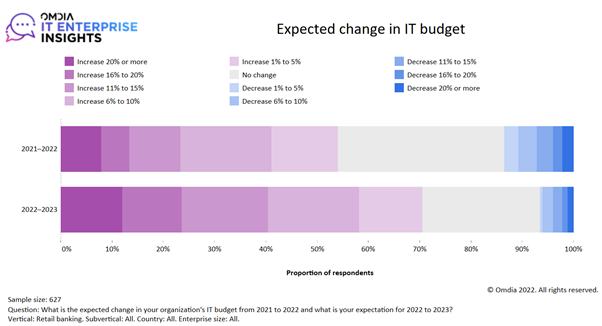

Good IT funding choices are closely depending on the power of the enterprise to forecast what the quick, medium, and long-term market setting will maintain, in order to map investments to targets and outcomes accordingly. At the beginning of 2023, precisely forecasting enterprise, monetary and political landscapes has by no means been more difficult. In keeping with Omdia’s IT Enterprise Insights (ITEI) Survey 2022/23, seven in 10 IT decision-makers in retail banking plan to extend spending in 2023. As they place excessive significance on IT investments for the 12 months forward, they have to prioritize the next three areas to realize enterprise continuity:

- Modernization of core banking to maneuver the business forward with open APIs,

- Automation of processes to rework each buyer and workers expertise,

- Energetic engagement with what IT sustainability means to their group.

Legacy Modernization Will Intensify in 2023; Core Banking Ought to Be a Key Precedence

A shift to the cloud and composable banking to handle front- and back-office modernization extra successfully have been key enablers of digital transformation lately. In keeping with Omdia’s ITEI 2022/23 survey, 63% of banks rated their progress within the adoption of cloud as superior. Nonetheless, an extra step up in modernizing core banking is required to maneuver the business forward with open APIs. Cloud-based core banking developed as real-time, API-first, and cloud-native options, can carry flexibility and scalability advantages, thereby assembly the present on-demand IT necessities of retail banks. Given the anticipated development in real-time funds and open banking use circumstances, retail banks ought to take into account next-generation cloud-based options to enhance their present capabilities.

Funding Ought to Materialize in Excessive Stage of Automation and Use of Analytics

Personalised (23%) and constant cross-channel (22%) buyer expertise and a complete view of the client throughout enterprise strains (20%) are the highest IT initiatives for omnichannel banking technique, in line with Omdia’s ITEI 2022/23 survey. Banks additionally prioritize interplay with contact facilities on chat and through chatbots, which permits a big proportion of queries to be resolved simply, thus decreasing the price of buyer care.

Primarily, bankers have to have a transparent understanding of the place expertise and automation present an unambiguous profit to their technique (from digital channels to contact facilities and branches) and the place human staff are the best path to delivering the technique and develop processes and providers round that.

IT Sustainability Beneficial properties Prominence By means of Properly-defined Methods by Retail Banks

Retail banks’ IT sustainability technique at present revolves round broad spectrum together with use of kit that’s compliant with business requirements, product takeback whereby selling reuse of merchandise and supplies, transfer to totally digital processes, buy of low-energy-consumption gear and use of renewable vitality and water administration.

In keeping with Omdia’s ITEI 2022/23 survey, greater than 1 / 4 of banks said their sustainability technique is well-defined and covers each their firm and provide chain. Almost one in 5 retail banks are on observe with their technique implementation, whereas the biggest proportion of banks (practically 30%) are within the evaluation section at current. Nonetheless, the identical quantity (1 in 5) additionally don’t have any particular technique at current.

Whereas some banks are making vital progress, others report issue in sustaining compliance with present guidelines, understanding which applied sciences could have the largest optimistic affect and advantages. Suppliers and companions that don’t share sustainability targets are additionally a problem for banks. Due to this fact, complete organizations throughout the value-chain require to endure a cultural shift to deal with IT sustainability initiatives pursued by many banks and thus assist them obtain long-term enterprise continuity.