Are we safety sufficient to keep away from a knowledge breach?

Usually the primary query CEOs and boards need to know is whether or not the group is safe sufficient to stop a knowledge breach. Nobody can predict that with certainty as a result of no firm has good safety free from threat. It’s rather a lot like predicting costs of securities on the inventory market. You may’t. It’s playing any means you take a look at it. One thing sudden may all the time occur. Too many variables exist.

Studying from inventory market investing methods

As I write this part of my collection of articles let me begin by saying that this isn’t investing recommendation. Nevertheless, I do have some expertise with and information about investing. I labored within the again workplace of Capital One Investing constructing techniques that take care of investments and skim a whole lot of books concerning the inventory market over the previous 25 years or so — to the purpose that I just about invested all my cash in my home and averted the market for a very long time. I’m not recommending that both.

My challenge with the market was that I discovered it too akin to playing after all of the issues I’ve discovered, and managed by large corporations who’ve much more entry to make their trades occur when they need. I assumed issues had been principally overvalued like the massive tech shares. When working for myself I didn’t have anybody matching my 401K or making these large trades on my behalf. For those who do, it’s best to max that out as a result of it’s immediately doubling your cash. I put my cash into my home and bought it for a reasonably sizable revenue somewhat over a 12 months in the past.

We will be taught one thing from buyers by way of how they handle the danger of costs rising and falling within the inventory market. The value of a inventory available in the market can’t be predicted with 100% accuracy, just like the prospect of a knowledge breach. Buyers use methods to enhance odds, restrict losses, and improve earnings. How do they do it? There are two main methods:

Development Investing: Making an attempt to select shares primarily based on their future potential to outperform the market. Development investing is principally attempting to foretell the longer term. You may take a look at a whole lot of indicators to make a greater prediction, however it’s nonetheless a prediction. We all the time hear concerning the winners, however there are additionally a whole lot of losers and a justifiable share of threat.

Worth Investing: Investing in firms which can be buying and selling under what they’re actually value. Buyers take a look at firm monetary studies reminiscent of a steadiness sheet, revenue and loss assertion, and the detailed footnotes in monetary studies to find out the worth of an organization. They may search for a low P/E (value to earnings) ratio and different elements to give you a price and decide how a lot cash they’ll make if the inventory value rises to match that worth. As well as, value-oriented shares usually pay dividends.

Development Investing Versus Worth Investing

As simply talked about, development investing tries to foretell future will increase, whereas worth investing tries to seek out good offers primarily based on the worth of an organization.

Which technique is best? It relies upon the way you take a look at it as this text explains:

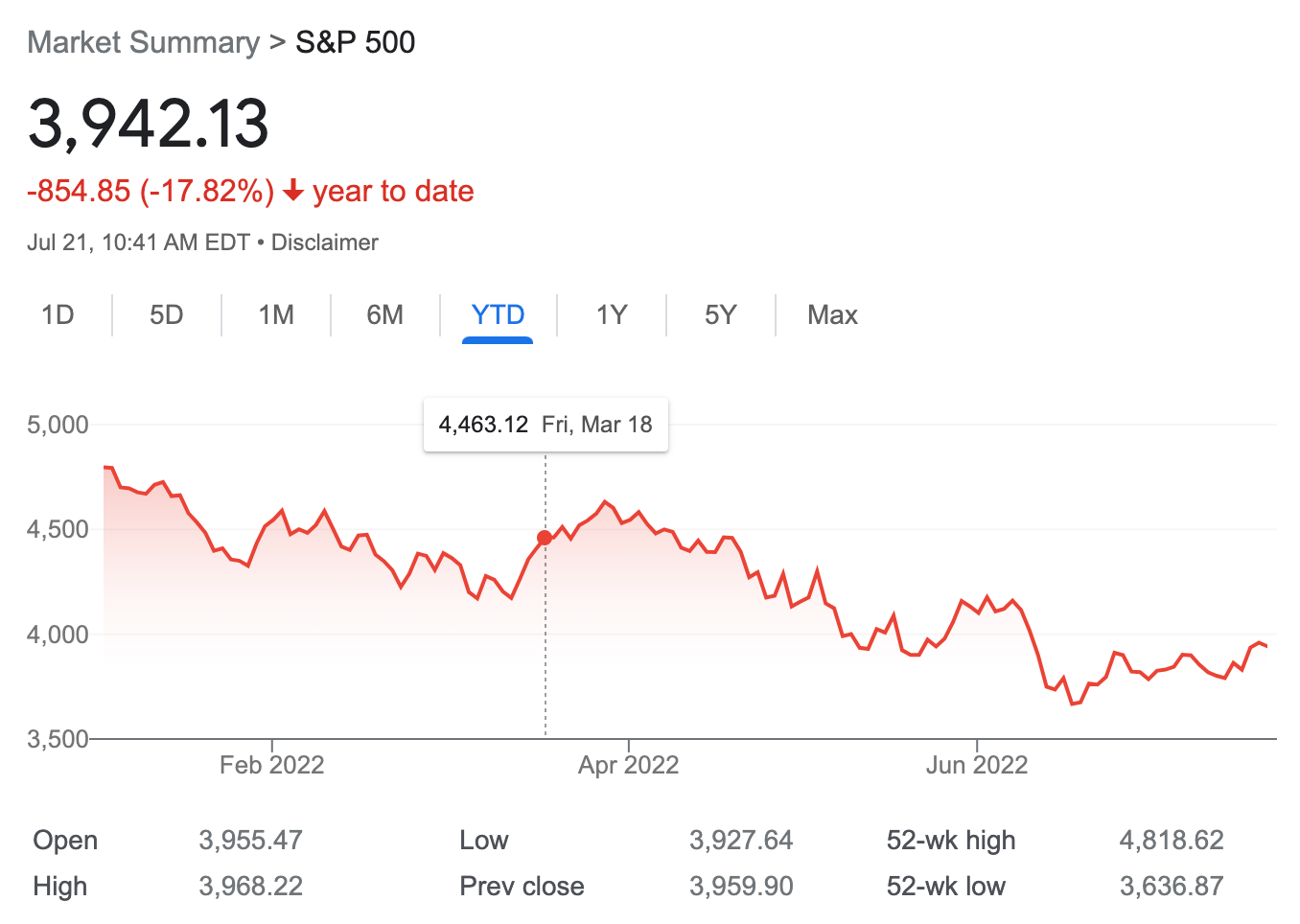

Over all time, worth investing has produced higher outcomes. Within the final 10 years, development investing has out carried out worth investing. Nevertheless, that could be altering as I write this. Check out these charts that present inventory market developments and point out the cut-off date when this text was printed.

The inventory market is falling. Many are predicting that as a consequence of inflation and the U.S. Federal Reserve elevating rates of interest that we’re about to enter a recession. Indicators already level to the consequences of the elevated charges in numerous sectors. Buyers are anxious a couple of recession. When that occurs, individuals are inclined to attempt to discover safer investments. Right here’s an article that claims buyers are turning to worth shares to climate the inventory market storm:

You may take a look at the chart within the above article to see the market shifting in the direction of value-oriented shares.

Not each development inventory previously 10 years was a winner

Even when you selected to spend money on development shares previously ten years, did you select the fitting development shares? Those that are investing in development shares and are profitable at it are sometimes nonetheless taking a look at firm financials. The next article warns in opposition to choosing shares which can be overvalued:

The idea of worth nonetheless applies when deciding on shares that you just suppose will develop. The perfect state of affairs can be to seek out an undervalued development inventory with strong enterprise financials. Better of each worlds. Decrease threat, better upside.

In just lately examine buyers leaping in and shopping for any electric-vehicle-related inventory they may discover. A few of these firms had been full facades and others are at the moment struggling for various causes. Listed below are a couple of examples:

For those who invested and weren’t listening to the financials of those firms, you may be headed for some losses. No matter what technique you utilize to speculate, it’s usually a good suggestion to know the monetary well being of the the businesses wherein you make investments. The monetary well being is gleaned from the main points within the monetary studies.

Utilizing quantitative fashions to assist make funding selections

There may be yet one more kind of investing to think about. The title could sound just like the quantitative metrics we’ve been discussing on this thread of weblog posts, however I’ll clarify the way it additionally could possibly be totally different. I’m a fan of quantitative strategies to investigate metrics and numbers however favor to take a value-investing method to versus a predictive statistical method. Maintain that thought.

Quantitative Investing or Quantitative Evaluation (QA) in finance leverages mathematical and statistical evaluation to assist decide the worth of a monetary asset, reminiscent of a inventory or choice.

Within the above definition there are several types of quantitative metrics that could possibly be relevant. The guide I reviewed appeared to suggest that the one quantitative strategies you might use the place the predictive quantitative strategies they described, however a quantitative technique could possibly be something that leverages numbers to measure and consider one thing as in comparison with phrases (a qualitative method).

Quantitative evaluation has been round longer than computer systems — over 80 years. Quantitative strategies use mathematical fashions to make selections. You would use strategies I wrote about beforehand like Monte Carlo simulations and the Bayes theorem, or you might take a look at monetary metrics the way in which Warren Buffet does. Each are quantitative.

How profitable is buying and selling primarily based on quantitative strategies? That article sums it up properly:

Choosing the proper knowledge is certainly not a assure, simply as buying and selling patterns that seem to counsel sure outcomes may match completely till they don’t. Even when a sample seems to work, validating the patterns generally is a problem. As each investor is aware of, there aren’t any positive bets.

People are emotional. They may usually be swayed by market swings to make the mistaken funding decisions. Taking people out of the equation can and letting a pc algorithm make the trades removes the emotion and offers extra constant buying and selling. It can also velocity up commerce execution. This is called “high-frequency buying and selling.” This technique of buying and selling can even result in large issues when algorithms go haywire. Quoting from the article under a couple of buying and selling algorithm utilized by an organization known as Knight Capital:

We don’t know precisely what. They switched it on and instantly they began dropping actually $10 million [£6.4m] a minute. It appears to be like like they had been shopping for excessive and promoting low many, many instances per second, and dropping 10 or 15 {dollars} every time. And this went on for 45 minutes. On the finish of all of it they wound up having misplaced $440 million [£281m].

Because the article goes on to clarify, some nefarious people or teams strive to determine what buying and selling algorithms funding corporations use. Then they attempt to manipulate monetary knowledge and provides to trick these algorithms into making the trades they need.

Quantitative strategies can to overlook what Nassim Nicolas Taleb calls a “black swan” in his guide: The Black Swan:

A “black swan” is an occasion that your threat predicting algorithms would possibly counsel is very unlikely. In different phrases, the chances of this occasion occurring appear to be miniscule. And but, it occurs. And when it does, it leads to big losses. Two examples that quantitative strategies missed in response to the aforementioned article:

- The 2008 crash the place they didn’t account for mortgage-backed securities.

- Taleb tells a narrative a couple of dealer basing his foreign money trades on statistical possibilities and he went from a high-flying dealer with a great deal of cash to broke in a brief time frame when his favourite algorithm failed him.

That latter story was in Taleb’s second guide, Fooled by Randomness, which I really learn first and probably like higher than the primary on the time I learn them.

The guide I reviewed and wrote about about in my final publish on utilizing statistical strategies for cybersecurity metrics means that arguments about black swans are irrelevant. Listed below are the prior posts when you missed them:

The authors of the guide brush off the black swan idea stating that even these issues thought-about black swans may have been predicted with a correct quantitative strategies. They point out the 2008 crash as one instance of one thing that would have been predicted. Mockingly, the article above factors out that quantitative investing missed that crash completely. For those who consider that article, it refutes the argument made within the guide that the occasion was predictable with quantitative strategies.

In fact, if everybody had good fashions it might have been predictable, however as one individual put it my final publish, “the fashions are by no means good.” These examples level to the validity of a quote from my final publish that recommended individuals ought to be extra involved with failures than successes. That’s very true in cybersecurity the place it’s the failure — a knowledge breach — leads to substantial value for organizations primarily based on the typical value of a knowledge breach. Are you able to afford to be mistaken? Do you need to be? That’s as much as your CEO and board to determine.

Somebody did, actually, predict the 2008 crash — Michael Burry — however he didn’t do it by calculating possibilities. He found the issue by pouring over the main points of economic knowledge. He seen an issue with the information within the mortgage trade. You may learn the story about those that did predict this crash and who argued in opposition to the likelihood right here:

The dot-bomb crash in 2000 was additionally predictable, however it didn’t take quantitive predictive statistical strategies to do it. I had just lately learn Warren Buffet’s guide on worth investing on the time and it was apparent to me that the cash pouring into startups was greater than they may ever repay primarily based on their enterprise fashions. I used to be supplied jobs at lots of these firms in Seattle and opted to not take a job with any of them. I didn’t purchase suppose most of their enterprise fashions would work, whereas on the identical time, enterprise capital was pouring hundreds of thousands or billions into all of them. My CPA instructed me later I used to be the primary one to inform him it was a home of playing cards and all going to crash.

Generally you simply want somewhat widespread enterprise sense, not a flowery algorithm.

What does Taleb consider Bayesian evaluation? I can’t converse to the legitimacy of this publish however it sounds about proper, and I agree with the final line:

He’s a Bayesian in epistemological phrases, he agrees Bayesian pondering is how we be taught what we all know. Nevertheless he’s an empiricist (and a skeptical one) that means he doesn’t consider Bayesian priors come from any supply apart from expertise. For instance, suppose a Bayesian says he thinks earthquake dimension and frequency obey an influence legislation with some prior, and makes use of historic knowledge to compute the chance of a magnitude 8.0 or bigger earthquake in California over the following decade. Nassim would criticize the evaluation as a result of the prior primarily determines the reply.

Except for philosophic subtleties, the place he differs from many practising Bayesians is in his choice for strong conclusions primarily based on broad commentary over particular fashions. When individuals assemble priors to investigate particular knowledge units on the lookout for particular kinds of conclusions, Nassim would say, they usually miss the purpose. Less complicated and extra normal strategies will be extra dependable, and formal evaluation may give a false precision to solutions.

You may learn a few of Taleb’s ideas on his twitter account. Right here’s one instance:

And apparently there’s extra in his guide printed March 2020. I haven’t learn it however I’m guessing so as a result of it’s received the tag “bayesian-schmayesian” on his weblog. On Amazon:

With regards to predicting what is going to occur within the inventory market utilizing AI (an thought which has been round for the reason that Nineteen Forties), the next article covers a few of the challenges:

Whereas synthetic intelligence has dramatically improved chess applications, the funding markets behave otherwise than a board sport that has mounted guidelines and no aspect of likelihood. As with abnormal, human-inspired intelligence, the unreal model thereof could require particular info to succeed. Nice ideas alone could not suffice.

I’d counsel that cybersecurity falls into that very same class and can face related challenges. It will likely be troublesome to make use of an algorithm to find out what an attacker will do subsequent. The truth is, the attackers will attempt to hack your prediction engines. If a hacker breaches your techniques and is aware of what algorithm you’re utilizing — which may really assist them to craft an assault you’ll miss. Take into account the consequences of an assault known as knowledge poisoning:

Leveraging a value-based method to cybersecurity metrics

Again to the title of this publish: A Worth-Primarily based Strategy to Cybersecurity Metrics. What do I imply by that? As a substitute of attempting to foretell the longer term or wager the chances, what if we may take a look at an organization’s cybersecurity fundamentals and decide their worth primarily based on some metrics? What if we may use these metrics to enhance the worth of the corporate and it’s potential to resist a cyber-attack?

How will we do this? We’d like to have the ability to measure the state of safety controls on the firm utilizing safety studies — akin to monetary studies as I describe in my guide. These safety studies I keep in mind may give us empirical knowledge on which to base a cybersecurity threat evaluation. This knowledge demonstrates what number of possibilities an organization is giving attackers to interrupt in. It additionally reveals the potential injury, ought to an assault happen, primarily based on the power to travers inner techniques or entry knowledge on non-public networks.

I wrote about all these ideas in my guide, Cybersecurity for Executives within the Age of Cloud, additionally proven on the backside of this publish if you’re unfamiliar with any of these phrases or don’t know what I imply.

Corporations may assemble studies primarily based on cybersecurity metrics that reveal the safety well being of an organization. These studies wouldn’t be primarily based on human evaluation or vulnerable to human judgement or statistical fashions. They’re simply metrics. They’re the sort of quantitative metrics that measure the issues that would facilitate a knowledge breach or improve the ensuing impression because of the size of time it takes to find the breach or the power to precisely outline the scope of affected data. These issues can all be measured objectively.

If an organization has extra findings over time, the danger is rising. If the corporate has much less findings over time, the danger is reducing. That could be a bit simplified however it’s a normal place to begin. We have to discover a widespread technique to measure cybersecurity metrics the way in which the monetary trade has established a way to measure the monetary well being of an organization. That permits us to make worth judgments reminiscent of whether or not or to not give an organization a cyber insurance coverage coverage or what it’s best to cost for it. It might assist you decide if you wish to do enterprise with that firm. These worth judgements are primarily based on safety fundamentals.

Safety fundamentals

What are safety fundamentals? They’re the traits that outline the state of safety at a company. Very like a steadiness sheet you possibly can create studies that quantify the state of your safety.

Don’t we have already got issues like that? Now we have PCI compliance and SOC2 and ISO 27001 the CIS high safety controls. As I clarify in my guide these frameworks and assessments are helpful and you might use them if that’s all you’ve gotten — however they aren’t all the time immediately correlated with what causes knowledge breaches or will increase the scope. In addition they generally contain a whole lot of paperwork and guide processes and lack adequate metrics.

I attempted to stay to metrics in my guide that quantify what causes, prevents, and reduces the scope of information breaches. A lot of the metrics in my guide come all the way down to safety configurations and processes that permit attackers to breach a company or disallow them from accessing delicate techniques and knowledge. I additionally need to attempt to automate gathering, reporting on, and analyzing these metrics — with quantitative strategies however not the sort that attempt to predict a breach. Reasonably, they calculate threat primarily based on the amount of findings and ideally, incorporate knowledge on the reason for breaches within the trade. We don’t have sufficient particular knowledge on the latter as I began explaining right here:

Gathering the information (metrics)

Individuals preserve on the lookout for a less complicated reply. How can we probably know and monitor all of our safety configurations? However on the finish of the day, your configurations and processes are what let an attacker breach techniques or not. The guide I discussed earlier glosses over the idea of configuration metrics with the instance of a company that has a firewall however hasn’t configured any firewall guidelines. I suggest that we will do higher at measuring the state of cyber safety at a company.

I wrote a associated weblog publish about the way you deal with the information inside your group and hope to offer extra concrete strategies for doing what I’m proposing on this newest collection of weblog posts (if I’ve time.)

Configurations and processes are measurable and will be evaluated. As soon as we all know what dangerous configurations and processes exist inside a company we will determine what to do about it primarily based on the potential for a dangerous configuration to guide to a knowledge breach, just like a door and not using a lock or a home with out an alarm.

After you’ve collected the information, you might use statistical strategies like these proposed within the guide I reviewed on methods to measure something in cybersecurity, or you might merely contemplate the price of the worst-case state of affairs alongside along with your price range and assets that could possibly be utilized to remediating the issue. I contemplated these choices within the final publish on leveraging statistical strategies in cybersecurity.

For those who monitor misconfigurations in a holistic means you possibly can generate studies that let you know whether or not your dangerous configurations are rising or reducing, whatever the chance of a knowledge breach. Clearly, a rise in configurations which offer a gap for attackers will increase your threat that they’ll accomplish that.

Given the potential value of a knowledge breach and the challenges related to predictive fashions, maybe as a substitute of attempting to beat the chances, firms can specializing in threat discount by enhancing security-related configurations — and thereby enhancing the safety fundamentals that make up their cybersecurity steadiness sheets:

Property - Liabilities = Homeowners Fairness

Observe me for extra on gathering cybersecurity metrics.

Teri Radichel

For those who appreciated this story please clap and observe:

Medium: Teri Radichel or Electronic mail Listing: Teri Radichel

Twitter: @teriradichel or @2ndSightLab

Requests companies through LinkedIn: Teri Radichel or IANS Analysis

© 2nd Sight Lab 2022

Different posts on this collection:

Different posts on this thread:

____________________________________________

Writer:

Cybersecurity for Executives within the Age of Cloud on Amazon

Want Cloud Safety Coaching? 2nd Sight Lab Cloud Safety Coaching

Is your cloud safe? Rent 2nd Sight Lab for a penetration check or safety evaluation.

Have a Cybersecurity or Cloud Safety Query? Ask Teri Radichel by scheduling a name with IANS Analysis.

Cybersecurity & Cloud Safety Assets by Teri Radichel: Cybersecurity and Cloud safety courses, articles, white papers, displays, and podcasts