accounts just by signing up for brand spanking new accounts utilizing the sufferer’s private info and a special e mail handle.

The lawsuit, filed July 28, 2022 in California Central District Courtroom, argues that Experian’s documented follow of permitting the re-registration of present Experian accounts with out first verifying that the prevailing account holder licensed the adjustments violates the

In July’s Experian, You Have Some Explaining to Do, we heard from two totally different readers who had safety freezes on their credit score recordsdata with Experian and who additionally lately obtained notifications from Experian that the e-mail handle on their account had been modified. So had their passwords and account PIN and secret questions. Each had used password managers to choose and retailer advanced, distinctive passwords for his or her accounts.

Each had been capable of recuperate entry to their Experian account just by recreating it — sharing their identify, handle, telephone quantity, social safety quantity, date of delivery, and efficiently gleaning or guessing the solutions to 4 a number of alternative questions which can be virtually solely based mostly on public information (or else info that’s not terribly tough to seek out).

Right here’s the bit from that story that received excerpted within the class motion lawsuit:

KrebsOnSecurity sought to duplicate Turner and Rishi’s expertise — to see if Experian would permit me to re-create my account utilizing my private info however a special e mail handle. The experiment was completed from a special pc and Web handle than the one which created the unique account years in the past.

After offering my Social Safety Quantity (SSN), date of delivery, and answering a number of a number of alternative questions whose solutions are derived virtually solely from public information, Experian promptly modified the e-mail handle related to my credit score file. It did so with out first confirming that new e mail handle might reply to messages, or that the earlier e mail handle permitted the change.

Experian’s system then despatched an automatic message to the unique e mail handle on file, saying the account’s e mail handle had been modified. The one recourse Experian provided within the alert was to check in, or ship an e mail to an Experian inbox that replies with the message, “this e mail handle is now not monitored.”

After that, Experian prompted me to pick out new secret questions and solutions, in addition to a brand new account PIN — successfully erasing the account’s beforehand chosen PIN and restoration questions. As soon as I’d modified the PIN and safety questions, Experian’s web site helpfully jogged my memory that I’ve a safety freeze on file, and would I wish to take away or briefly elevate the safety freeze?

To be clear, Experian does have a enterprise unit that sells one-time password companies to companies. Whereas Experian’s system did ask for a cell quantity once I signed up a second time, at no time did that quantity obtain a notification from Experian. Additionally, I might see no choice in my account to allow multi-factor authentication for all logins.

In response to my story, Experian instructed the reviews from readers had been remoted incidents, and that the corporate does all types of issues it may well’t discuss publicly to stop unhealthy folks from abusing its programs.

“We imagine these are remoted incidents of fraud utilizing stolen client info,” Experian’s assertion reads. “Particular to your query, as soon as an Experian account is created, if somebody makes an attempt to create a second Experian account, our programs will notify the unique e mail on file.”

“We transcend reliance on personally identifiable info (PII) or a client’s capacity to reply knowledge-based authentication inquiries to entry our programs,” the assertion continues. “We don’t disclose further processes for apparent safety causes; nonetheless, our information and analytical capabilities confirm identification components throughout a number of information sources and will not be seen to the patron. That is designed to create a extra optimistic expertise for our customers and to offer further layers of safety. We take client privateness and safety significantly, and we frequently evaluation our safety processes to protect towards fixed and evolving threats posed by fraudsters.”

That sounds nice, however since that story ran I’ve heard from a number of extra readers who had been doing every part proper and nonetheless had their Experian accounts hijacked, with little left to point out for it besides an e mail alert from Experian saying they’d modified the handle on file for the account.

I’d wish to imagine this class motion lawsuit will change issues, however I don’t. Probably, the one factor that can come from this lawsuit — if it isn’t dismissed outright — is a fats payout for the plaintiffs’ attorneys and “free” credit score monitoring for just a few years compliments of Experian.

Credit score bureaus don’t view customers as clients, who’re as an alternative the product that’s being bought to 3rd social gathering corporations. Typically that information is bought based mostly on the pursuits of the entity buying the info, whereby client information will be packaged into classes like “canine proprietor,” “expectant mum or dad,” or “diabetes affected person.”

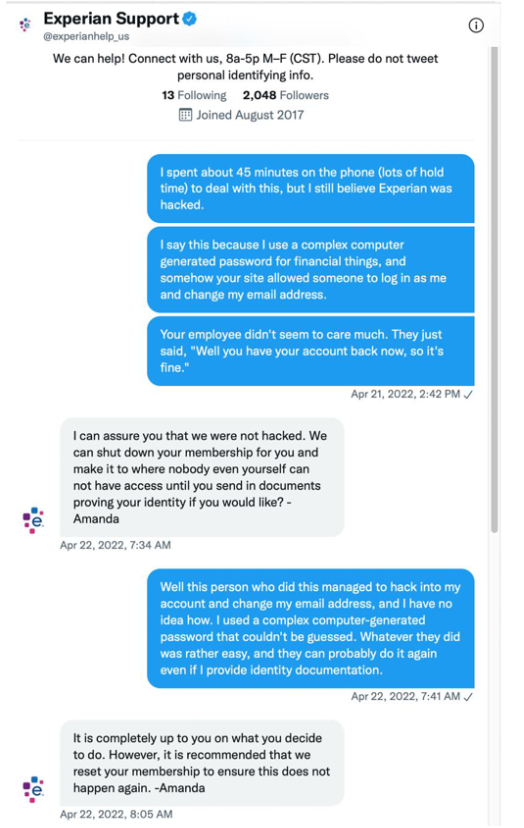

A chat dialog between the plaintiff and Experian’s help workers reveals he skilled the identical account hijack as described by our readers, regardless of his use of a computer-generated, distinctive password for his Experian account.

Nonetheless, most lenders depend on the big-three client credit score reporting bureaus, together with Equifax, Experian and Trans Union — to find out everybody’s credit score rating, fluctuations through which could make or break one’s software for a mortgage or job.

On Tuesday, The Wall Avenue Journal broke a narrative saying Equifax despatched lenders incorrect credit score scores for thousands and thousands of customers this spring.

In the meantime, the credit score bureaus hold having fun with file earnings. For its half, Equifax reported a file fourth quarter 2021 income of 1.3 billion. A lot of that income got here from its Workforce Options enterprise, which sells details about client wage histories to quite a lot of clients.

The Biden administration reportedly desires to create a public entity throughout the Client Monetary Safety Bureau (CFPB) that may incorporate elements like lease and utility funds into lending selections. Such a transfer would require congressional approval however CFPB officers are already discussing the way it is perhaps arrange, Reuters reported.

“Credit score reporting corporations oppose the transfer, saying they’re already working to offer honest and inexpensive credit score to all customers,” Reuters wrote. “A public credit score bureau could be unhealthy for customers as a result of it will broaden the federal government’s energy in an inappropriate method and its objectives would shift with political winds, the Client Knowledge Trade Affiliation (CDIA), which represents non-public score corporations, stated in a press release.”

A public credit score bureau is more likely to meet fierce resistance from the Congress’s most beneficiant constituents — the banking trade — which detests fast change and is closely reliant on the credit score bureaus.

And there’s a preview of that battle occurring proper now over the bipartisan American Knowledge Privateness and Safety Act, which The Hill described as probably the most lobbied payments in Congress. The concept behind the invoice is that corporations can’t accumulate any extra info from you than they should give you the service you’re searching for.

“The bipartisan invoice, which represents a breakthrough for lawmakers after years of negotiations, would limit the form of information corporations can accumulate from on-line customers and the methods they will use that information,” The Hill reported Aug. 3. “Its provisions would affect corporations in each consumer-centric trade — together with retailers, e-commerce giants, telecoms, bank card corporations and tech corporations — that compile large quantities of person information and depend on focused advertisements to draw clients.”

In accordance with the Digital Frontier Basis, a nonprofit digital rights group, the invoice as drafted falls quick in defending customers in a number of areas. For starters, it will override or preempt many sorts of state privateness legal guidelines. The EFF argues the invoice additionally would block the Federal Communications Fee (FCC) from imposing federal privateness legal guidelines that now apply to cable and satellite tv for pc TV, and that buyers ought to nonetheless be allowed to sue corporations that violate their privateness.

A duplicate of the category motion grievance towards Experian is out there right here (PDF).