Frauds are in every single place. We’re so used to information of monetary crimes that it doesn’t trouble most individuals. However you would be a sufferer any day. It’s a rampant crime that we frequently downplay.

In 2021, there have been greater than 88000 reviews of bank card fraud and practically 70000 frauds from fee apps and companies.

There have been, considerably surprisingly, 12000 crimes involving money and 8000 involving checks. These numbers, when mixed, are even scarier.

In 2021, the entire sum of money concerned in scams and fraudulent actions was $5.8 billion.

That’s how massive of a menace that is.

Know-how birthed a wholly new breed of monetary crimes. Know-how can be giving us methods to guard ourselves from these crimes. Once you mix tech literacy, anti-fraud instruments, and customary sense, you get a potent antidote to fraudulent actions.

The function of know-how in frauds

On this article, we’ll have a look at how know-how can assist you keep protected against monetary crimes and fraudulent actions.

We’ll additionally speak about basic tech literacy since many of the victims are unaware of how frauds work. The extra educated you might be, the safer you might be.

Forms of monetary frauds

First, let’s outline what fraud is. When a number of individuals tries to deliberately mislead and misdirect somebody with the intention of deceptively taking cash, we name it fraud. There are a number of varieties wherein the cash might be taken, not essentially in money alone.

There are broadly two forms of frauds — on-line fraud and offline/bodily fraud. For our function, we’ll solely speak about on-line fraud.

Listed here are the most typical forms of monetary fraudulent actions.

Id theft

To place it in easy phrases, identification theft means somebody is impersonating another person to make purchases or transfer cash on their behalf. When a cybercriminal will get entry to your bank card data, they will fake to be you to switch cash and purchase issues. Id theft is by far the most typical kind of fraud.

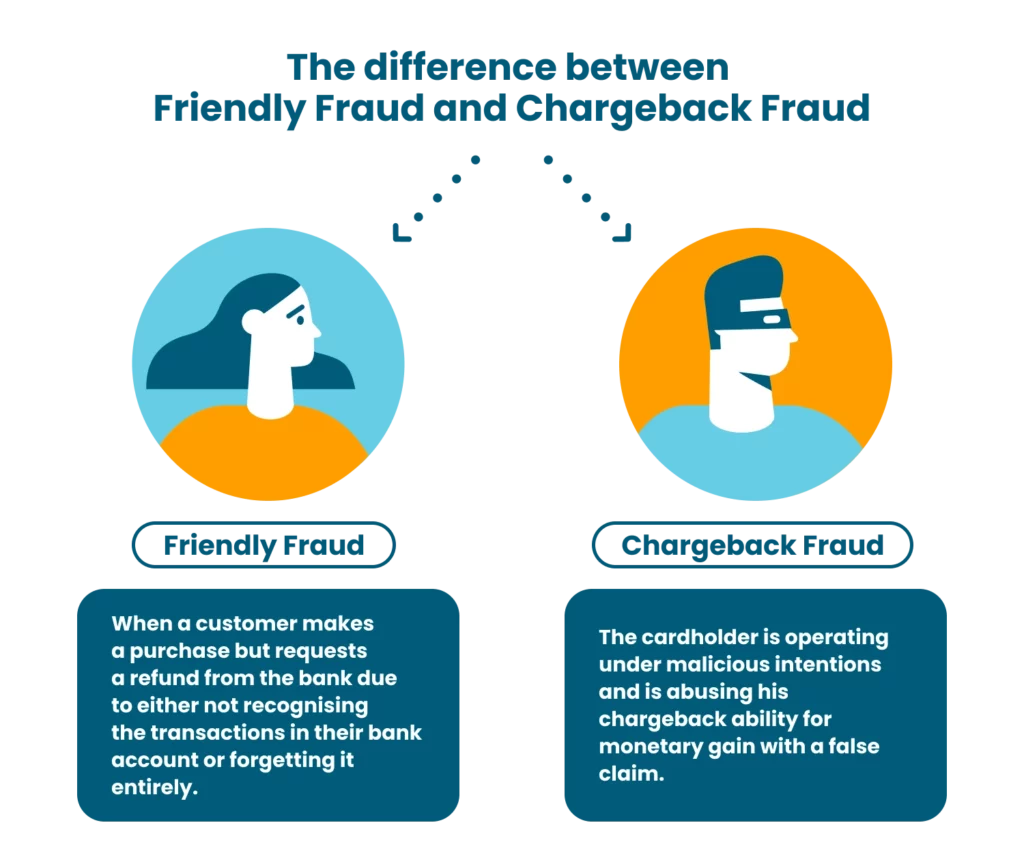

Chargeback fraud

In chargeback fraud, the financial institution or the service provider is the sufferer, and the client is the perpetrator. Consumers first make a purchase order utilizing their bank card. As soon as the acquisition is full, they report that their card has been stolen and they didn’t make any buy. Then the financial institution or the service provider has to provide a refund. That is also called pleasant fraud.

Thankfully, chargeback fraud prevention is feasible with the best instruments and software program. It’s a needed part for all companies which have a web based store. Whereas chargeback fraud doesn’t concern patrons, sellers and lending establishments must be on their guard always.

Service provider fraud

Service provider fraud is a reasonably direct kind of fraud that you may keep away from by being vigilant. In service provider fraud, the service provider takes orders and receives funds with the promise of delivering an merchandise, however then disappears with the cash. It’s a typical type of monetary fraud within the offline world as nicely.

Cybercriminals usually use spoof web sites to hold out service provider fraud. A spoof web site appears to be like precisely like an authentic on-line buying web site however steals your bank card and different delicate data. As an illustration, chances are you’ll purchase one thing from a web site that appears precisely like Amazon however is definitely a spoof web site. You may keep from spoof web sites by not clicking on adverts and popups and all the time checking web site URLs.

Pyramid schemes

Pyramid schemes promise superb returns however find yourself fleeing with the traders’ cash. Pyramid schemes don’t fall beneath the class of on-line fraud, however are sometimes carried out digitally.

There are quite a few instruments you should use to not fall for pyramid schemes. Google alone provides you with details about a sure scheme or fund. So long as you might be conscious and vigilant, you don’t want to fret about pyramid schemes.

Can know-how finish fraud?

Know-how alone can’t finish fraud. Regardless of how environment friendly a instrument is, you additionally must be competent sufficient to make use of it. In any other case, it’d be ineffective. Know-how mixed with consciousness and customary sense can stop fraud even when it could actually’t finish it.

Fraudulent actions are as previous as civilization itself. There’s no approach we will finish it, however one of the best we will do is to maintain ourselves secure.

The right way to use know-how to stop fraud?

There are numerous methods you possibly can stop fraud, with or with out know-how. However in some circumstances, you want a powerful technology-based anti-fraud framework to remain protected.

The way you undertake know-how to stop fraud additionally is dependent upon whether or not you might be primarily a purchaser or vendor. Many people fall in each classes, however extra in a single than the opposite. For enterprise homeowners, it’s essential to make use of the best anti-fraud instruments and software program.

Listed here are some methods you should use know-how to stop fraud:

Use anti-fraud software program

Anti-fraud software program is available in differing types and skills. Whereas some goal particular areas like chargeback fraud, others present complete safety for a enterprise. In the event you run a enterprise, you can not overlook the significance of anti-fraud software program.

When selecting from completely different anti-fraud instruments, be sure you take note the potential development of your online business. What suffices as we speak could not suffice tomorrow, and that makes scalability a vital function. Other than that, the price is an apparent issue.

Nonetheless, it’s price spending just a few extra bucks to avoid wasting your self from a rip-off that may go away you bankrupt.

In case you are primarily a purchaser, chances are you’ll not want to fret about anti-fraud software program. Nonetheless, you possibly can nonetheless use some components from them to higher defend your funds. For instance, you should use databases to test the legitimacy of a monetary scheme you might be interested by investing in.

Cloud safety

In 2022, many people have delicate data saved on the cloud, for each people and companies. It’s essential for everybody to place particular consideration to cloud safety, particularly when you use cloud-based companies on a regular basis.

Cybersecurity instruments do an excellent job of offering real-time cloud safety. Even when you solely order issues from buying web sites sometimes, it’s sensible to put money into a cyber safety instrument that’ll allow you to safe cloud information. For companies, cloud safety usually comes as part of a complete anti-fraud software program suite.

Safe your bank cards

We regularly retailer our bank card data with buying web sites for comfort and quick checkouts. In case you are eager on doing it, be sure the buying web site in query isn’t doubtful. It’s finest to retailer bank card data solely with the web sites you employ ceaselessly.

There’s one other approach to retailer bank card data with a lot decrease danger. The trick is to make use of password managers. These instruments and apps add a number of layers of safety to make it nearly unattainable for cybercriminals to entry your bank card data. On the similar time, you possibly can conveniently pull the small print from the supervisor for fast purchases.

Password managers

Password managers now supply bank card storage amenities, however they have been initially designed to retailer login passwords and usernames. Other than being extraordinarily handy, password managers are additionally far safer than manually storing your passwords.

Password managers not solely retailer your passwords safely but additionally counsel robust passwords. Giant databases of passwords and usernames are sometimes leaked in information breaches. In the event you use the identical or comparable password throughout platforms, it’s very simple for hackers to get your passwords. By producing a powerful and random password, password managers maintain you protected against information breaches.

Buyer profiling and background checks

In case you are within the B2B area or concerned in a lending enterprise, you’ll all the time need to know in case your shoppers are dependable. Up to now, you would need to depend upon sparse data and word-of-mouth to find out an individual’s legitimacy. Now banks are utilizing machine studying applied sciences to scan enormous databases and detect suspicious actions.

A number of SaaS safety instruments assist small companies and lenders scan potential shoppers for reliability and authenticity. In case you are utilizing these instruments, you might be at a a lot decrease danger of getting duped.

Common practices for on-line security

There are just a few common ideas that everybody ought to take note to be safer on-line:

- By no means reply to suspicious emails, SMS, or calls. Keep in mind that banks would by no means name you and demand delicate data

- By no means click on on pop-up adverts, particularly on shady web sites

- All the time be sure you are utilizing the official web site and/or app of an eCommerce web site

- By no means give bank card pins to anybody

- Use anti-virus software program in your private pc

- Don’t store on-line from public networks (cafes, malls, and so forth.)

- Use two-factor authentication wherever doable

- In the event you lose cash to fraud, report it to the authorities on the earliest because it will increase the possibilities of retrieving the quantity

Conclusion

Following the fundamental guidelines of web security can maintain you and your cash secure.

Once you mix the best instruments and software program, your possibilities of being a sufferer cut back drastically.

We hope we have now raised some essential factors about stopping fraudulent actions. The extra you recognize about these frauds, the higher geared up you could be.