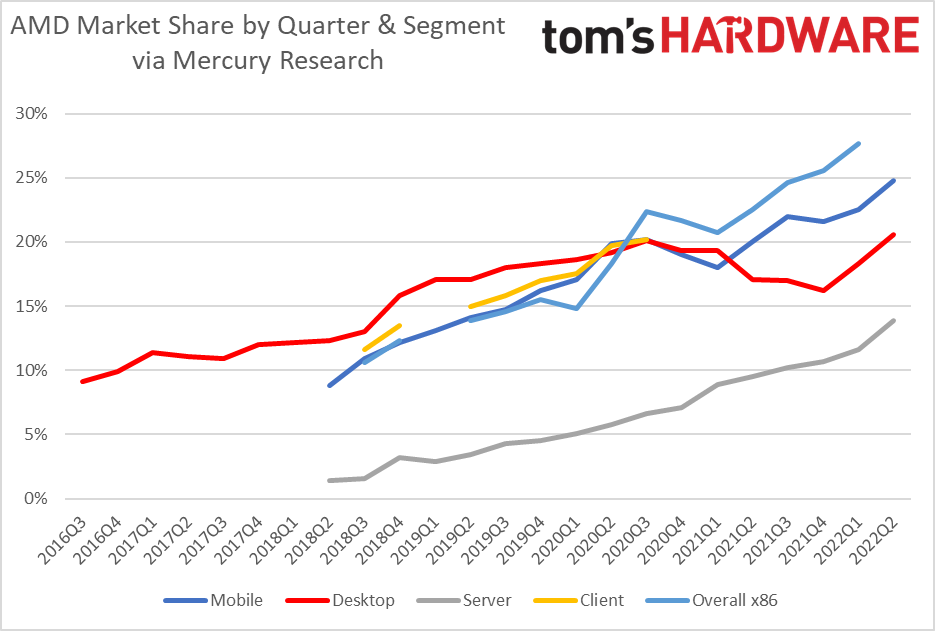

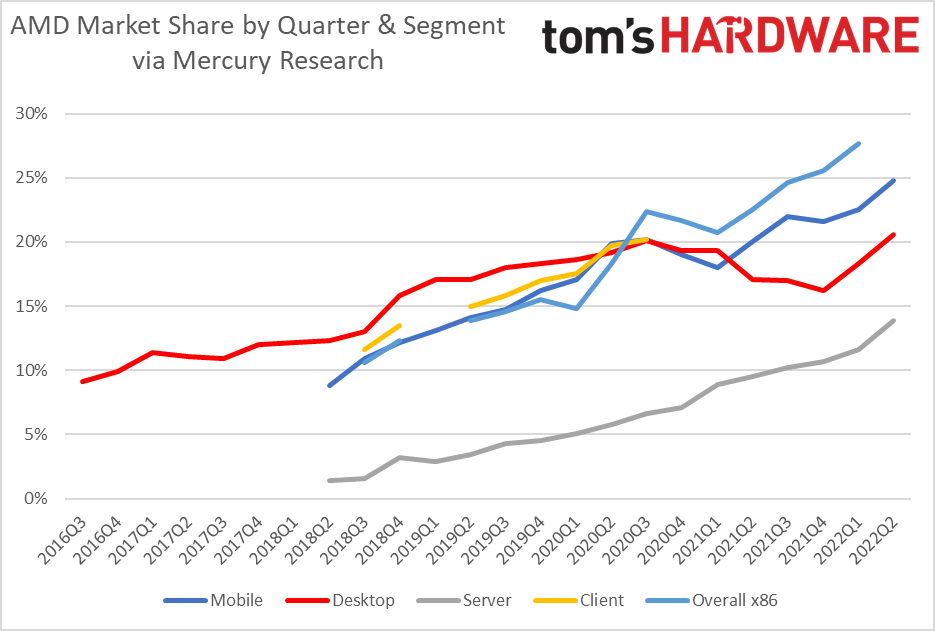

The preliminary Mercury Analysis CPU market share outcomes are in for the second quarter of 2022, arriving throughout what’s changing into a extra dire scenario for the PC market as gross sales cool after a number of years of stratospheric progress. In keeping with the current earnings report from Intel, AMD, and Nvidia, the restoration will probably be an extended one. Nonetheless, for now, AMD seems to be weathering the storm higher than others because it continued to steal market share from Intel in each section of the CPU market, setting information in all of them.

The desktop PC market continues to be on hearth, but it surely is not a very good form of hearth. Intel issued a dire earnings report final week — the firm misplaced cash for the primary time in many years, partially pushed by PC declines. Intel additionally introduced it was delaying its crucial Xeon Sapphire Rapids information middle chips and killing off one other failing enterprise unit, Optane; the sixth unit retired since new CEO Pat Gelsinger took over.

In distinction, AMD’s income was up 70% year-over-year as the corporate continued to enhance its already-great profitability. AMD is firing on all cylinders and can launch its Ryzen 7000 CPUs, RDNA 3 GPUs, and EPYC Genoa information middle processors on schedule.

That constant execution continues to repay. AMD continued to take huge strides within the cellular/laptop computer market, setting one other document for unit share in that section with 24.8%. AMD additionally gained within the server marketplace for the thirteenth consecutive quarter, reaching 13.9% of the market. Notably, AMD’s quarterly achieve in servers is the very best we have seen with our historic information, which dates again to 2017.

It is protected to say that each one indicators level to a continued PC droop — Intel and AMD anticipate the desktop PC market to be down double-digits by way of the top of the yr. Nvidia additionally introduced that it had drastically underperformed its information by $1.4 billion as a result of slumping gaming GPU gross sales, and its companions anticipate as much as a 50% decline in GPU shipments this yr. It is exhausting to gauge how a lot of that quantity was really destined for gaming PCs versus cryptominers, so the tea leaves are murky.

We do not have the evaluation from Mercury Analysis but, although we anticipate that to reach quickly. We’re notably to see how Arm’s assault on the x86 market goes, notably as Apple’s new chips proceed to realize reputation. Apple encountered provide disruptions through the quarter as a result of lockdowns in China, impacting its capacity to ship items and certain impacting its share beneficial properties in opposition to x86.

We’ll replace the article with Mercury Analysis’s commentary when it turns into accessible. However, for now, you’ll find the uncooked numbers under.

AMD vs. Intel Desktop PC Market Share Q2 2022

| 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | 4Q19 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 | 1Q18 | 4Q17 | 3Q17 | 2Q17 | 1Q17 | 4Q16 | 3Q16 | |

| AMD Desktop Unit Share | 20.6% | 18.3% | 16.2% | 17.0% | 17.1% | 19.3% | 19.3% | 20.1% | 19.2% | 18.6% | 18.3% | 18% | 17.1% | 17.1% | 15.8% | 13% | 12.3% | 12.2% | 12.0% | 10.9% | 11.1% | 11.4% | 9.9% | 9.1% |

| Quarter over Quarter / Yr over Yr (pp) | +2.3% / +3.5% | +2.1 / -1.0 | -0.8 / -3.1 | -0.1 / -3.1 | -2.3 / -2.1 | +0.1 / +0.7 | -0.8 / +1.0 | +0.9 / +2.1 | +0.6 / +2.1 | +0.3 / +1.5 | +0.3 / +2.4 | +0.9 / +5 | Flat / +4.8 | +1.3 / +4.9 | +2.8 / +3.8 | +0.7 / +2.1 | +0.1 / +1.2 | +0.2 / +0.8 | +1.1 / +2.1 | -0.2 / +1.8 | -0.3 / – | +1.5 / – | +0.8 / – | – |

The decline within the PC market comes because the pandemic recedes and world financial turmoil and inflation mount. Sluggish CPU gross sales are exacerbated by seasonal downturns, and all of those components have conspired to scale back demand for each Intel and AMD. Nevertheless, AMD continues its streak of market share beneficial properties, reaching 20.6% of the unit share within the quarter.

AMD vs. Intel Pocket book / Cellular Market Share Q2 2022

| 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | Q419 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 | |

| AMD Cellular Unit Share | 24.8% | 22.5% | 21.6% | 22.0% | 20.0% | 18.0% | 19% | 20.2% | 19.9% | 17.1% | 16.2% | 14.7% | 14.1% | 13.1% | 12.2% | 10.9% | 8.8% |

| Quarter over Quarter / Yr over Yr (pp) | +2.3% / +4.8% | +0.9 / +4.4 | -0.4 / +2.6 | +2.0 / +1.8 | +1.9 / +0.01 | -1.0 / +1.1 | -1.2 / +2.8 | +0.3 / +5.5 | +2.9 / +5.8 | +0.9 / +3.2 | +1.5 / +4.0 | +0.7 / +3.8 | +1.0 / +5.3 | +0.9 / ? |

AMD set one more market share document within the pocket book market, a powerful feat provided that it would not promote as many chips into the low-end section as Intel. This marks one more market share document for AMD within the cellular area.

Arm vs x86 Market Share Q2 2022

| Arm vs x86 Market Share | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 2Q20 |

| Arm Unit Share | ? | 11.3% | 10.3% | 8.3% | ~7.0% | 5.9% | 3.4% | Lower than 2% |

We’re nonetheless ready on up to date information for this section.

AMD vs. Intel Server Unit Market Share Q2 2022

| 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | 4Q19 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 | 4Q17 | |

| AMD Server Unit Share | 13.9% | 11.6% | 10.7% | 10.2% | 9.5% | 8.9% | 7.1% | 6.6% | 5.8% | 5.1% | 4.5% | 4.3% | 3.4% | 2.9% | 3.2% | 1.6% | 1.4% | 0.8% |

| Quarter over Quarter / Yr over Yr (pp) | +2.3% / +4.4% | +0.9 / +2.7 | +0.5% / +3.6 | +0.7 / +3.6 | +0.6 / +3.7 | +1.8 / +3.8 | +0.5 / +2.6 | +0.8 / +2.3 | +0.7 / +2.4 | +0.6 / 2.2 | +0.2 / +1.4 | +0.9 / +2.7 | +0.5 / +2.0 | -0.3 / – | +1.6 / 2.4 | +0.2 / – |

AMD bases its server share projections on IDC’s forecasts however solely accounts for the single- and dual-socket market, which eliminates four-socket (and past) servers, networking infrastructure, and Xeon D’s (edge). As such, Mercury’s numbers differ from the numbers cited by AMD, which predicts a better market share. Right here is AMD’s touch upon the matter: “Mercury Analysis captures all x86 server-class processors of their server unit estimate, no matter gadget (server, community or storage), whereas the estimated 1P [single-socket] and 2P [two-socket] TAM [Total Addressable Market] offered by IDC solely consists of conventional servers.”

AMD continued its three-year streak of quarterly share beneficial properties and made the most important single quarterly achieve way back to our information go (2017). AMD gained within the server marketplace for the thirteenth consecutive quarter, reaching 13.9% of the market.

Intel continues to endure on this section, and it additionally introduced its Sapphire Rapids will probably be delayed but once more. The corporate hasn’t set a discernable date for the complete launch, however we anticipate that to come back in Q1 subsequent yr.

AMD vs. Intel General x86 Market Share Q2 2022

| 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | 4Q19 | 3Q19 | 2Q19 | 4Q18 | 3Q18 | |

| AMD General x86 | ? | 27.7% | 25.6% | 24.6% | 22.5% | 20.7% | 21.7% | 22.4% | 18.3% | 14.8% | 15.1% | 14.6% | 13.9% | 12.3% | 10.6% |

| General PP Change QoQ / YoY | ? | +2.1 / +7.0 | +1.0 / +3.9 | +2.1 / +2.2 | +1.8 / +4.2 | -1.0 / +6.0 | -0.7 / +6.2 | +4.1 / +6.6 | +3.5 / +1.2 (+3.7?) | -0.7 / ? | +0.9 / +3.2 | +0.7 / +4 | ? | ? | – |

Whereas different segments exclude IoT and semi-custom (like AMD’s recreation console enterprise), this accounting of the general x86 market additionally consists of these merchandise and is targeted totally on the broader AMD vs Intel competitors.

Sadly, we cannot have info for this section till a bit later. We’ll replace the article as quickly because the commentary and last numbers are available from Mercury Analysis. Keep tuned.