AMD introduced third quarter outcomes this week, and whereas it posted a $64 million loss when it comes to general working earnings—primarily because of its acquisition of Xilinx—however massive good points within the firm’s information heart, embedded and gaming segments offered an encouraging word.

Whole income rose by 29% for the third quarter of 2022, to $5.56 billion from $4.31 billion one 12 months in the past. Gross revenue additionally rose in 12 months on 12 months phrases, from $2.08 billion in final 12 months’s third quarter to $2.35 billion for the previous three months. The decline in working earnings was brought on by a lot greater working bills, which greater than doubled within the third quarter, rising from $1.14 billion a 12 months in the past to $2.42 billion in the newest figures.

AMD chalked the upper bills as much as its acquisition, in February 2022, of semiconductor firm Xilinx, which value the corporate roughly $50 billion. Moreover, greater spending on R&D additionally reduce into AMD’s margins.

Traders appeared to give attention to the great information heart and embedded phase information, as AMD shares rose 3.7% to $61.83 in Thursday afternoon buying and selling.

Knowledge heart uptake helps compensate for PC market decline

Like the remainder of the semiconductor business, AMD’s development was slowed considerably by the decline in PC gross sales. That a part of the corporate’s enterprise declined from $1.69 billion within the third quarter of 2021 to $1.02 billion this 12 months. Nevertheless, different components of AMD grew considerably to compensate for that decline, with the corporate’s information heart internet income rising from $1.1 billion final third quarter to $1.6 billion within the newest numbers, which represents a forty five% enhance.

The Xilinx acquisition additionally helped bolster AMD’s numbers within the embedded sector – which is unsurprising given Xilinx’s give attention to that space. The third quarter of 2021 noticed AMD make simply $79 million in internet income from embedded merchandise, whereas the newest quarter confirmed $1.3 billion in the identical phase.

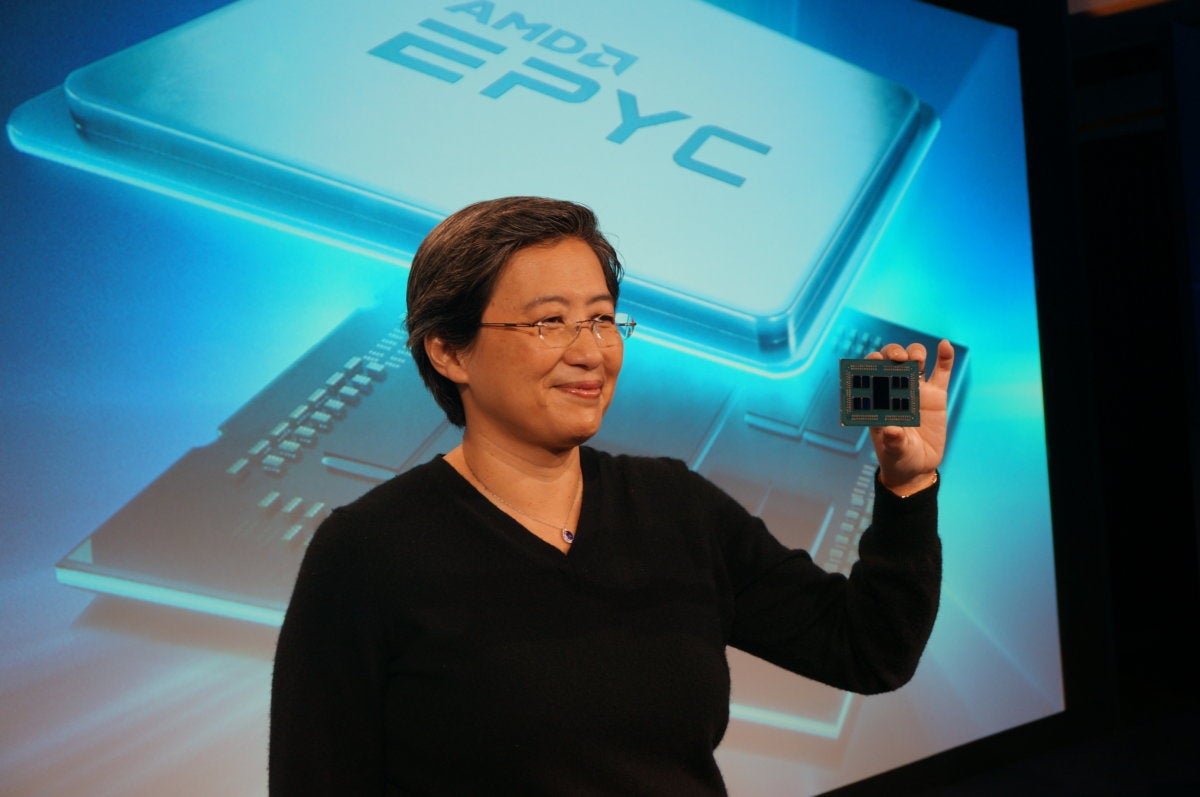

The corporate mentioned that it credit development within the information heart market to constructive gross sales numbers for its EPYC processors, which have helped it take substantial market share away from Intel. Whereas the server processor market has largely belonged to Intel over the previous many years, that firm’s market share has fallen from 98% 5 years in the past to 88%, as of Might of this 12 months. AMD’s estimates for future income are bullish, with the corporate predicting a roughly 14% year-on-year rise for its fourth quarter, to a complete of roughly $5.5 billion. AMD additionally acknowledged that it expects development each in year-over-year and sequential phrases for its embedded and information heart companies.

Copyright © 2022 IDG Communications, Inc.