The disclosing of Meta’s Diem stablecoin venture will likely be remembered as extra vital than its failure due to the domino impact it had on central banks worldwide, which rushed to make sure they’d not quickly lose management of financial coverage on account of the exponential development of cryptocurrencies. This suspicion was confirmed when an govt order from US President Joe Biden to look at the dangers and advantages of cryptocurrencies got here totally two months after the Diem venture formally ended.

CBDCs have the potential to essentially alter how sovereign cash is issued, saved, and exchanged, with industrial banks susceptible to being excluded from the ecosystem altogether. The fact is, nonetheless, that industrial banks will nonetheless have an vital function to play as custodians of CBDCs, however central banks’ views on the regulation of personal cryptocurrencies alongside CBDCs differ broadly.

Nonetheless, it’s clear that CBDCs will turn out to be a actuality with greater than 80% of the world’s central banks already contemplating launching their very own. Timelines have been accelerated, and Omdia expects to see as many as 10 CBDCs reside by end-2023 with that quantity prone to rise to 25–30 by the tip of 2025. Nonetheless, central banks, industrial banks, and software program distributors must collaborate within the settlement of widespread requirements to make sure the success and mass adoption of CBDCs globally.

Crypto: Compete or Management?

Cryptocurrencies are decentralized by their very nature: they had been designed to work with out reliance on a centralized physique to supervise them. Nonetheless, governments have turn out to be involved concerning the rising recognition of cryptocurrencies and their potential to destabilize sovereign-issued currencies, which has compelled some to behave. Nigeria, China, and Turkey are just some of the governments to suggest outright bans on using personal, decentralized cryptocurrencies inside their sovereignty as they search to speed up the adoption of their very own centrally issued digital currencies as a substitute.

Different governments are as a substitute in search of to manage cryptocurrencies. The European Central Financial institution lately authorised a brand new oversight framework for digital funds, which can embrace protection of stablecoins and different crypto property. India is proposing the introduction of a 30% crypto tax that targets all transfers of digital digital property whereas it develops its personal CBDC, the digital rupee, which is about for launch by 2023. President Biden signed an govt order on cryptocurrencies in March 2022 calling on the federal government to look at the dangers and advantages of cryptocurrencies, which included calling on federal businesses to take a unified method to regulation and oversight of digital property. El Salvador and the Central African Republic have taken an altogether totally different method by being the primary nations to undertake Bitcoin as authorized tender.

Whichever method governments select, CBDCs ought to coexist and work together with different fee schemes, and central banks should additionally guarantee they aren’t in direct competitors with industrial banks. If CBDCs had been to be completely issued immediately by central banks, this is able to weaken the steadiness sheets of business banks and threaten their enterprise mannequin. The CBDC framework is required to steadiness the wants of central banks and governments with these of shoppers, retailers, and companies.

Fixing the Offline Conundrum

The speed at which CBDCs are launched and thereafter adopted will likely be dictated by numerous societal, financial, and political elements. Nonetheless, the important thing problem that also must be resolved is how to make sure CBDC funds can happen in an offline setting. This flaw was critically uncovered when the pilot of Jap Caribbean’s CBDC DCash skilled an outage for six weeks in early 2022 due to a technical difficulty. DCash requires an web connection to operate, which might not suffice if CBDC had been to finally displace money.

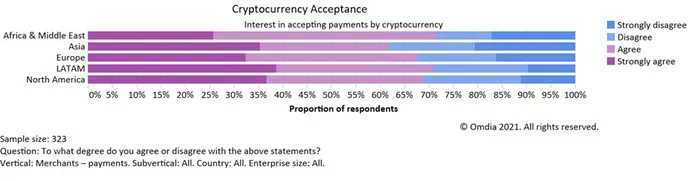

Cash is finally about belief in its intrinsic worth, which is why it’s crucial to make sure CBDCs are fail-safe and safe as a fee technique in each on-line and offline environments. Customers are sometimes creatures of behavior in terms of fee and should be closely incentivized to beat their inertia. There are lots of of various fee technique choices on the disposal of shoppers, and retailers want to have the ability to predict how their goal shoppers will need to pay and supply that most well-liked fee technique at checkout to scale back friction. Curiously, 67% of retailers globally are already excited by accepting cryptocurrency as a fee technique with retailers in Latin America essentially the most enthusiastic to undertake.

Greater than two-thirds of worldwide retailers need to settle for crypto funds

Central financial institution digital currencies are a pure evolution of the cash system, and there’s already a number of enthusiasm from personal banks, retailers, and shoppers to embrace cryptocurrencies. To ensure that CBDCs to achieve success they should have interoperability at their core whereas functioning in each on-line and offline environments.

Entry the Full Market Panorama Central Financial institution Digital Currencies Report Right here