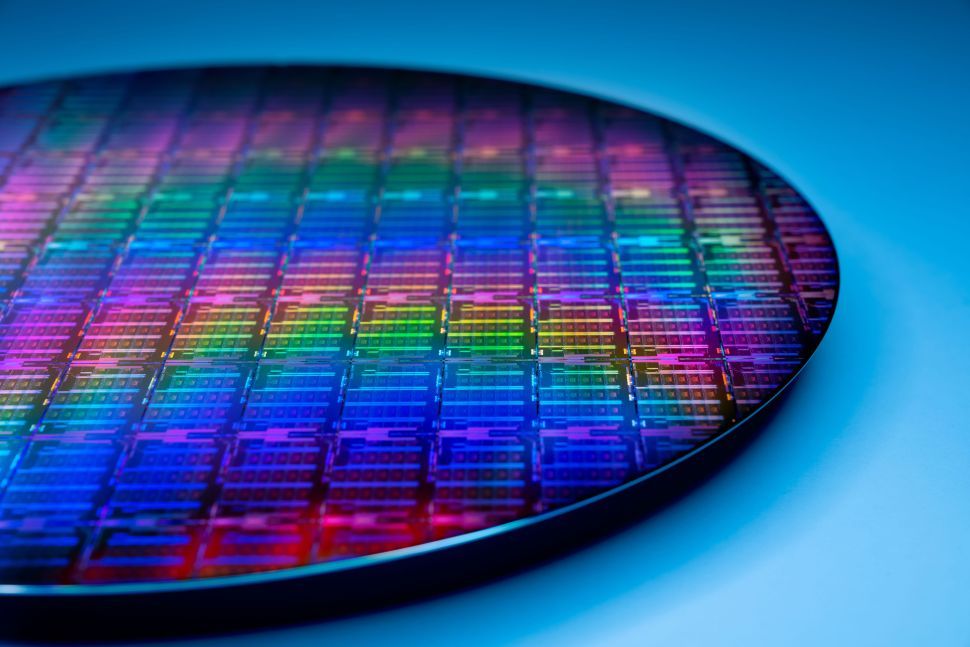

Intel has made a giant stink in regards to the $52 billion CHIPS Act, which might bolster the home manufacturing of semiconductors. Taiwan Semiconductor Inc. (TSMC) has turn out to be the dominant pressure globally within the contract chipmaking sector, and Intel is eager on regaining the market share that it has misplaced in current a long time. If the CHIPS Act passes, Intel will transfer ahead with an preliminary funding of $20 billion into a brand new Ohio “mega web site” fab (as much as $100 billion may ultimately be invested within the web site).

However some within the U.S. semiconductor trade really feel that the model of the CHIPS Act, which is about to be voted on as early as tomorrow by the Senate, unfairly advantages Intel. In response to Reuters, the $52 billion in subsidies and tax advantages afforded by the invoice will present the majority of the advantages to firms like Intel. Intel designs and manufactures the vast majority of its semiconductors, and the CHIPS Act closely favors offsetting the price of constructing new fabs within the U.S. Different main U.S.-based firms that design and manufacture their very own chips embody Micron and Texas Devices.

A separate FABS Act (which has bipartisan help) would supply as much as a 25% tax credit score for the development of fabs and the manufacturing tools essential to function the services.

Nevertheless, Intel’s most direct competitors within the consumer computing, graphics, and server/HPC markets comes from AMD and NVIDIA. Whereas AMD and NVIDIA are U.S.-based and design their very own microprocessors, they contract exterior companies like TSMC and Samsung to supply their chips. In consequence, they would not have the ability to reap the total advantages of the $52 billion windfall from the U.S. authorities.