Within the first quarter of 2022, the Prime 10 fabless chip designers elevated their cumulative gross sales to $39.43 billion, or by a whopping 44% year-over-year, in line with TrendForce (opens in new tab) . Qualcomm and Nvidia continued to stay on high of the record, however AMD — now within the fourth place — is slowly however certainly growing its gross sales and has all possibilities to develop into the third largest fabless chip designer within the coming quarters.

Being the world’s main provider of smartphone SoCs and RF modules, Qualcomm loved the pure progress of those companies in Q1 2022. As well as, the corporate skilled progress in its automotive and IoT gross sales, so Qualcomm’s earnings for the primary quarter totaled $9.548 billion (excluding its licensing enterprise), up 52% from the identical quarter a 12 months in the past.

Nvidia continued to learn from the rising demand for discrete graphics processing items for consumer PCs and datacenter GPUs for AI and high-performance computing functions. Therefore, its income for Q1 reached $7.904 billion, up 53% yearly. In contrast, Broadcom was not that fortunate, so its gross sales ‘solely’ elevated by 26% YoY to $6.11 billion.

AMD changed MediaTek from the No.4 spot in Q1 primarily as a result of it added Xilinx gross sales to its revenues. Nonetheless, AMD’s CPU and GPU gross sales considerably elevated within the first quarter as a result of robust demand for high-performance processors and graphics playing cards. Consequently, AMD’s earnings exceeded $5.887 billion in Q1 2022, up 71% from the identical quarter final 12 months. As soon as the corporate provides Pensando to its outcomes and ramps up manufacturing of CPUs, GPUs, and console SoCs as a result of seasonality later this 12 months, it can in all probability outpace Broadcom by way of earnings. It would develop into one of many world’s Prime 3 fabless designers of chips, a landmark occasion for an organization that nearly went bankrupt about half of a decade in the past. After all, it stays to be seen how easy integration of Pensando and Xilinx will proceed, however for now, the sky is blue for AMD.

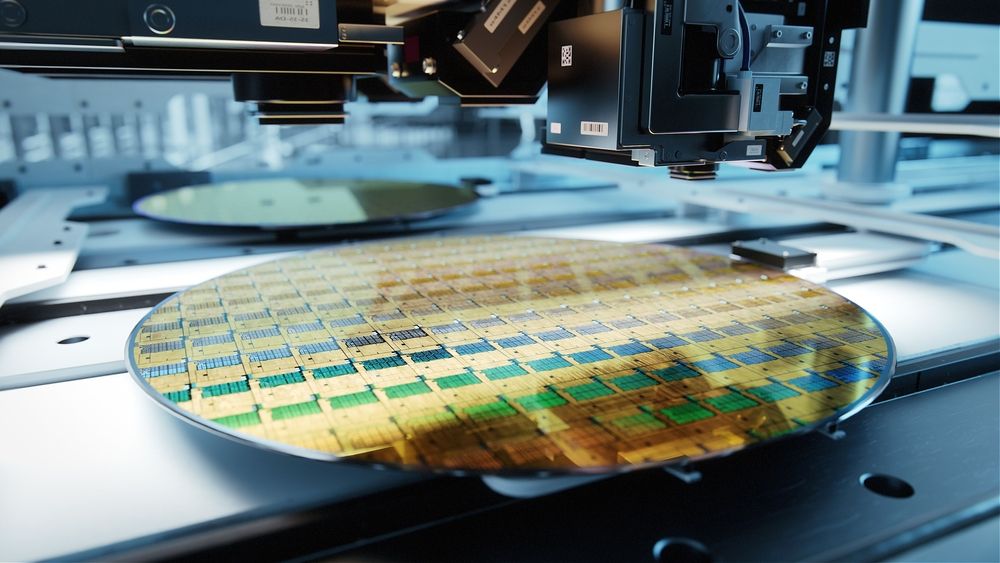

(Picture credit score: TrendForce)

Whereas MediaTek switched its place with AMD, its Q1 income grew a wholesome 32% year-over-year to $5.007 billion. The corporate continues to deal with every kind of smartphones and tablets with its cellular SoCs. As its portfolio expands and the efficiency of utility processors will increase, the corporate can cost extra vital premiums for its merchandise.

Marvell was one other firm in Q1 2022 to exhibit an over 70% income progress year-over-year (to $1.412 billion) primarily as a result of its acquisition of Innovium, a cloud and edge information heart networking options designer, in October 2021. In the meantime, Marvell was not the one firm to enhance its enterprise outcomes by adopting an M&A method. For instance, Cirrus Logic (No.10) took over Lion Semiconductor to spice up its mixed-signal enterprise in mid-2021, so its Q1 2022 gross sales reached $490 million, up 67% year-over-year.

Demand for various chips continues to stay robust, notably in 5G, automotive, AI, high-performance computing, and edge computing areas. However the geopolitical and macroeconomic scenario could pose challenges even for the seemingly resilient semiconductor market. Consequently, will probably be fascinating to look at how the main chip corporations will handle these challenges within the coming quarters.