Nvidia is taking part in some critical video games.

When Jensen Huang and his two companions established Nvidia in 1993, the graphics chip market had many extra rivals than the CPU market, which had simply two. Nvidia’s rivals within the gaming market included ATI Applied sciences, Matrox, S3, Chips & Expertise, and 3DFX.

A decade later, Nvidia had laid waste to each one in every of them apart from ATI, which was bought by AMD in 2006. For many of this century, Nvidia has shifted its focus to deliver the identical expertise it makes use of to render videogames in 4k pixel decision to energy supercomputers, high-performance computing (HPC) within the enterprise, and synthetic intelligence.

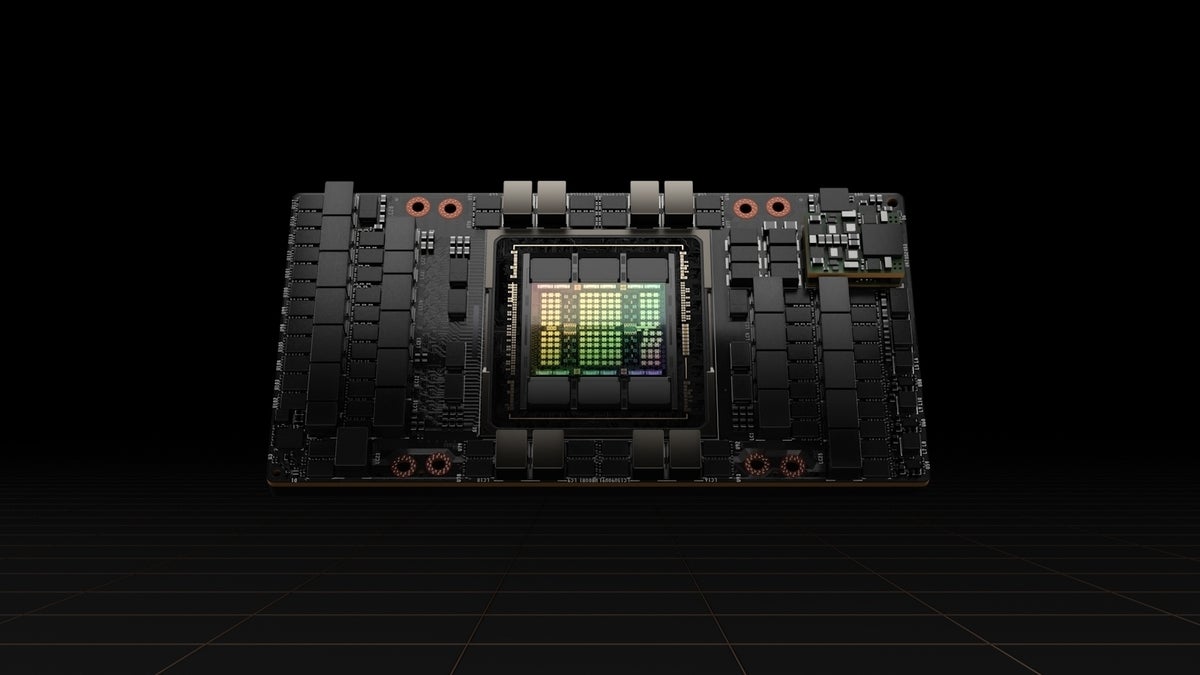

The outcomes of that shift are laid clear in Nvidia’s monetary stories and within the business. For its most up-to-date quarter, knowledge heart income hit $3.81 billion, up 61% from a 12 months earlier, and it accounted for 56% of Nvidia’s whole income. Within the newest Top500 checklist of supercomputers, 153 are working Nvidia accelerators whereas AMD solely has 9. In line with IDC, Nvidia held 91.4% of the enterprise GPU market to AMD’s 8.5% in 2021.

How did it get right here? Earlier within the century, Nvidia realized that the character of the GPU, a floating-point math co-processor with hundreds of cores working in parallel, lends itself very effectively to HPC and AI computing. Like 3D graphics, HPC and AI are closely depending on floating-point math.

The primary steps towards an enterprise shift got here in 2007, when former Stanford College pc science professor Ian Buck developed CUDA, a C++-like language for programming GPUs. Videogame builders didn’t code to the GPU; they programmed to Microsoft’s DirectX graphics library, which in flip spoke to the GPU. CUDA introduced a chance to code on to the GPU similar to a programmer working in C/C++ would to a CPU.

Fifteen years later, CUDA is taught in a number of hundred universities all over the world and Buck is the top of Nvidia’s AI efforts. CUDA allowed builders to make GPU-specific purposes – one thing not doable earlier than –but it surely additionally locked them into the Nvidia platform, as a result of CUDA isn’t simply moveable.

Few corporations play in each the buyer and enterprise areas. Hewlett-Packard cut up itself in two to raised serve these markets. Manuvir Das, vice chairman of enterprise computing at Nvidia, says the corporate “is certainly centered on enterprise corporations immediately. After all, we’re additionally a gaming firm entity. That is not going to vary.”

The gaming and enterprise sides of the home each use the identical GPU structure, however the firm thinks of those two companies as separate entities. “So in that sense, we’re nearly type of two corporations inside one. It is one structure however two very completely different routes to market, units of consumers, use circumstances, all of that,” he says.

Das provides that Nvidia has a variety of GPUs, and so they all have completely different performance relying on the goal market. The enterprise GPUs have a transformer engine that performs pure language processing, for instance, and different capabilities which aren’t discovered within the gaming GPUs.

Addison Snell, principal researcher and CEO of Intersect360 Analysis, says Nvidia is straddling the 2 markets effectively for now. Nonetheless, “the expansion in GPU computing is actually taking them full pressure into enterprise computing and AI. And I believe they’re predominantly now serving the hyperscale market there, which is the house of nearly all of AI spending,” Snell says.

Anshel Sag, principal analyst with Moor Insights & Technique, echoes this. “I really feel like quite a lot of the corporate’s efforts are very a lot centered on the enterprise immediately, however I nonetheless suppose that there is quite a lot of gaming that is nonetheless very a lot inside its general branding,” he says.

Sag believes Nvidia’s greatest room for enchancment is in cell applied sciences, the place it performs second fiddle to Qualcomm. “I believe they’re very weak within the cell house, and that cell house isn’t just restricted to smartphones, however handheld gaming, and AR/VR purposes. I believe it exposes them on the sting, and I believe that they may have competitors down the street,” Sag says.

In line with Snell, Nvidia is constant to downplay HPC in favor of AI and specializing in hyperscale corporations, relying on cloud computing because the supply mechanism for every type of enterprise computing.

“This factors to Nvidia aiming to be an entire answer supplier for hyperscale and cloud, whereas diminishing its efforts as a element supplier by means of conventional server OEMs to finish customers,” Snell says.

Competing in opposition to its companions

Nvidia operates in another way than different chip giants in that it competes with its OEM companions. That has brought about at the least one public blowup.

In September, peripheral maker EVGA introduced it could now not make Nvidia playing cards. EVGA was one of many high distributors out there, and graphics playing cards accounted for 80% of its earnings. In order that they needed to be fairly indignant with Nvidia to stroll away from 80% of its income.

EVGA CEO Andy Han cited a number of grievances with Nvidia, not the least of which was that it competes with Nvidia. Nvidia makes graphics playing cards and sells them to shoppers below the model identify Founder’s Version, one thing AMD and Intel do little or no or by no means.

As well as, Nvidia’s line of graphics playing cards was being bought for lower than what licensees have been promoting their playing cards. So not solely was Nvidia competing with its licensees, but it surely was additionally undercutting them.

Nvidia does the identical on the enterprise aspect, promoting DGX server items (rack-mounted servers full of eight A100 GPUs) in competitors with OEM companions like HPE and Supermicro. Das defends this follow.

“DGX for us has at all times been type of the AI innovation automobile the place we do quite a lot of merchandise testing,” he says, including that constructing the DGX servers provides Nvidia the possibility to shake out the bugs within the system, data it passes on to OEMs. “Our work with DGX provides the OEMs a giant head-start in getting their techniques prepared and on the market. So it is truly an enabler for them.”

However each Snell and Sag suppose Nvidia shouldn’t be competing in opposition to its companions. “I am extremely skeptical of that technique,” Snell says. “It defies the tenet of not competing with your personal clients. If I have been one of many main server OEMs, I would not like the concept that Nvidia is now performing as a system supplier and taking me out of the loop.”

“I believe these [DGX] techniques do, to a sure diploma, compete with what their companions are providing. However that stated, I additionally suppose that Nvidia does not essentially wish to present assist and providers for these techniques, like their companions will. And I believe that is a giant element of the enterprise options that is not actually current on the buyer aspect,” Sag says.

AMD, Intel bolster their GPU applied sciences

So who may knock Nvidia from its perch? All through the historical past of the Silicon Valley, most corporations that skilled a fantastic fall weren’t knocked off by a competitor however fell other than inside.

IBM and Apple within the Nineteen Nineties, Solar Microsystems, SGI, Novell, and now Fb have been all undone or almost undone due to dangerous administration and dangerous choices, not as a result of anyone else got here alongside and knocked them off.

Nvidia has had product misfires alongside the best way, but it surely has at all times rapidly course-corrected with the following technology of silicon. And it has had just about the identical govt administration crew because the starting, and so they haven’t made that many errors.

One factor that helped Nvidia obtain such dominance is that it had the market to itself. AMD was struggling to outlive for years, and Intel repeatedly tried and didn’t develop a GPU.

However that is not the case anymore. AMD is totally revitalized, and it has bragging rights now that its GPU expertise, Intuition, is powering the quickest supercomputer on the planet, Frontier. And Intel lastly appears to be heading in the right direction with its Xe GPU structure, discovered within the forthcoming Ponte Vecchio enterprise GPU.

If there’s an organization that has Das trying over his shoulder, he is not admitting it, nonetheless. “I believe the actual competitors we see is mainly how can we [support] the workloads that exist already, which might be working non-accelerated?” he asks.

Copyright © 2022 IDG Communications, Inc.